A) one of the most liquid assets and thus are always considered current assets.

B) claims that are expected to be collected in cash.

C) shown on the income statement at cash realizable value.

D) always the result of revenue recognition.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

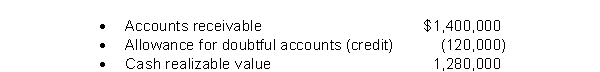

The following information is related to December 31, 2016 balances.  During 2017 sales on account were $390,000 and collections on account were $230,000. Also, during 2017 the company wrote off $22,000 in uncollectible accounts. An analysis of outstanding receivable accounts at year end indicated that bad debts should be estimated at $144,000. The change in the cash realizable value from the balance at 12/31/16 to 12/31/17 was

During 2017 sales on account were $390,000 and collections on account were $230,000. Also, during 2017 the company wrote off $22,000 in uncollectible accounts. An analysis of outstanding receivable accounts at year end indicated that bad debts should be estimated at $144,000. The change in the cash realizable value from the balance at 12/31/16 to 12/31/17 was

A) 136,000 increase.

B) $160,000 increase.

C) $114,000 increase.

D) $138,000 increase.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company regularly sells its receivables to a factor who assesses a 2% service charge on the amount of receivables purchased. Which of the following statements is true for the seller of the receivables?

A) The loss section of the income statement will increase each time receivables are sold.

B) The credit to Accounts Receivable is less than the debit to Cash when the accounts are sold.

C) Selling expenses will increase each time accounts are sold.

D) The other expenses section of the income statement will increase each time accounts are sold.

Correct Answer

verified

Correct Answer

verified

True/False

The Allowance for Doubtful Accounts is a liability account.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Smithson Corporation's unadjusted trial balance includes the following balances (assume normal balances) : Accounts Receivable Allowances for Doubtful Accounts Bad debts are estimated to be 6% of outstanding receivables. What amount of bad debt expense will the company record?

A) $67,140

B) $45,840

C) $44,562

D) $68,418

Correct Answer

verified

Correct Answer

verified

True/False

When the due date of a note is stated in months, the time factor in computing interest is the number of months divided by 360 days.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which receivables accounting and reporting issue is essentially the same for IFRS and GAAP?

A) The use of allowance accounts and the allowance method.

B) How to record discounts.

C) How to record factoring.

D) All of these answer choices are essentially the same for IFRS and GAAP.

Correct Answer

verified

Correct Answer

verified

True/False

An aging schedule is prepared only for old accounts receivables that have been past due for more than one year.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The collection of an account that had been previously written off under the allowance method of accounting for uncollectibles

A) will increase income in the period it is collected.

B) will decrease income in the period it is collected.

C) requires a correcting entry for the period in which the account was written off.

D) does not affect income in the period it is collected.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A note receivable is executed in December. When the note is paid the following February, the payee's entry includes (assuming a calendar-year accounting period and no reversing entries) a

A) credit to Interest Receivable.

B) credit to Cash.

C) debit to Notes Receivable.

D) debit to Interest Income.

Correct Answer

verified

Correct Answer

verified

True/False

The two accounting problems with accounts receivable are: (1) recognizing and (2) disposing.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A dishonored note receivable

A) Is no longer negotiable.

B) Must be written off by the lender.

C) Creates a claim against the maker for the amount of principal only.

D) Is one that is not paid in full within 10 days of maturity.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Using the allowance method, the uncollectible accounts for the year is estimated to be $50,000. If the balance for the Allowance for Doubtful Accounts is a $9,000 debit before adjustment, what is the amount of bad debt expense for the period?

A) $9,000

B) $41,000

C) $50,000

D) $59,000

Correct Answer

verified

Correct Answer

verified

True/False

Bad debt expense and interest revenue are reported in the income statement under other revenues and expenses.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The financial statements of the Nelson Manufacturing Company reports net sales of $360,000 and accounts receivable of $50,000 and $30,000 at the beginning of the year and end of year, respectively. What is the accounts receivable turnover for Nelson?

A) 4.5 times

B) 7.2 times

C) 12.0 times

D) 9.0 times

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In 2017 the Golic Co. had net credit sales of $900,000. On January 1, 2017, the Allowance for Doubtful Accounts had a credit balance of $22,500. During 2017, $36,000 of uncollectible accounts receivable were written off. Past experience indicates that the allowance should be 10% of the balance in receivables (percentage-of-receivables basis) . If the accounts receivable balance at December 31 was $240,000, what is the required adjustment to the Allowance for Doubtful Accounts at December 31, 2017?

A) $24,000.

B) $37,500.

C) $46,500.

D) $36,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A captive finance company refers to

A) a finance company that is owned by individuals who borrow money from the company.

B) finance companies that won't allow early repayment of loans.

C) a company that is wholly owned by another company and provides financing to purchasers of its owner company's goods.

D) any company that issues a major credit card.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When an account becomes uncollectible and must be written off

A) Allowance for Doubtful Accounts should be credited.

B) Accounts Receivable should be credited.

C) Bad Debt Expense should be credited.

D) Sales Revenue should be debited.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Accounts receivable are valued and reported on the balance sheet

A) in the investments section.

B) at gross amounts less sales returns and allowances.

C) at cash realizable value.

D) only if they are not past due.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Using the percentage-of-receivables method for recording bad debt expense, estimated uncollectible accounts are $55,000. If the balance of the Allowance for Doubtful Accounts is $11,000 debit before adjustment, what is the balance after adjustment?

A) $55,000

B) $11,000

C) $66,000

D) $44,000

Correct Answer

verified

Correct Answer

verified

Showing 181 - 200 of 220

Related Exams