A) Stocks pay interest, while bonds pay dividends.

B) One can lose with stocks but not with bonds.

C) The U.S.Federal government issues bonds but not stocks.

D) Bonds are long-term, while stocks are short-term investments.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

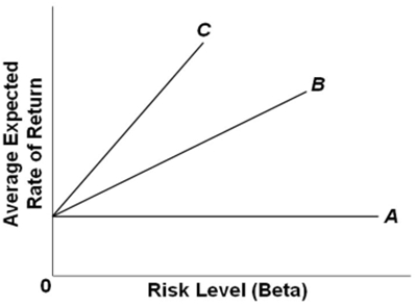

Refer to the graph.Which of the three Security Market Lines would represent a situation where investors do not care about the risk level of a financial asset?

Refer to the graph.Which of the three Security Market Lines would represent a situation where investors do not care about the risk level of a financial asset?

A) line A

B) line B

C) line C

D) none of these

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Security Market Line (SML) is upward-sloping, indicating that the

A) beta of an investment increases as its risk level increases.

B) average expected return on investments decreases as their risk level decreases.

C) average expected return on the risk-free asset increases as its beta increases.

D) average expected return of the market portfolio increases as its beta increases.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Federal Reserve changes the risk-free interest rate most directly

A) by changing the reserve requirement.

B) by changing the federal funds rate.

C) by changing the discount rate.

D) with open-market operations.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Indy owns 100 shares of stock in Pet Mart Corporation that he purchased for $20 per share.Every year he has received, from company profits, $1 for each share he owns.Indy should necessarily sell his stock if

A) the price falls below $20 per share.

B) he expects the sum of future capital gains and dividends to be negative.

C) the company stops paying dividends.

D) any of these circumstances occur.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Bonds represent

A) a claim on company dividends.

B) ownership of a company.

C) all financial assets guaranteed to pay interest.

D) loans to governments and corporations.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the Federal Reserve uses open-market operations to lower the interest rate on short-term U.S.government bonds, then, as a consequence, asset prices

A) increase and the average expected rate of return on assets decreases.

B) decrease and the average expected rate of return on assets increases.

C) increase and the average expected rate of return on assets increases.

D) decrease and the average expected rate of return on assets decreases.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A bond that pays annual interest (or coupons) and a face value at maturity will fetch a price today that is equal to the

A) future value of its annual coupons and face value.

B) future value of its annual coupons minus its face value.

C) present value of its annual coupons and face value.

D) present value of its annual coupons minus its face vale.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The line that depicts the relationship between the average expected rate of return and the risk level of a financial asset is known as the

A) Beta Line.

B) Security Market Line.

C) Risk Premium Line.

D) Risk-Return Line.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following financial assets is considered to be essentially risk-free?

A) gold

B) stock in Fortune 500 companies

C) real estate

D) short-term U.S.government bonds

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The current share price of a corporation's stock is determined by the

A) original purchase price multiplied by 1 plus the interest rate.

B) present value of capital gains and dividends received by stock owners.

C) expected interest and dividend payments.

D) expected capital gains and dividends prospective buyers will earn.

Correct Answer

verified

Correct Answer

verified

True/False

Short-term U.S.government bonds are considered to be risk-free.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Shawna bought an antique table for $200 last year and is now selling it for $250.Her rate of return on the table is

A) 10 percent.

B) 20 percent.

C) 25 percent.

D) 30 percent.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Mutual fund managers tend to focus solely on the

A) short-term (quarterly) performance of the corporations whose securities they invest in.

B) long-term performance of the corporations whose securities they invest in.

C) assets of the corporations whose securities they invest in.

D) liabilities of the corporations whose securities they invest in.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If i is the interest rate and X is the number of dollars to be received after t years, the formula to calculate the present value of a future payment is

A) (1 + i) tX.

B) X/(1 + i) t.

C) it/(1 + X) .

D) (X/i) t.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose stock A sells for $50 per share and pays dividends of $2 per share per year.Stock B sells for $100 per share and pays dividends of $4 per share per year.Through the process of arbitrage, we would expect the price of

A) stock A to fall and/or the price of stock B to rise.

B) stock A to rise and/or the price of stock B to fall.

C) both stocks to rise or fall together.

D) neither stock to change.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Matt, a star basketball player, is looking to join a new NBA team. The Bulls are offering him $24 million for one year. The Heat is offering him $10 million this year and $7.0 million in each of the next two years. The market interest rate is 5 percent.What is the present value of the offer from The Heat in millions (rounded to the nearest one hundred thousand dollars) ?

A) $22.5 million

B) $23.0 million

C) $24.0 million

D) $25.2 million

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is a difference between stocks and bonds?

A) Bonds may be issued by corporations or government; stock is only issued by corporations.

B) Stock may be issued by corporations or government; bonds are only issued by corporations.

C) Bonds are only issued by government; stock is only issued by corporations.

D) There is no difference in terms of who issues stocks and bonds.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Investors diversify portfolios

A) because diversified portfolios pay the highest rates of return.

B) because diversified portfolios are guaranteed not to lose money.

C) to reduce the risk of losing their investment.

D) to guarantee minimum returns on their investment.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The present value of a future amount of money will be greater the

A) greater the interest rate.

B) greater the amount of time before the future payment is received.

C) lower the interest rate.

D) greater the rate of the expected rate of inflation.

Correct Answer

verified

Correct Answer

verified

Showing 201 - 220 of 323

Related Exams