A) shift AS1 to the right.

B) shift AD1 to the right.

C) shift AD1 to the left.

D) not change AD or AS.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume that the demand for money depends on the interest rate. A decrease in the money supply will cause

A) the interest rate to increase, the quantity demanded of money to decrease, and the velocity of money to decrease.

B) the interest rate to increase, the quantity demanded of money to decrease, and the velocity of money to increase.

C) the interest rate to decrease, the quantity demanded of money to decrease, and the velocity of money to increase.

D) the interest rate to decrease, the quantity demanded of money to increase, and the velocity of money to decrease.

Correct Answer

verified

Correct Answer

verified

True/False

Keynesians believe the economy can be managed using monetary and fiscal policy.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

People are said to have rational expectations if they

A) use all available information in forming their expectations.

B) assume that this year's inflation rate will be equal to the average inflation rate over the past 10 years.

C) merely guess at the inflation rate.

D) assume that this year's inflation rate will be the same as last year's inflation rate.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If real output is $20 billion, the price level is 4, and velocity is 2, what is the stock of money?

A) $2.5 billion

B) $10 billion

C) $40 billion

D) $160 billion

Correct Answer

verified

Correct Answer

verified

Multiple Choice

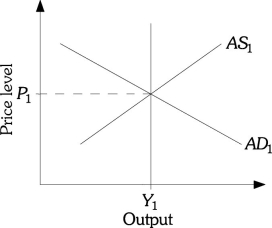

Refer to the information provided in Figure 32.2 below to answer the question(s) that follow.  Figure 32.2

-Refer to Figure 32.2. According to ________ economists, under rational expectations an expected decrease in government spending would not change AD or AS.

Figure 32.2

-Refer to Figure 32.2. According to ________ economists, under rational expectations an expected decrease in government spending would not change AD or AS.

A) Keynesian

B) the new classical

C) monetarist

D) none of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would be considered a supply-side policy?

A) an increase in the minimum wage that would cause consumer spending to increase

B) an increase in government spending that would lead to increased aggregate demand

C) investment tax credits for businesses to encourage investment

D) a decrease in the growth of the money supply

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In economics, the concept of active government intervention in the macroeconomy was first emphasized by

A) rational expectation theorists.

B) supply-side economists.

C) monetarists.

D) John Maynard Keynes.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Monetarists argue that the money supply should

A) grow at a rate equal to the average growth of real output.

B) grow at a rate slower than the average growth of real output.

C) grow at a rate greater than the average growth of real output.

D) be held constant over the business cycle.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Keynes believed which of the following?

A) The government has a role to play in fighting inflation, but not in fighting unemployment.

B) The government has a role to play in fighting unemployment, but not in fighting inflation.

C) The government does not have a role to play in fighting inflation or unemployment.

D) The government has a role to play in fighting inflation and unemployment.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The quantity theory of money implies that a 7% increase in the ________ will eventually cause a 7% increase in the ________.

A) money demand; inflation rate

B) money demand; money supply

C) money supply; price level

D) money supply; money demand

Correct Answer

verified

Correct Answer

verified

True/False

If nominal GDP is $300 billion and the velocity is 3, the stock of money is $900 billion.

Correct Answer

verified

Correct Answer

verified

True/False

If GDP increases and the stock of money does not change, the income velocity of money will increase.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following schools of economic thought will recommend an expansionary fiscal policy to reduce the unemployment rate?

A) the monetary schools

B) the classical school

C) the Keynesian school

D) the rational expectation school

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If nominal GDP is $400 billion and the money supply is $50 billion, the velocity of money is

A) 0.125.

B) 8.

C) 12.

D) 20.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to the quantity theory of money, nominal GDP will double if the money supply is

A) reduced by one-half.

B) reduced threefold.

C) doubled.

D) tripled.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to the Lucas supply function, when the income effect dominates the substitution effect, workers who experience a ________ price surprise will work ________ hours.

A) positive; more

B) positive; fewer

C) negative; fewer

D) negative; the same number of

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Laffer curve shows the relationship between

A) aggregate supply and aggregate demand.

B) unemployment and inflation.

C) consumer spending and business spending.

D) tax rates and tax revenues.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Lucas supply function, in combination with the assumption that expectations are rational, implies that announced policy changes

A) will have no effect on the actual price level.

B) will have no effect on real output.

C) will have no effect on the expected price level.

D) will have no effect on nominal output.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

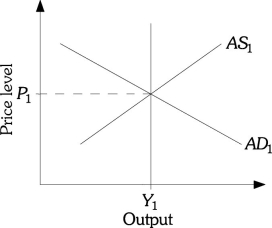

Refer to the information provided in Figure 32.2 below to answer the question(s) that follow.  Figure 32.2

-Refer to Figure 32.2. According to the new classical economists, under rational expectations an expected decrease in government spending would

Figure 32.2

-Refer to Figure 32.2. According to the new classical economists, under rational expectations an expected decrease in government spending would

A) shift AS1 to the right.

B) shift AD1 to the right.

C) shift AD1 to the left.

D) not change AD and AS.

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 294

Related Exams