Correct Answer

verified

Correct Answer

verified

Multiple Choice

With respect to a corporation, select the statement that is false:

A) A corporation cannot sue others or be sued.

B) Ownership rights to the corporation are transferable.

C) Its organization requires an approved charter which is governed by state law.

D) A corporation is a separate legal entity from its owners.

Correct Answer

verified

Correct Answer

verified

True/False

When a corporation calls in its outstanding shares and issues two or more shares with a lower value in place of each share called in, the corporation is said to have issued a stock split.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

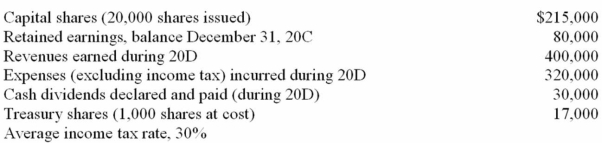

Before the journal entry to record income tax and before the closing entries were recorded at the end of the accounting period (December 31, 20D) , the following data were taken from the accounts of Buynow Corporation:  What is the total amount of shareholders' equity that should be reported on the statement financial position dated December 31, 20D?

What is the total amount of shareholders' equity that should be reported on the statement financial position dated December 31, 20D?

A) $300,000

B) $96,000

C) $304,000

D) $128,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On which of the following dates should the dividends payable account be recorded in the company records for a stock dividend?

A) Date of declaration.

B) No liability is associated with a share dividend.

C) Date of payment.

D) Date of record.

Correct Answer

verified

Correct Answer

verified

True/False

Preferred shares provide investors certain advantages, but not dividend preferences and a preference on asset distributions in the event the corporation is liquidated.

Correct Answer

verified

Correct Answer

verified

True/False

A very low dividend yield ratio is usually indicative of a growth-oriented corporation.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A stock dividend results in

A) the same ownership interest.

B) increased total assets.

C) greater ownership interest.

D) less ownership interest.

Correct Answer

verified

Correct Answer

verified

True/False

Most companies provide needed funds for expansion from a combination of operating and financing activities. This means that cash flow used by investing activities is usually provided by positive cash flow from operations and through a combination of borrowings or share issuances.

Correct Answer

verified

Correct Answer

verified

True/False

Some preferred share issues are redeemable at the option of the shareholder.

Correct Answer

verified

Correct Answer

verified

True/False

Dividends may be declared and paid in cash or stock.

Correct Answer

verified

Correct Answer

verified

True/False

Cash dividends are not a liability of the corporation until they are declared by the board of directors.

Correct Answer

verified

Correct Answer

verified

True/False

When preferred shares are cumulative and the board of directors passes on a dividend, the amount in arrears must be shown as a liability on the statement of financial position and a reduction from retained earnings on the statement of shareholders' equity and the statement of financial position.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The per share amount normally assigned by the board of directors to a stock dividend is

A) the fair value at the distribution date.

B) the fair value at the declaration date.

C) the average price paid by shareholders on total shares issued.

D) zero.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume the following shares outstanding: (1) Preferred shares, $3, cumulative, 1,000 shares with dividends in arrears 3 years, for 20A, 20B, and 20C. (2) Common shares, 2,000 shares. Total dividends declared in 20D were $30,000. What is the total amount of dividends to which common shareholders are entitled?

A) $27,000

B) $21,000

C) $30,000

D) $18,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Miter Corporation had a credit balance of $5,450,000 in its retained earnings account as of January 1, 2014. During the year Miter paid $250,000 in dividends, reported net earnings of $560,000 and comprehensive income of $750,000. The December 31 balance of retained earnings is:

A) $6,450,000

B) $5,760,000

C) $5,950,000

D) $6,200,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A stock split will

A) have no effect on retained earnings.

B) increase the total assets.

C) decrease the number of shares.

D) increase total share capital.

Correct Answer

verified

Correct Answer

verified

True/False

Stock splits and stock dividends are basically the same from the viewpoint of the shareholders but not from the viewpoint of the corporation.

Correct Answer

verified

Correct Answer

verified

True/False

A stock split results in a transfer at market value from retained earnings to share capital.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

From an investor's viewpoint, in today's litigious environment, what would be considered the most advantageous characteristic of the corporate form of organization?

A) Absolute control and management in the hands of shareholders.

B) Limited liability for shareholders.

C) Non-applicability of going concern.

D) Lack of income taxes on the business itself.

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 138

Related Exams