A) symmetry; affecting

B) symmetry; not affecting

C) asymmetry; affecting

D) asymmetry; not affecting

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The government's provision of nonexcludable public goods such as national defense is accepted because

A) government is more efficient than private firms at producing goods.

B) the market fails to produce nonexcludable public goods as a result of the free-rider problem.

C) people do not value public goods such as national defense very highly.

D) a and c

E) all of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose a particular production process results in a large amount of pollution and the government decides to impose a tax to correct for this externality,such that the socially optimal output will be produced.The tax will have the effect of shifting the

A) marginal private benefit curve to the right.

B) marginal social benefit curve to the right.

C) marginal private cost curve to the left.

D) marginal social cost curve to the left.

E) marginal private cost curve to the right.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A positive externality exists and government wants to apply a per-unit subsidy in order to bring about the socially optimal output.Under what condition will the solution (of the subsidy) be worse than the problem (the market failure) ?

A) Under the condition that the subsidy is greater than the marginal external benefit (associated with the positive externality) .

B) Under the condition that the post-subsidy output is not farther away from the socially optimal output than the pre-subsidy output is from the socially optimal output.

C) Under the condition that the post-subsidy output is farther away from the socially optimal output than the pre-subsidy output is from the socially optimal output.

D) Under the condition that the subsidy is less than the marginal external benefit (associated with the positive externality) .

E) none of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

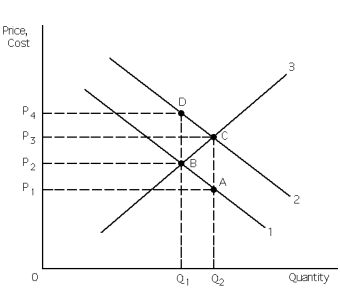

Exhibit 31-5

-Refer to Exhibit 31-5.If a positive externality exists,then curve __________ represents the marginal social benefit curve and the area __________ represents the market failure.

-Refer to Exhibit 31-5.If a positive externality exists,then curve __________ represents the marginal social benefit curve and the area __________ represents the market failure.

A) 2; BDC

B) 1; ABC

C) 3; ABC

D) 2; ABC

E) 1; BDC

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When negative externalities are involved,the market is said to

A) fail, because it underproduces the good connected with the negative externality.

B) fail, because it overproduces the good connected with the negative externality.

C) succeed, because it produces the socially optimal quantity of the good connected with the negative externality.

D) be "in optimum," because the equilibrium fully adjusts for the negative externality.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the consumption of a good by one person reduces its consumption by others,then the good is

A) nonrivalrous in consumption.

B) rivalrous in consumption.

C) nonexcludable.

D) excludable.

E) b and d

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When negative externalities are connected with the production of a good,

A) market output will be greater than the socially optimal output.

B) private costs and social costs are equal.

C) the government should subsidize the production of the good.

D) there will be a shortage of the good.

Correct Answer

verified

Correct Answer

verified

True/False

A good is nonexcludable if no externalities,either negative or positive,are associated with its production or consumption.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

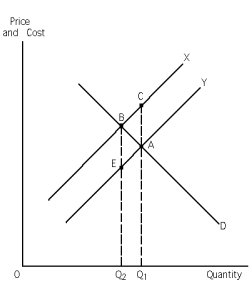

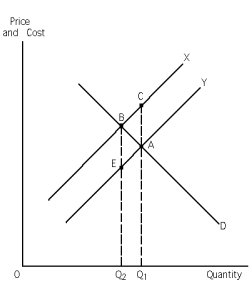

Exhibit 31-1

-Refer to Exhibit 31-l.If the exhibit represents a negative externality situation,the benefit of expanding output from Q1 to Q2 is the area of

-Refer to Exhibit 31-l.If the exhibit represents a negative externality situation,the benefit of expanding output from Q1 to Q2 is the area of

A) ABC.

B) Q2BCQ1.

C) Q2BAQ1.

D) Q2EAQ1.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the case of a negative externality,the entire marginal social cost curve lies

A) below the entire marginal private cost curve by the amount of the external costs associated with the negative externality.

B) below the entire demand curve by the amount of the external costs associated with the negative externality.

C) above the entire marginal private cost curve by the amount of the external costs associated with the negative externality.

D) above the entire demand curve by the amount of the external costs associated with the negative externality.

E) none of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a person who generates a negative externality incorporates into his or her private cost-benefit calculations the effects that this externality will have on third parties,the externality has been

A) substituted.

B) accommodated.

C) compounded.

D) internalized.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the early West,many of the open lands were overgrazed.This was largely because

A) landowners charged ranchers a fee to graze their cattle.

B) the lands were unowned.

C) a government policy in effect at the time subsidized cattle production.

D) none of the above

Correct Answer

verified

Correct Answer

verified

True/False

Positive externalities can be internalized using persuasion,but persuasion is not effective with negative externalities.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When marginal private cost is equal to marginal social cost,

A) the activity in question generates no positive externality.

B) the activity in question generates no negative externality.

C) all positive externalities have been internalized.

D) all negative externalities have been internalized.

E) b or d

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Exhibit 31-1

-Refer to Exhibit 31-1.If the exhibit represents a negative externality situation,the net social cost of expanding output from Q1 to Q2 is the area of

-Refer to Exhibit 31-1.If the exhibit represents a negative externality situation,the net social cost of expanding output from Q1 to Q2 is the area of

A) ABC.

B) BEA.

C) Q2BAQ1.

D) Q2EAQ1.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The disagreement between A.C.Pigou and Ronald Coase arose because

A) Pigou argued that the government should ban all externality-generating activities, while Coase thought that taxes and subsidies should be used instead.

B) Coase argued that the government should ban all externality-generating activities, while Pigou thought that taxes and subsidies should be used instead.

C) Pigou argued that the government should use taxes and subsidies to adjust for externalities, while Coase proposed a market solution to the externality problem.

D) Coase argued that the government should use taxes and subsidies to adjust for externalities, while Pigou proposed a market solution to the externality problem.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

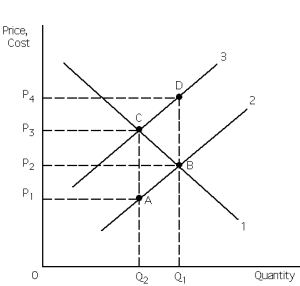

Exhibit 31-4

-Refer to Exhibit 31-4. If a negative externality exists,then the market ____________output by the amount ________________.

-Refer to Exhibit 31-4. If a negative externality exists,then the market ____________output by the amount ________________.

A) overproduces; Q1

B) underproduces; Q2

C) overproduces; Q1 - Q2

D) underproduces; Q2 - Q1

Correct Answer

verified

Correct Answer

verified

True/False

Ronald Coase stressed the necessity of using taxes to internalize negative externalities.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A negative externality exists when

A) marginal social costs are less than marginal private costs.

B) marginal social costs are greater than marginal private costs.

C) marginal social benefits are less than marginal private benefits.

D) marginal social benefits are greater than marginal private benefits.

E) b and c

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 185

Related Exams