Correct Answer

verified

Correct Answer

verified

True/False

A tariff quota is a combination of a specific tariff and an ad valorem tariff.

Correct Answer

verified

Correct Answer

verified

True/False

Most countries in the world have about the same tariff levels.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A problem encountered when implementing an "infant industry" tariff is that

A) domestic consumers will purchase the foreign good regardless of the tariff.

B) special interest groups may prevent the tariff's removal when the industry matures.

C) most industries require tariff protection when they are mature.

D) labor unions will capture the protective effect in higher wages.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If Brazil levies a tariff on oil that is so high that it effectively prohibits imports of oil, the tariff has

A) only a protective effect.

B) only a revenue effect.

C) both a revenue effect and a protective effect.

D) no effect on trade.

Correct Answer

verified

Correct Answer

verified

True/False

An import tariff reduces the welfare of a "small" country by an amount equal to the redistribution effect plus the revenue effect.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The deadweight loss of a tariff is

A) a welfare loss since it promotes inefficient production.

B) a welfare loss since it reduces the revenue for the government.

C) not a welfare loss because society as a whole doesn't pay for the loss.

D) not a welfare loss since only business firms suffer revenue losses.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

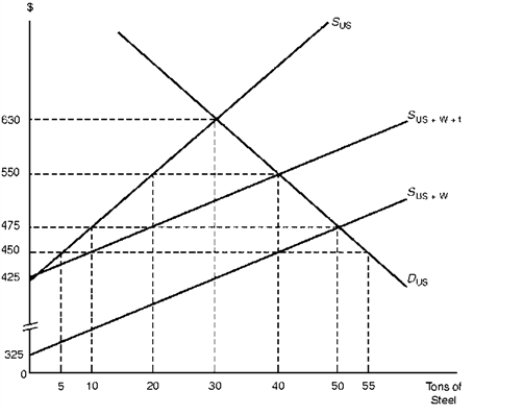

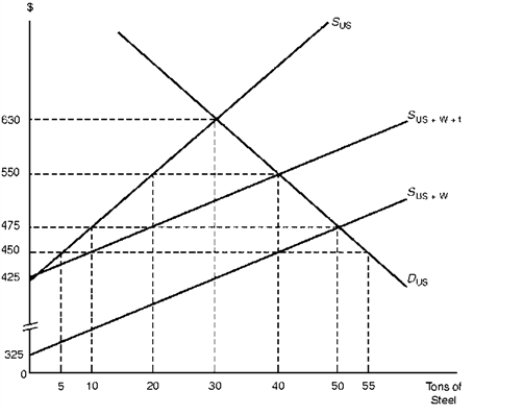

Assume the United States is a large consumer of steel that is able to influence the world price. Its demand and supply schedules are respectively denoted by DU.S. and SU.S. in Figure 4.2. The overall (United States plus world) supply schedule of steel is denoted by SU.S.+W.

Figure 4.2. Import Tariff Levied by a "Large" Country  ?

-Consider Figure 4.2.Suppose the United States imposes a tariff of $100 on each ton of steel imported.With the tariff, the price of steel rises to ____ and imports fall to ____ .

?

-Consider Figure 4.2.Suppose the United States imposes a tariff of $100 on each ton of steel imported.With the tariff, the price of steel rises to ____ and imports fall to ____ .

A) $550, 20 tons

B) $550, 30 tons

C) $575, 20 tons

D) $575, 30 tons

Correct Answer

verified

Correct Answer

verified

True/False

A compound tariff permits a specified amount of goods to be imported at one tariff rate while any imports above this amount are subjected to a higher tariff rate.

Correct Answer

verified

Correct Answer

verified

True/False

Bonded warehouses and foreign trade zones have the effect of allowing domestic importers to prorate their input duties over time.

