Correct Answer

verified

Correct Answer

verified

Multiple Choice

On the balance sheet, any account having a balance intended to be deducted from another related account balance for financial statement purposes is known as a(n)

A) expense account.

B) discount account.

C) contra account.

D) uncollectible account.

Correct Answer

verified

Correct Answer

verified

True/False

The percentage of receivables method is often referred to as aging the receivables.

Correct Answer

verified

Correct Answer

verified

True/False

Most firms are able to increase sales by extending credit to customers.

Correct Answer

verified

Correct Answer

verified

True/False

Whenever a company elects to make sales on account, it is inevitable that some receivables will become uncollectible.

Correct Answer

verified

Correct Answer

verified

Essay

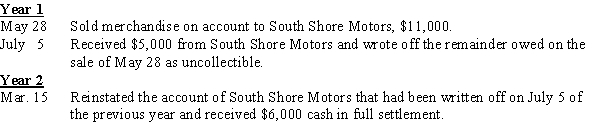

Texas Roundup uses the direct write-off method in accounting for uncollectible accounts.

Required:

Record the above transactions in general journal form.

Required:

Record the above transactions in general journal form.

Correct Answer

verified

Correct Answer

verified

True/False

The percentage of receivables method of estimating uncollectible accounts is based on the relationship between the amount of accounts payable and the amount of uncollectible accounts.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

After aging the accounts receivable, it is estimated that $1,200 will not be collected and the allowance account has an existing credit balance of $400. If the accounts receivable total $130,000, the net receivables would be

A) $128,800.

B) $129,600.

C) $128,400.

D) $128,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match the terms with the definitions. -A technique that attempts to recognize bad debt expense in the same period that the related credit sales are made.

A) aging the receivables

B) allowance method

C) bad debt expense

D) direct write-off method

E) matching principle

F) net receivables

G) percentage of receivables method

H) percentage of sales method

Correct Answer

verified

Correct Answer

verified

True/False

Under the direct write-off method, the bad debt expense is recognized before it has been determined that an account is uncollectible.

Correct Answer

verified

Correct Answer

verified

True/False

Under the percentage of sales method, the credit sales are analyzed to estimate the amount that will not be collected.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The expense associated with an uncollectible account is recognized when it has been determined that a customer will not pay the amount owed under the

A) reserve method.

B) allowance method.

C) allocation method.

D) direct write-off method.

Correct Answer

verified

Correct Answer

verified

True/False

The amount of the year-end adjustment for Allowance for Bad Debts is equal to the aging percent of uncollectible accounts multiplied by the amount of accounts receivable.

Correct Answer

verified

Correct Answer

verified

True/False

When it is possible to make a reasonable estimate of the amount of uncollectible accounts, the allowance method is preferred for financial reporting purposes.

Correct Answer

verified

Correct Answer

verified

True/False

Aging the receivables is often referred to as the percentage of sales method.

Correct Answer

verified

Correct Answer

verified

True/False

The percentage of sales method emphasizes proper estimating and reporting of bad debt expense on the income statement and the matching of expenses with revenues.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match the terms with the definitions. -The amount a business expects to collect from its accounts receivable; calculated as Accounts Receivable less Allowance for Bad Debts.

A) aging the receivables

B) allowance method

C) bad debt expense

D) direct write-off method

E) matching principle

F) net receivables

G) percentage of receivables method

H) percentage of sales method

Correct Answer

verified

Correct Answer

verified

True/False

The term "net receivables" refers to the difference between Accounts Receivable and Allowance for Bad Debts.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match the terms with the definitions. -A loss from failure to collect an account receivable.

A) aging the receivables

B) allowance method

C) bad debt expense

D) direct write-off method

E) matching principle

F) net receivables

G) percentage of receivables method

H) percentage of sales method

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A detailed analysis of the accounts receivable to determine the length of time each account has been outstanding is called

A) taking a percentage of sales on account.

B) aging the accounts receivable.

C) analyzing the accounts receivable.

D) aging the uncollectible accounts.

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 77

Related Exams