Correct Answer

verified

Correct Answer

verified

Multiple Choice

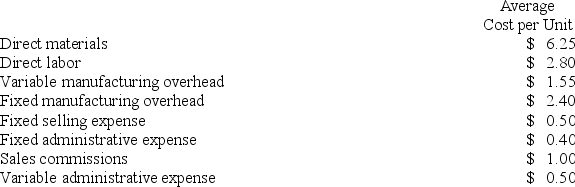

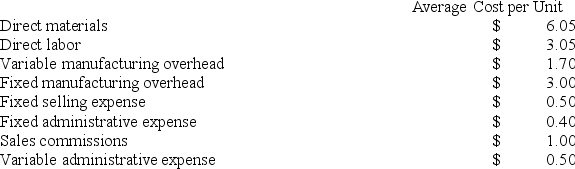

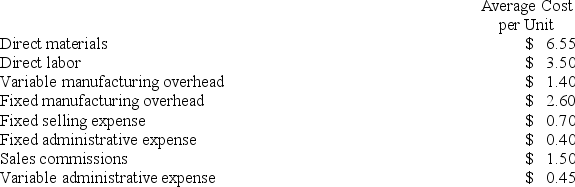

Adens Corporation's relevant range of activity is 2,000 units to 6,000 units. When it produces and sells 4,000 units, its average costs per unit are as follows:  If 5,000 units are sold, the total variable cost is closest to:

If 5,000 units are sold, the total variable cost is closest to:

A) $53,000

B) $65,000

C) $60,500

D) $77,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Kesterson Corporation has provided the following information:  If 6,000 units are produced, the total amount of direct manufacturing cost incurred is closest to:

If 6,000 units are produced, the total amount of direct manufacturing cost incurred is closest to:

A) $55,800

B) $63,900

C) $80,700

D) $64,800

Correct Answer

verified

Correct Answer

verified

True/False

A fixed cost is not constant per unit of product.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Fixed costs expressed on a per unit basis:

A) increase with increases in activity.

B) decrease with increases in activity.

C) are not affected by activity.

D) should be ignored in making decisions since they cannot change.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

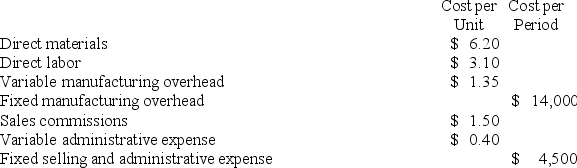

The University Store, Inc. is the major bookseller for four nearby colleges. An income statement for the first quarter of the year is presented below:  On average, a book sells for $40.00. Variable selling expenses are $3.00 per book; the remaining selling expenses are fixed. The variable administrative expenses are 5% of sales; the remainder of the administrative expenses are fixed.

The cost formula for selling and administrative expenses with "X" equal to the number of books sold is:

On average, a book sells for $40.00. Variable selling expenses are $3.00 per book; the remaining selling expenses are fixed. The variable administrative expenses are 5% of sales; the remainder of the administrative expenses are fixed.

The cost formula for selling and administrative expenses with "X" equal to the number of books sold is:

A) Y = $105,000 + $3X

B) Y = $105,000 + $5X

C) Y = $110,000 + $5X

D) Y = $110,000 + $33X

Correct Answer

verified

Correct Answer

verified

Essay

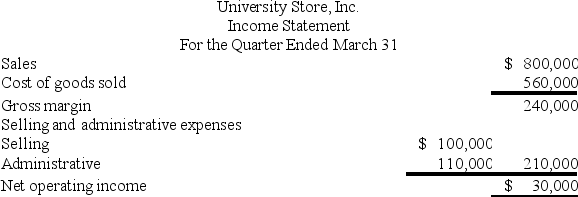

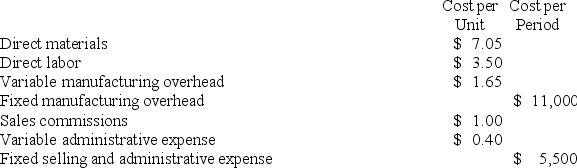

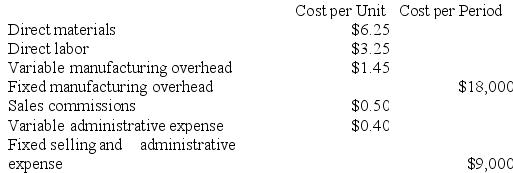

Asplund Corporation has provided the following information:

Required:

a. For financial reporting purposes, what is the total amount of product costs incurred to make 5,000 units?

b. For financial reporting purposes, what is the total amount of period costs incurred to sell 5,000 units?

Required:

a. For financial reporting purposes, what is the total amount of product costs incurred to make 5,000 units?

b. For financial reporting purposes, what is the total amount of period costs incurred to sell 5,000 units?

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Schwiesow Corporation has provided the following information:  For financial reporting purposes, the total amount of period costs incurred to sell 5,000 units is closest to:

For financial reporting purposes, the total amount of period costs incurred to sell 5,000 units is closest to:

A) $12,500

B) $8,300

C) $7,000

D) $5,500

Correct Answer

verified

Correct Answer

verified

Multiple Choice

For the past 8 months, Jinan Corporation has experienced a steady increase in its cost per unit even though total costs have remained stable. This cost per unit increase may be due to ________ costs if the level of activity at Jinan is ________.

