A) bad debt expense.

B) cash.

C) net income.

D) accounts receivable.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

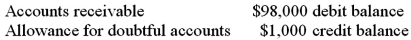

The unadjusted trial balance at the end of the year includes the following:  The company uses the allowance method and has completed the aging schedule which indicates $5,800 of accounts are estimated uncollectible.What is the amount of bad debt expense to be recorded for the year?

The company uses the allowance method and has completed the aging schedule which indicates $5,800 of accounts are estimated uncollectible.What is the amount of bad debt expense to be recorded for the year?

A) $5,800

B) $4,800

C) $6,800

D) $7,800

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Total doubtful accounts at the end of the year are estimated to be $25,000 based on an aging of accounts receivable.If the balance in the Allowance for Doubtful Accounts is a $7,000 debit before adjustment,what will be the amount of bad debt expense recorded for the period?

A) $7,000.

B) $18,000.

C) $25,000.

D) $32,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

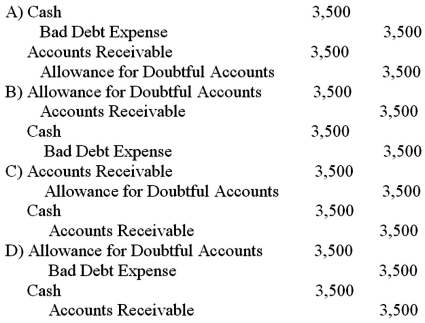

Use the information above to answer the following question.The required entry(ies) on May 29 to record the recovery is:

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer

verified

Correct Answer

verified

Multiple Choice

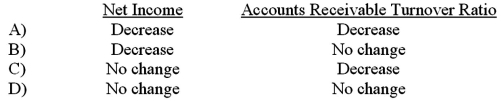

Using the allowance method,how would net income and the accounts receivable turnover ratio be affected when a customer's account balance,which is known to be uncollectible,is written off?

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The days-to-collect measure is calculated as:

A) the number of days an average selling and collecting cycle takes.

B) the average number of times the firm completes the selling and collecting cycle during the year.

C) the average number of days for a customer's payment to clear the banking system.

D) the average number of days before the company receives a customer's payment and uses the cash to re-order merchandise.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements regarding methods of accounting for bad debts is true?

A) When the allowance method is used,the journal entry to write-off an uncollectible account does not change the amount reported as net accounts receivable on the balance sheet.

B) The two methods of accounting for bad debts that are acceptable under GAAP are the allowance method and the direct write-off method.

C) When the allowance method is used,if actual results differ from the estimates,the prior year financial statements must be corrected.

D) When the allowance method is used,bad debt expense is equal to the write-offs that occurred during the period.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Extending credit to customers will not result in which of the following additional costs?

A) Increased wage costs will be incurred to evaluate customer creditworthiness,track what each customer owes,and follow up to ensure collection.

B) Bad debt expense will result when amounts cannot be collected from customers.

C) Delayed receipt of cash may result in requiring the company to take out short-term loans and incur interest costs.

D) Decreased gross profit from reduced sales.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company has a debit balance of $3,500 in the Allowance for Doubtful Accounts.It estimates that 2% of net credit sales of $1,500,000 will be uncollectible.The required journal entry to record bad debt expense should include a debit to:

A) Allowance for Doubtful Accounts for $30,000.

B) Allowance for Doubtful Accounts for $33,500.

C) Bad Debt Expense for $33,500.

D) Bad Debt Expense for $30,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Under the direct write-off method,the entry to write off a customer's account would be:

A) Debit Bad Debt Expense,credit Allowance for Doubtful Accounts.

B) Debit Bad Debt Expense,credit Accounts Receivable.

C) Debit Write-off Expense,credit Accounts Receivable.

D) Debit Sales,credit Accounts Receivable.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Grass is Greener Corporation is owed $11,890 from a client for landscaping.The account is overdue and the client is having difficulty paying.Why might the Grass is Greener Corporation extend a note receivable to the client?

A) The loan will decrease the net income of the Grass is Greener Corporation for the current accounting period.

B) The loan will strengthen the Grass is Greener Corporation's legal right to be repaid with interest.

C) The loan will reduce the tax liability for the Grass is Greener Corporation.

D) The loan will eliminate any doubts of collection of the amount due.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the information above to answer the following question.What was the total amount of cash collections from accounts receivable customers this year?

A) $846,950

B) $850,000

C) $849,800

D) $847,150

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Before adjustment,the allowance for doubtful accounts has a credit balance of $2,700.The company had $140,000 of net credit sales during the period and historically fails to collect 4% of credit sales.The company uses the percentage of credit sales method of estimating doubtful accounts.After adjusting for estimated bad debts,the ending balance in the allowance for doubtful accounts account will be:

A) $8,300.

B) $5,400.

C) $2,900.

D) $5,600.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the information above to answer the following question.The receivables turnover ratio for 2014 is closest to:

A) 8.93

B) 8.48

C) 8.71

D) 9.14

Correct Answer

verified

Correct Answer

verified

True/False

Interest revenue from notes receivable is reported on a multiple step income statement as a part of Income from Operations.

Correct Answer

verified

Correct Answer

verified

True/False

When a company routinely sells on credit,it is inevitable that some of its customers will not pay the amount owed.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On average,5% of credit sales has been uncollectible in the past.At the end of the year,the balance of accounts receivable is $100,000 and the allowance for doubtful accounts has an unadjusted credit balance of $500.Net credit sales during the year were $150,000.Using the percentage of credit sales method,the estimated bad debt expense would be:

A) $5,000.

B) $7,000.

C) $7,500.

D) $8,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the information above to answer the following question.What is the amount of Bad Debt Expense for 2015?

A) $2,000

B) $5,050

C) $5,000

D) $4,950

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is true about interest receivable?

A) It is an asset reported on the balance sheet.

B) It is a temporary account reported on the income statement.

C) It is a permanent account reported on the income statement.

D) It represents the amount of interest the company has received on promissory notes.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If an uncollectible account,previously written off,is recovered:

A) net accounts receivable increases.

B) net accounts receivable decreases.

C) net accounts receivable stays the same.

D) total revenues increase.

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 146

Related Exams