A) $4,000.

B) $5,000.

C) $15,000.

D) $25,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The measure or value upon which a tax is levied is the

A) tax base.

B) tax rate.

C) tax structure.

D) tax incidence.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The ________ is the percentage of a tax base that must be paid in taxes.

A) tax base

B) tax incidence

C) proportional tax

D) tax rate structure

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is a tax based on the benefits-received principle?

A) A property tax, if the revenue is used to finance public education.

B) A tax on imports that is used to finance job retraining for workers who have lost their jobs because of the competition from imported products.

C) A progressive income tax that is used to finance national defense.

D) A tax added to the camping fee at national parks that is used to maintain and upgrade camping facilities at national parks.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The total amount of tax you pay divided by your total income is the

A) marginal tax rate.

B) average tax rate.

C) total tax rate.

D) proportional tax rate.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

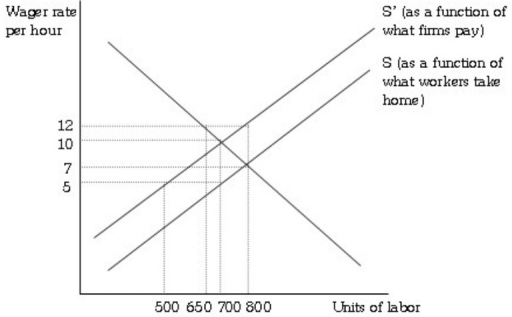

Refer to the information provided in Figure 19.1 below to answer the question(s) that follow.  Figure 19.1

-Refer to Figure 19.1. Prior to the imposition of the payroll tax, this labor market ________ at a wage of $7.00 and employment of 800 workers.

Figure 19.1

-Refer to Figure 19.1. Prior to the imposition of the payroll tax, this labor market ________ at a wage of $7.00 and employment of 800 workers.

A) was employing too many workers

B) was in equilibrium

C) was employing too few workers

D) was paying too high a wage rate

Correct Answer

verified

Correct Answer

verified

Multiple Choice

________ is caused by the fact that taxes distort economic decisions.

A) Neutrality

B) Excess burden

C) Tax shifting

D) Market failure

Correct Answer

verified

Correct Answer

verified

True/False

The United States payroll tax is progressive.

Correct Answer

verified

Correct Answer

verified

True/False

Consumption is a flow measure.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The excess burden of a tax is $5,000 and the tax revenue from this tax is $15,000. The total burden of this tax is

A) $3,000.

B) $5,000.

C) $10,000.

D) $20,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The progressive income tax is a tax based on the

A) benefits-received principle.

B) tax equity principle.

C) efficiency tax principle.

D) ability-to-pay principle.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is a base on which taxes are levied in the United States?

A) income

B) sales

C) property

D) all of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

As a result of an increase in the payroll tax that employers must pay on their employeesʹ wages, employers reduce the starting wage for new employees. This is an example of

A) tax shifting.

B) tax incidence.

C) a regressive tax.

D) tax avoidance.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A local property tax is a tax on ________, while a tax on your salary is a tax on ________.

A) a flow; a stock

B) a stock; a flow

C) a flow; income

D) a residential holding; a flow

Correct Answer

verified

Correct Answer

verified

True/False

The property that a person owns at the time of her death is her estate.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

During 2016, Sean's consumption equals $25,000 and the change in his net worth is -$5,000. Sean's economic income for 2012 is

A) $5,000.

B) $20,000.

C) $25,000.

D) $30,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The tax ________ is the measure or value upon which a government levies a tax.

A) base

B) rate

C) structure

D) incidence

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The total burden of a tax is $10,000 and the tax revenue from this tax is $8,000. The excess burden of this tax is

A) $2,000.

B) $8,000.

C) $10,000.

D) $18,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

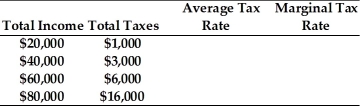

Refer to the information provided in Table 19.7 below to answer the question(s) that follow.

Table 19.7  -Refer to Table 19.7. The tax rate structure in this example is

-Refer to Table 19.7. The tax rate structure in this example is

A) proportional.

B) progressive.

C) regressive.

D) marginal.

Correct Answer

verified

Correct Answer

verified

True/False

Excess burden is the total burden of a tax minus the tax revenue generated by the tax.

Correct Answer

verified

Correct Answer

verified

Showing 221 - 240 of 281

Related Exams