Correct Answer

verified

Correct Answer

verified

Multiple Choice

Stockholders of the Sasha Deal Company are concerned about irregularities in the firm's accounting system.One approach to identify problems in the records of the company would be to have an) ________ performed.

A) internal audit

B) independent audit

C) unofficial audit

D) GAAP analysis

Correct Answer

verified

Correct Answer

verified

True/False

Posting is a step in the accounting cycle that involves transferring information from the journal into the appropriate accounts in a ledger.

Correct Answer

verified

Correct Answer

verified

True/False

Independent audits are prepared by accountants within the organization to ensure that proper accounting procedures are followed.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

________ is the monetary value that is received for goods sold,services rendered and money received from other sources.

A) Revenue

B) Gross margin

C) Net income

D) Cost of goods sold

Correct Answer

verified

Correct Answer

verified

True/False

Money received from tickets sold for the Rolling Stones concert is recorded as net income on the concert promoter's income statement.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

During a period of rising prices,if a firm desires to report a low gross profit figure in hopes of reducing their income tax liability,the firm will use the __________ inventory valuation method.

A) FIFO first in,first out)

B) LIFO last in,first out)

C) sliding scale

D) average cost

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Peak Performance Sporting Goods Company continues to perform well in spite of an economic recession.Company executives credit this to the strong partnerships it enjoys with category killer and large discount chains.Last week Peak Performance reported basic EPS [earnings per share] = $.80/share.If the firm has 4,000,000 shares outstanding,net income after taxes for the same period = ______.

A) $80,000

B) $5,000,000

C) $3,200,000

D) $32,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Before starting his landscape business,Andrew took a marketing class at the local Community College.He decided that his time would be better utilized in this class because if he could learn to sell his services well,the revenues and profits would follow.Your assessment of his plan might include which of the following:

A) Andrew understands that Marketing is the life-blood of the company,and he is right on track with his approach.

B) Andrew has elected to operate like a virtual company and leave various parts of the business including accounting,environmental trends scanning,and management to outsourcers.

C) Andrew knows that increasing revenues will always keep the business profitable and in a positive cash position.

D) Andrew needs to realize that the ability to understand and interpret financial statements provided by his accountant might enhance his profits.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

"You Incorporated",Figure 17.6,in Chapter 17 shows how to calculate your personal balance sheet.You can list your assets as well as your debts,in order to calculate your _________.

A) cash flow

B) real income

C) working capital

D) net worth

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Accountants not only provide financial information to the firm,they:

A) Replace the firm's need for managers.

B) Also provide information regarding competitors.

C) Assist in interpreting that information.

D) Design the computer information systems.

Correct Answer

verified

Correct Answer

verified

True/False

Bark Three Times Pet Store's accountant has recorded the following: Total current assets = $60,000,including Cash = $24,000;Accounts Receivable = $20,000;and,Inventory = $16,000.Total assets = $230,000;Total current liabilities = $48,000;and,Total current and long-term liabilities = $98,000.The store's current ratio = 1.25.The store's acid-test ratio = .92

Correct Answer

verified

Correct Answer

verified

True/False

The current ratio is a good indicator of the degree to which a firm relies on borrowed funds in its operations.

Correct Answer

verified

Correct Answer

verified

True/False

Accounting is not important for nonprofit organizations since financial data is not critical to their success.

Correct Answer

verified

Correct Answer

verified

True/False

FIFO and LIFO are two common methods used to compute the depreciation of tangible assets.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The _____ account on the Balance Sheet shows profits that the firm has reinvested in the company.

A) retained earnings

B) stockholder's equity

C) intangible assets

D) notes payable

Correct Answer

verified

Correct Answer

verified

True/False

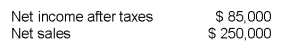

Preferred Pet Care,Inc. ,has recorded the following on its income statement for the period ending,December 31,2012:  The return on sales = 34%.This return is outstanding and there is no need to compare this return to competitors in the veterinary services industry.

The return on sales = 34%.This return is outstanding and there is no need to compare this return to competitors in the veterinary services industry.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

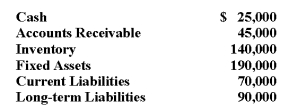

In the current economic climate,banks are remaining very conservative in their lending practices.Peak Performance Sporting Goods is seeking a loan for expansion.As a loan officer for the local bank,you calculate the acid-test ratio for Peak Performance Sporting Goods.Using the information below,you determine Peak Performance's acid-test ratio = _____.

A) 1.0

B) 1.5

C) 2.5

D) 3.0

Correct Answer

verified

Correct Answer

verified

True/False

Juliet has found that her small business needs a better way to maintain accounting records and analyze business opportunities.Currently,she uses a manual accounting system.These days,any off-the-shelf accounting package available at a local software retailer should do an excellent job of meeting her firm's accounting needs.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Peak Performance Sporting Goods Company has just applied for a bank loan in order to expand the business.Using the most recent Balance Sheet data provided by the company owner,you calculate that the company's current ratio is 2.5.In your presentation to the company boss,you remark:

A) Peak Performance is currently having trouble meeting its short-term obligations.

B) Peak Performance has $2.50 that it owes each month,for every $1.00 of cash that it is generating.

C) Peak Performance has $2.50 of current assets for each $1.00 of currently liabilities.

D) Due to the fact that most of Peak Performance's current assets are tied-up in inventory,there is no need to worry about whether Peak Performance will be able to make loan payments.

Correct Answer

verified

Correct Answer

verified

Showing 301 - 320 of 382

Related Exams