A) $10,700

B) $74,100

C) $63,400

D) $52,700

Correct Answer

verified

Correct Answer

verified

Multiple Choice

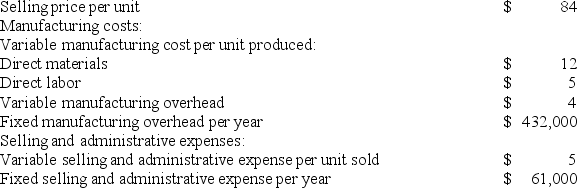

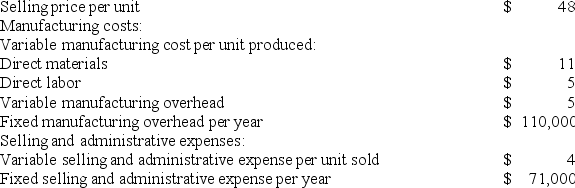

Neef Corporation has provided the following data for its two most recent years of operation:

The unit product cost under absorption costing in Year 1 is closest to:

The unit product cost under absorption costing in Year 1 is closest to:

A) $36.00

B) $21.00

C) $57.00

D) $62.00

Correct Answer

verified

Correct Answer

verified

True/False

Under variable costing, an increase in fixed manufacturing overhead will affect the unit product cost.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The impact on net operating income of a small change in sales for a segment is best predicted by using:

A) the contribution margin ratio.

B) the segment margin.

C) the ratio of the segment margin to sales.

D) net sales less segment fixed costs.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Delisa Corporation has two divisions: Division L and Division Q. Data from the most recent month appear below:  The break-even in sales dollars for Division Q is closest to:

The break-even in sales dollars for Division Q is closest to:

A) $352,635

B) $234,615

C) $403,635

D) $512,742

Correct Answer

verified

Correct Answer

verified

True/False

A company has two divisions, each selling several products. If segment reports are prepared for each product, the division managers' salaries should be considered as common fixed costs of the products.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

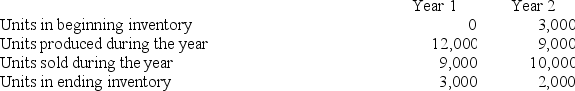

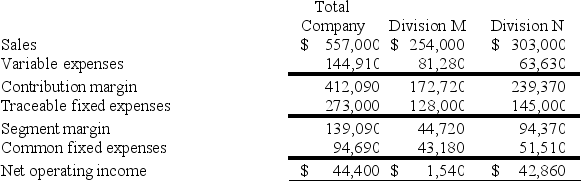

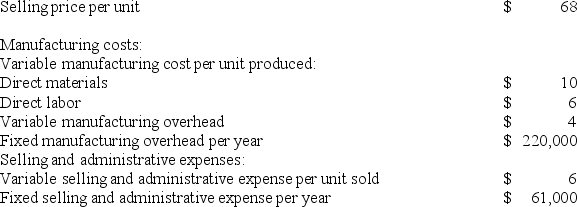

Gabuat Corporation, which has only one product, has provided the following data concerning its most recent month of operations:

The total gross margin for the month under the absorption costing approach is:

The total gross margin for the month under the absorption costing approach is:

A) $73,000

B) $37,400

C) $13,200

D) $50,600

Correct Answer

verified

Correct Answer

verified

Multiple Choice

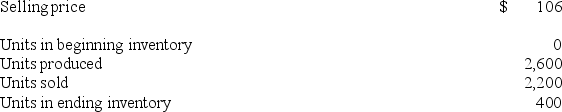

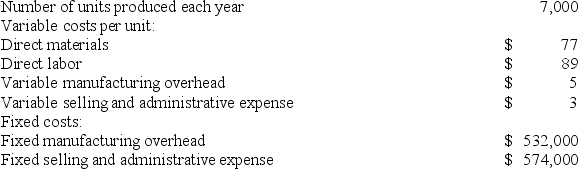

Wolanski Corporation has provided the following data for its most recent year of operations:

The unit product cost under variable costing is closest to:

The unit product cost under variable costing is closest to:

A) $21.00

B) $31.00

C) $35.00

D) $25.00

Correct Answer

verified

Correct Answer

verified

Multiple Choice

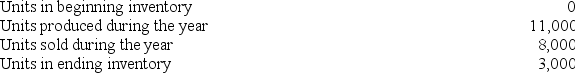

Nuzum Corporation has two divisions: Division M and Division N. Data from the most recent month appear below:  Management has allocated common fixed expenses to the Divisions based on their sales. The break-even in sales dollars for Division N is closest to:

Management has allocated common fixed expenses to the Divisions based on their sales. The break-even in sales dollars for Division N is closest to:

A) $248,747

B) $496,987

C) $183,544

D) $303,405

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Tubaugh Corporation has two major business segments--East and West. In December, the East business segment had sales revenues of $690,000, variable expenses of $352,000, and traceable fixed expenses of $104,000. During the same month, the West business segment had sales revenues of $140,000, variable expenses of $56,000, and traceable fixed expenses of $24,000. The common fixed expenses totaled $162,000 and were allocated as follows: $89,000 to the East business segment and $73,000 to the West business segment. The contribution margin of the West business segment is:

A) $84,000

B) $234,000

C) $422,000

D) $145,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

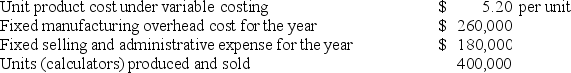

Shun Corporation manufactures and sells a hand held calculator. The following information relates to Shun's operations for last year:  What is Shun's absorption costing unit product cost for last year?

