A) the tax cut is large.

B) the MPC is relatively high.

C) the economy experiences a contractionary gap.

D) the short-run aggregate supply curve is relatively flat.

E) people based consumption decisions on their level of permanent income.

Correct Answer

verified

Correct Answer

verified

True/False

Growing capital spending and privatization were two of the factors due to which the U.S.economy experienced a strong recovery in 1994.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the economy is already at its potential output,then the spending multiplier is:

A) zero in the long run.

B) infinite in the long run.

C) equal to 1 in the long run.

D) zero in the short run.

E) equal to 1 in the short run.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the government expenditure increases by $200 and the simple spending multiplier equals 5.The final increase in output will be:

A) $6000.

B) $500.

C) $200.

D) more than $200.

E) less than $200.

Correct Answer

verified

Correct Answer

verified

True/False

Expansionary and contractionary gaps are automatically eliminated by shifts in aggregate demand.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

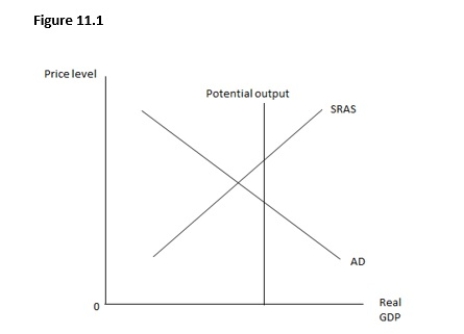

Figure 11.1 shows the relationship between the price level and the real GDP.Which of the following sets of policies would unambiguously move the economy to full employment?

A) Increase in government purchases,increase in taxes,and decrease in transfer payments

B) Decrease in government purchases,increase in taxes,and decrease in transfer payments

C) Increase in government purchases,decrease in taxes,and increase in transfer payments

D) Increase in government purchases,increase in taxes,and increase in transfer payments

E) Decrease in government purchases,decrease in taxes,and decrease in transfer payments

Correct Answer

verified

Correct Answer

verified

True/False

Because of automatic stabilizers,disposable income varies proportionately less than real GDP during periods of economic fluctuations.

Correct Answer

verified

Correct Answer

verified

True/False

Government transfer payments are a good example of an automatic stabilizer.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If policy makers estimate the natural rate of unemployment incorrectly,_____.

A) their policies will cause deflation in the long run

B) their policies will cause even more unemployment in the long run

C) the economy will stay below its potential GDP in the long run

D) the economy will tend toward the level of unemployment the policy makers believe is correct

E) policies that appear to be successful in the short run will lead to further economic problems

Correct Answer

verified

Correct Answer

verified

True/False

Classical economists believed that the economy automatically moves toward equilibrium at full employment.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The effect of automatic stabilizers on the business cycle is to:

A) make upswings larger and downswings smaller.

B) make upswings smaller and downswings larger.

C) make both upswings and downswings smaller.

D) eliminate fiscal drag.

E) make both upswings and downswings larger.

Correct Answer

verified

Correct Answer

verified

True/False

The only way by which government can affect aggregate demand is through changes in its own purchases.

Correct Answer

verified

Correct Answer

verified

True/False

It has been estimated that the marginal propensity to consume out of tax rebate money is around 1/3.

Correct Answer

verified

Correct Answer

verified

True/False

The simple spending multiplier understates the amount by which output changes.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

During the 1970s,demand-management policy:

A) continued to be highly successful in curing the economy's economic problems.

B) was found to be highly unsuitable in periods of stagflation such as the decade of the 1970s.

C) was so unsuccessful that economists advised a return to the pre-World War II philosophy of fiscal policy.

D) was unsuccessful because automatic stabilizers no longer influenced the economy.

E) was unsuitable because it affected aggregate supply more than aggregate demand.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The tax cut of 1964 (proposed by President Kennedy) :

A) was the last time fiscal policy was used.

B) was the greatest failure as a demand-management tool.

C) actually increased investment,consumption,and employment.

D) shifted the aggregate demand curve leftward.

E) was the first time the focus moved away from managing aggregate demand to focusing exclusively on aggregate supply.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the government reduces its budget deficit at the same time that energy prices rise sharply.Which of the following is most likely to happen?

A) The price level will rise,since higher energy prices increase the cost of production.

B) Real GDP will fall since both events will tend to cause an economic contraction.

C) The price level will fall because the aggregate demand curve has shifted leftward.

D) Real GDP will rise as less government spending leads to more opportunities for the private sector.

E) Both the price level and real GDP will fall.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A decrease in net taxes:

A) increases GDP as much as an equal decrease in government purchases.

B) increases GDP less than an equal increase in government purchases.

C) decreases GDP more than an equal decrease in government purchases.

D) changes GDP in an unpredictable manner.

E) has no effect on GDP.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The U.S.federal income tax is progressive,which means that _____.

A) tax receipts grow at the same rate that income does

B) tax receipts grow at the same rate that government spending does

C) middle-income individuals pay more in taxes than either high-income or low-income individuals

D) the tax rate decreases with increases in income.

E) high-income individuals are taxed at a higher rate than low-income individuals

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A decrease in net taxes:

A) raises aggregate expenditure by raising disposable income,thereby increasing consumption.

B) raises aggregate expenditure by raising disposable income,thereby decreasing consumption.

C) lowers aggregate expenditure by lowering disposable income,thereby decreasing consumption.

D) lowers aggregate expenditure by lowering disposable income,consumption remaining constant.

E) has no effect on aggregate expenditure.

Correct Answer

verified

Correct Answer

verified

Showing 121 - 140 of 151

Related Exams