A) fixed, decreasing

B) fixed, increasing

C) variable, decreasing

D) variable, increasing

Correct Answer

verified

Correct Answer

verified

Multiple Choice

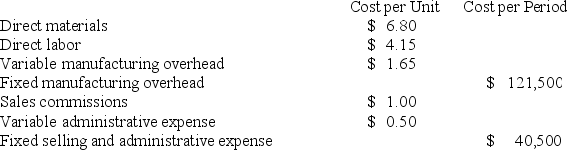

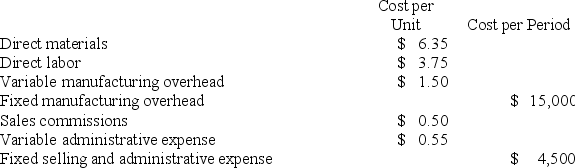

Kneeland Corporation has provided the following information:  If 10,000 units are produced, the total amount of manufacturing overhead cost is closest to:

If 10,000 units are produced, the total amount of manufacturing overhead cost is closest to:

A) $186,000

B) $138,000

C) $162,000

D) $150,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

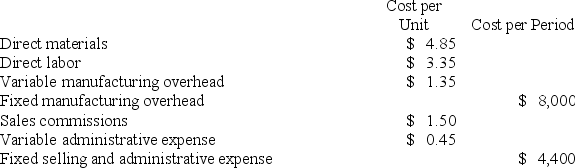

Lagle Corporation has provided the following information:  For financial reporting purposes, the total amount of period costs incurred to sell 4,000 units is closest to:

For financial reporting purposes, the total amount of period costs incurred to sell 4,000 units is closest to:

A) $12,200

B) $7,800

C) $4,400

D) $8,100

Correct Answer

verified

Correct Answer

verified

Multiple Choice

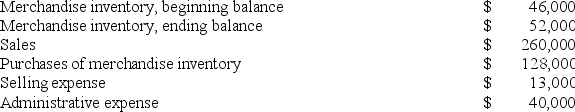

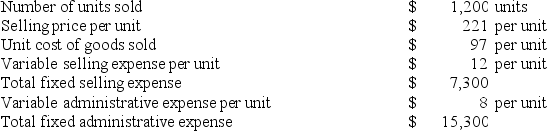

Streif Inc., a local retailer, has provided the following data for the month of June:  The cost of goods sold for June was:

The cost of goods sold for June was:

A) $128,000

B) $181,000

C) $122,000

D) $134,000

Correct Answer

verified

Correct Answer

verified

Essay

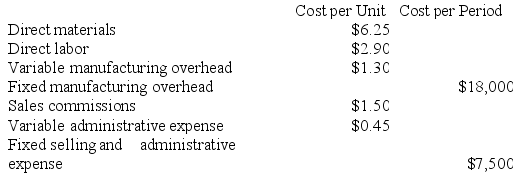

Menk Corporation has provided the following information:

Required:

a. If 5,000 units are sold, what is the variable cost per unit sold?

b. If 5,000 units are sold, what is the total amount of variable costs related to the units sold?

c. If 5,000 units are produced, what is the total amount of manufacturing overhead cost incurred?

Required:

a. If 5,000 units are sold, what is the variable cost per unit sold?

b. If 5,000 units are sold, what is the total amount of variable costs related to the units sold?

c. If 5,000 units are produced, what is the total amount of manufacturing overhead cost incurred?

Correct Answer

verified

Correct Answer

verified

True/False

The cost of napkins put on each person's tray at a fast food restaurant is a variable cost with respect to how many persons are served.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Pedregon Corporation has provided the following information:  If 4,000 units are produced, the total amount of manufacturing overhead cost is closest to:

If 4,000 units are produced, the total amount of manufacturing overhead cost is closest to:

A) $21,000

B) $14,000

C) $28,000

D) $17,500

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Delongis Corporation, a merchandising company, reported the following results for June:  Cost of goods sold is a variable cost in this company.

The gross margin for June is:

Cost of goods sold is a variable cost in this company.

The gross margin for June is:

A) $242,600

B) $148,800

C) $124,800

D) $102,200

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Fiori Corporation's relevant range of activity is 3,000 units to 7,000 units. When it produces and sells 5,000 units, its average costs per unit are as follows:  The incremental manufacturing cost that the company will incur if it increases production from 5,000 to 5,001 units is closest to:

The incremental manufacturing cost that the company will incur if it increases production from 5,000 to 5,001 units is closest to:

A) $16.20

B) $10.80

C) $13.80

D) $14.30

Correct Answer

verified

Correct Answer

verified

Multiple Choice

For an automobile manufacturer, the cost of a driver's side air bag purchased from a supplier and installed in every automobile would best be described as a:

A) fixed cost.

B) mixed cost.

C) step-variable cost.

D) variable cost.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Dake Corporation's relevant range of activity is 2,000 units to 6,000 units. When it produces and sells 4,000 units, its average costs per unit are as follows:  If 3,000 units are produced, the total amount of indirect manufacturing cost incurred is closest to:

If 3,000 units are produced, the total amount of indirect manufacturing cost incurred is closest to:

A) $4,200

B) $10,400

C) $14,600

D) $12,000

Correct Answer

verified

Correct Answer

verified

Showing 281 - 299 of 299

Related Exams