What is Shun's absorption costing unit product cost for last year?

A) $4.10 per unit

B) $4.55 per unit

C) $5.85 per unit

D) $6.30 per unit

Correct Answer

verified

Correct Answer

verified

Multiple Choice

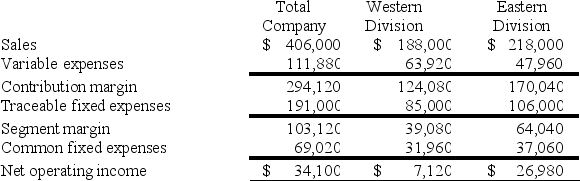

Jemmott Corporation has two divisions: Western Division and Eastern Division. The following report is for the most recent operating period:  The common fixed expenses have been allocated to the divisions on the basis of sales.

The Western Division's break-even sales is closest to:

The common fixed expenses have been allocated to the divisions on the basis of sales.

The Western Division's break-even sales is closest to:

A) $128,788

B) $233,364

C) $177,212

D) $358,929

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Allocating common fixed expenses to business segments:

A) may cause managers to erroneously discontinue business segments.

B) may cause managers to erroneously keep business segments that should be dropped.

C) ensures that all costs are covered.

D) helps managers make good decisions.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

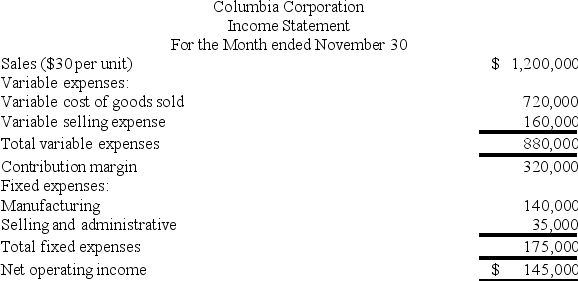

Columbia Corporation produces a single product. The company's variable costing income statement for November appears below:  During November, 35,000 units were manufactured and 8,000 units were in beginning inventory. Variable production costs have remained constant on a per unit basis over the past several months.

Under absorption costing, for November the company would report a:

During November, 35,000 units were manufactured and 8,000 units were in beginning inventory. Variable production costs have remained constant on a per unit basis over the past several months.

Under absorption costing, for November the company would report a:

A) $145,000 profit

B) $125,000 profit

C) $125,000 loss

D) $120,000 profit

Correct Answer

verified

Correct Answer

verified

True/False

Absorption costing treats all fixed costs as product costs.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

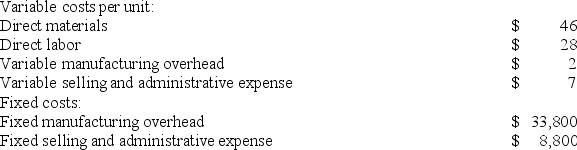

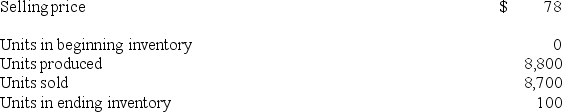

Farris Corporation, which has only one product, has provided the following data concerning its most recent month of operations:

What is the unit product cost for the month under variable costing?

What is the unit product cost for the month under variable costing?

A) $61 per unit

B) $37 per unit

C) $32 per unit

D) $66 per unit

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Data for January for Bondi Corporation and its two major business segments, North and South, appear below:  In addition, common fixed expenses totaled $179,000 and were allocated as follows: $93,000 to the North business segment and $86,000 to the South business segment.

A properly constructed segmented income statement in a contribution format would show that the segment margin of the North business segment is:

In addition, common fixed expenses totaled $179,000 and were allocated as follows: $93,000 to the North business segment and $86,000 to the South business segment.

A properly constructed segmented income statement in a contribution format would show that the segment margin of the North business segment is:

A) $105,000

B) $383,000

C) $198,000

D) $184,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

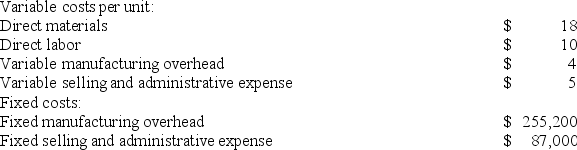

Tat Corporation produces a single product and has the following cost structure:  The unit product cost under variable costing is:

The unit product cost under variable costing is:

A) $169 per unit

B) $171 per unit

C) $247 per unit

D) $174 per unit

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Ross Corporation produces a single product. The company has direct materials costs of $8 per unit, direct labor costs of $6 per unit, and manufacturing overhead of $10 per unit. Sixty percent of the manufacturing overhead is for fixed costs. In addition, variable selling and administrative expenses are $2 per unit, and fixed selling and administrative expenses are $3 per unit at the current activity level. Assume that direct labor is a variable cost. Under absorption costing, the unit product cost is:

A) $24 per unit

B) $20 per unit

C) $26 per unit

D) $29 per unit

Correct Answer

verified

Correct Answer

verified

Multiple Choice

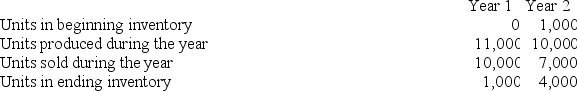

Tustin Corporation has provided the following data for its two most recent years of operation:

The net operating income (loss) under absorption costing in Year 2 is closest to:

The net operating income (loss) under absorption costing in Year 2 is closest to:

A) $81,000

B) $13,000

C) $184,000

D) $142,000

Correct Answer

verified

Correct Answer

verified

Showing 221 - 240 of 291

Related Exams