Correct Answer

verified

Correct Answer

verified

True/False

Assume that the United States imports laptops from South Korea at a price of $200 per unit and that these laptops are subject to an import tariff of 20 percent.Also assume that U.S.components are used in the laptops assembled by South Korea and that these components have a value of $100.Under the Offshore Assembly Provision of U.S.tariff policy, the price of an imported laptop to the U.S.consumer after the tariff has been levied is $220.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that Canada levies a tariff on imports that is a fixed percentage of the product's price.This refers to

A) a compound tariff.

B) an ad valorem tariff.

C) a specific tariff.

D) an effective tariff.

Correct Answer

verified

Correct Answer

verified

True/False

In the absence of international trade, assume that the equilibrium price and quantity of motorcycles in Canada is $14,000 and 10 units respectively. Assuming that Canada is a small country that is unable to affect the world price of motorcycles, suppose its market is opened to international trade. As a result, the price of motorcycles falls to $12,000 and the total quantity demanded rises to 14 units; out of this total, 6 units are produced in Canada while 8 units are imported. Now assume that the Canadian government levies an import tariff of $1,000 on motorcycles. With the tariff, 8 units are produced in Canada and quantity demanded is 12 units. -Refer to Exhibit 4.2.As a result of the tariff, the price of imported motorcycles equals $13,000 and imports total 4 cycles.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume the United States is a large consumer of steel that is able to influence the world price. Its demand and supply schedules are respectively denoted by DU.S. and SU.S. in Figure 4.2. The overall (United States plus world) supply schedule of steel is denoted by SU.S.+W.

Figure 4.2. Import Tariff Levied by a "Large" Country  ?

-Referring to Figure 4.2, the tariff's deadweight welfare loss to the United States totals

?

-Referring to Figure 4.2, the tariff's deadweight welfare loss to the United States totals

A) $450.

B) $550.

C) $650.

D) $750.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The United States imposes a tariff on imported stereos.This tariff would benefit

A) American consumers looking to purchase a stereo.

B) retail and shipping companies that import foreign-made stereos.

C) stereo producers in the United States.

D) the U.S. economy as a whole.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

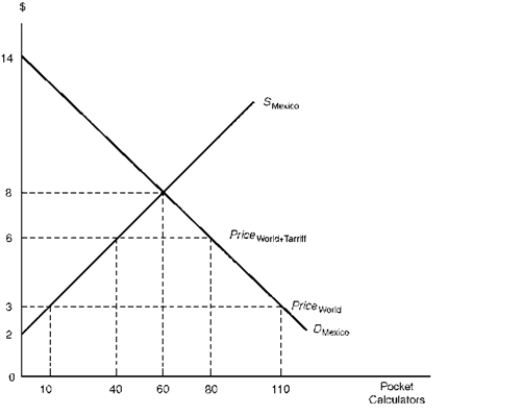

Figure 4.1 illustrates the demand and supply schedules for pocket calculators in Mexico, a "small" nation that is unable to affect the world price.

Figure 4.1. Import Tariff Levied by a "Small" Country  -According to Figure 4.1, the tariff results in the Mexican government collecting

-According to Figure 4.1, the tariff results in the Mexican government collecting

A) $100.

B) $120.

C) $140.

D) $160.

Correct Answer

verified

Correct Answer

verified

True/False

Democratic candidates for federal public office in the United States have always advocated for tariffs while Republican candidates uniformly favor free trade.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An importer of computers is required to pay a duty to the government of $100 per computer regardless of the price of the computer.Which type of tariff is described in this example?

A) tariff quota

B) compound tariff

C) specific tariff

D) ad valorem tariff

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In general, tariffs tend to have

A) only protective effects.

B) only consumption effects.

C) only revenue effects.

D) revenue effects, protective effects, and consumption effects.

Correct Answer

verified

Correct Answer

verified

True/False

A limitation of a specific tariff is that it provides a constant level of protection for domestic commodities regardless of fluctuations in their prices over time.

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 157

Related Exams