A) raise price because the firm is losing money.

B) keep the price the same because the firm is producing at minimum average variable cost.

C) raise price because the last unit of output decreased profit by $30.

D) lower price because the next unit of output increases profit by $20.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The market demand for a monopoly firm is estimated to be: where is quantity demanded,P is price,M is income,and is the price of a related good.The manager has forecasted the values of M and will be $50,000 and $20,respectively,in 2021.The average variable cost function is estimated to be Total fixed cost in 2021is expected to be $4 million.The manager should ________________ because_____________.

A) shut down; P = $520 < TVC = $320

B) shut down; P = $480 < AVC = $500

C) operate; P = $560 > AVC = $320

D) operate; P = 480 > AVC = $300

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The inverse demand equation for a monopoly firm is P = 60 - 0.015Q.The monopolist faces constant costs of production in the long run with LAC = LMC = $30.At the profit-maximizing price,the elasticity of demand is ________,which is __________ (elastic,inelastic,unit elastic) as expected.

A) -1.0; unit elastic

B) -3.0; elastic

C) -0.50; inelastic

D) -2; elastic

E) none of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A monopolist which suffers losses in the short run will

A) continue to operate as long as total revenue covers fixed cost.

B) raise price in order to eliminate losses.

C) exit in the long run if there is no plant size that will result in economic profit that is greater than or equal to zero.

D) both a and b

E) both a and c

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Refer to the following table that gives the demand facing a monopolist: How much does the 28th unit of output add to total revenue?

A) $2

B) $10

C) $20

D) $200

E) none of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A monopolist

A) can raise its price without losing any sales because it is the only supplier in the market.

B) can earn a greater than normal rate of return in the long run.

C) always charges a price that is higher than marginal revenue.

D) both a and b

E) both b and c

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A radio manufacturer has two plants -- one in Taiwan and one in California.At the current allocation of total output between the two plants,the last unit of output produced in the Taiwan plant added $8 to total cost,while the last unit of output produced in the California plant added $6 to total cost.If the firm switches one unit of output from the California to the Taiwan plant,then

A) profit will increase $6.

B) profit will increase $14.

C) profit will decrease $2.

D) profit will decrease $6.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

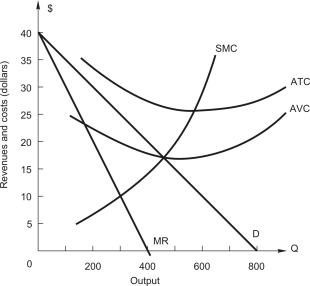

A price-setting firm faces the following estimated demand and average variable cost functions: where is the quantity demanded,P is price,M is income,and is the price of a related good.The firm expects income to be $40,000 and to be $53.Total fixed cost is $2,600,000.What is the firm's profit?

A) $1,470,000

B) $1,200,000

C) $1,600,000

D) -$2,600,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is true of a monopolist in the long run?

A) The firm will charge a price that is higher than long-run marginal cost.

B) The firm will charge a price that is equal to or greater than long-run average cost.

C) The firm will produce that level of output at which long-run average cost is minimum.

D) both a and b

E) both b and c

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A firm facing a downward sloping demand curve is producing a level of output at which price is $7,marginal revenue is $5,and average total cost,which is at its minimum value,is $3.In order to maximize profit,the firm should

A) decrease price.

B) keep price the same.

C) decrease output.

D) increase price.

E) both c and d

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The market demand for a monopoly firm is estimated to be: where is quantity demanded,P is price,M is income,and is the price of a related good.The manager has forecasted the values of M and will be $50,000 and $20,respectively,in 2021.The average variable cost function is estimated to be Total fixed cost in 2021is expected to be $4 million.The firm's profit is

A) $100,000.

B) $200,000.

C) $375,000.

D) -$182,000.

E) $800,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

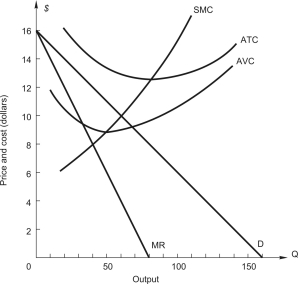

The above graph shows the demand and cost conditions facing a price-setting firm. What is the maximum amount of profit the firm can earn?

The above graph shows the demand and cost conditions facing a price-setting firm. What is the maximum amount of profit the firm can earn?

A) -$180

B) -$80

C) $60

D) $120

E) none of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In order to maximize profit,a firm that produces its output in two plants will produce the level of total output at which the last unit of output produced adds the same amount to total revenue as to the

A) first plant's total cost.

B) second plant's total cost.

C) firm's total cost

D) both a and b

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If demand is estimated to be = 240 -6P,the marginal revenue function is

A) MR = 40 - 0.33Q.

B) MR = 240 - 2Q.

C) MR = 40 - 2P.

D) MR = 240 -12P.

E) MR = 240 -6P.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Using time-series data,the demand function for a profit-maximizing monopolist has been estimated as where is the amount sold,P is price,M is income,and is the price of a related good.The estimated values for M and in 2021are $25,000 and $200,respectively.The short-run marginal cost curve for this firm has been estimated as: Total fixed cost is forecast to be $500,000 in 2021.The firm's forecasted profit (loss) in 2021is

A) a loss of $100,000.

B) a loss of $500,000.

C) a profit of $100,000.

D) a profit of $500,000.

E) a profit of $908,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A monopolist will

A) always charge a price higher than average cost.

B) always charge a price higher than marginal cost.

C) always produce a level of output at which marginal revenue equals marginal cost.

D) both b and c

E) all of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Using time-series data,the demand function for a profit-maximizing monopolist has been estimated as where is the amount sold,P is price,M is income,and is the price of a related good.The estimated values for M and in 2021are $25,000 and $200,respectively.The short-run marginal cost curve for this firm has been estimated as: Total fixed cost is forecast to be $500,000 in 2021.The forecasted marginal revenue function for 2021is:

A) MR = 200,000 - 0.004Q

B) MR = 424 - 0.002Q

C) MR = 110 -0.002Q

D) MR = 424-0.004Q

E) MR = 120 -0.002Q

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In a monopolistically competitive industry in long-run equilibrium

A) each firm is making a normal profit.

B) each firm is producing the output at which long-run average cost is at its minimum point.

C) price equals marginal cost for each firm.

D) all of the above

E) none of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

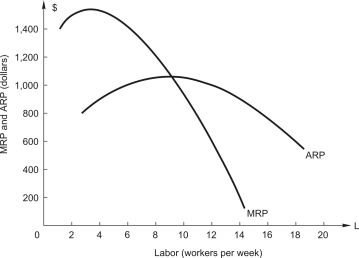

A manager of a firm with market power faces the marginal revenue product and average revenue product curves shown below.The firm incurs weekly fixed costs of $1,800.The firm employs a single variable input,labor,which costs $600 per worker each week.  Given the above,the 14th worker hired adds $_______ to the firm's total revenue each week.

Given the above,the 14th worker hired adds $_______ to the firm's total revenue each week.

A) $200 per week

B) $400 per week

C) $500 per week

D) $700 per week

E) $900 per week

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The figure above shows the demand and cost curves facing a price-setting firm.In profit-maximizing (or loss-minimizing) equilibrium,the Lerner index is _____,and the elasticity of demand is ______.

The figure above shows the demand and cost curves facing a price-setting firm.In profit-maximizing (or loss-minimizing) equilibrium,the Lerner index is _____,and the elasticity of demand is ______.

A) 1 ; -1

B) 0.6; -1.667

C) 0.5; -2.0

D) 0.667; -1.5

E) 1.33; -0.75

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 112

Related Exams