Correct Answer

verified

Correct Answer

verified

Essay

Dollar-value LIFO method. Part A. Judd Company has a beginning inventory in year one of $700,000 and an ending inventory of $847,000. The price level has increased from 100 at the beginning of the year to 110 at the end of year one. Calculate the ending inventory under the dollar-value LIFO method. Part B. At the end of year two, Judd's inventory is $943,000 in terms of a price level of 115 which exists at the end of year two. Calculate the inventory at the end of year two continuing the use of the dollar-value LIFO method.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Valuation of inventories requires the determination of all of the following except

A) the costs to be included in inventory.

B) the physical goods to be included in inventory.

C) the cost of goods held on consign?ment from other companies.

D) the cost flow assumption to be adopted.

Correct Answer

verified

Correct Answer

verified

Short Answer

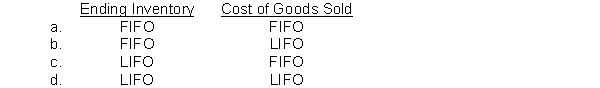

Which inventory costing method most closely approximates current cost for each of the following:

Correct Answer

verified

Correct Answer

verified

Multiple Choice

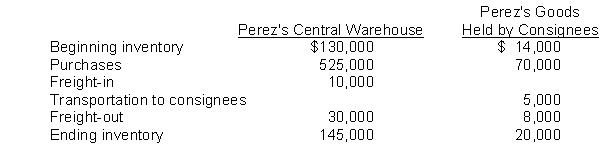

The following information was derived from the 2014 accounting records of Perez Co.:  Perez's 2014 cost of sales was

Perez's 2014 cost of sales was

A) $520,000.

B) $550,000.

C) $584,000.

D) $589,000.

Correct Answer

verified

Correct Answer

verified

True/False

The LIFO conformity rule requires that if a company uses LIFO for tax purposes, it must also use LIFO for financial accounting purposes.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the following information for questions 56 and 57. During 2014, which was the first year of operations, Oswald Company had merchandise purchases of $985,000 before cash discounts. All purchases were made on terms of 2/10, n/30. Three-fourths of the items purchased were paid for within 10 days of purchase. All of the goods available had been sold at year end. -Which of the following recording procedures would result in the highest cost of goods sold for 2014?1. Recording purchases at gross amounts2. Recording purchases at net amounts, with the amount of discounts not taken shown under "other expenses" in the income statement

A) 1

B) 2

C) Either 1 or 2 will result in the same cost of goods sold.

D) Cannot be determined from the information provided.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following methods is also referred as "parking transactions"?

A) Consignment sales.

B) Sales on installment.

C) Sales with high rates of return.

D) Sales with buyback agreement.

Correct Answer

verified

Correct Answer

verified

Short Answer

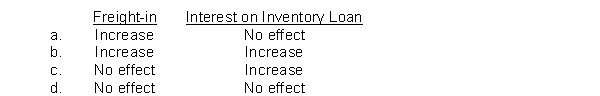

How should the following costs affect a retailer's inventory valuation?

Correct Answer

verified

Correct Answer

verified

Multiple Choice

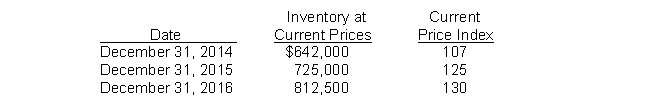

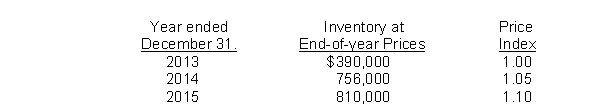

Use the following information for questions 125 through 127.

Gross Corporation adopted the dollar-value LIFO method of inventory valuation on December 31, 2013. Its inventory at that date was $550,000 and the relevant price index was 100. Information regarding inventory for subsequent years is as follows:  -What is the cost of the ending inventory at December 31, 2014 under dollar-value LIFO?

-What is the cost of the ending inventory at December 31, 2014 under dollar-value LIFO?

A) $600,000.

B) $642,000.

C) $603,500.

D) $588,500.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Opera Corp. uses the dollar-value LIFO method of computing its inventory cost. Data for the past three years is as follows:  What is the 2013 inventory balance using dollar-value LIFO?

What is the 2013 inventory balance using dollar-value LIFO?

A) $390,000.

B) $371,424.

C) $736,362.

D) $810,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Web World began using dollar-value LIFO for costing its inventory last year. The base year layer consists of $400,000. Assuming the current inventory at end of year prices equals $552,000 and the index for the current year is 1.10, what is the ending inventory using dollar-value LIFO?

A) $552,000.

B) $512,000.

C) $501,818.

D) $607,200.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Milford Company had 500 units of "Tank" in its inventory at a cost of $4 each. It purchased, for $2,800, 300 more units of "Tank". Milford then sold 400 units at a selling price of $10 each, resulting in a gross profit of $1,600. The cost flow assumption used by Milford

A) is FIFO.

B) is LIFO.

C) is weighted average.

D) cannot be determined from the information given.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the following information for questions 96 and 97. Winsor Co. records purchases at net amounts. On May 5 Winsor purchased merchandise on account, $40,000, terms 2/10, n/30. Winsor returned $3,000 of the May 5 purchase and received credit on account. At May 31 the balance had not been paid. -By how much should the account payable be adjusted on May 31?

A) $ 0.

B) $860.

C) $800.

D) $740.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

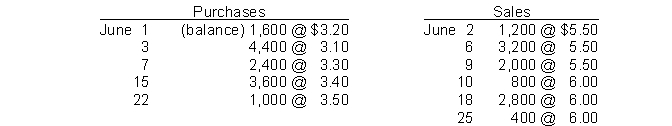

Use the following information for questions 103 through 106.

Transactions for the month of June were:  -Assuming that perpetual inventory records are kept in units only, the ending inventory on an average-cost basis, rounded to the nearest dollar, is

-Assuming that perpetual inventory records are kept in units only, the ending inventory on an average-cost basis, rounded to the nearest dollar, is

A) $8,192.

B) $8,476.

C) $8,580.

D) $8,644.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The pricing of issues from inventory must be deferred until the end of the accounting period under the following method of inventory valuation:

A) moving-average.

B) weighted-average.

C) LIFO perpetual.

D) FIFO.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following inventories carried by a manufacturer is similar to the merchandise inventory of a retailer?

A) Raw materials.

B) Work-in-process.

C) Finished goods.

D) Supplies.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Under what circumstances should a company with high rate of return on sales consider the inventory sold?

A) When it can reasonably estimate the amount of returns

B) When the retailer gives a confirmation that the goods won't be returned

C) When the goods are sold on installment

D) When the payment for goods is received

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Milford Company had 400 units of "Tank" in its inventory at a cost of $6 each. It purchased 600 more units of "Tank" at a cost of $9 each. Milford then sold 700 units at a selling price of $15 each. The LIFO liquidation overstated normal gross profit by

A) $ -0-

B) $300.

C) $600.

D) $900.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Feine Co. accepted delivery of merchandise which it purchased on account. As of December 31, Feine had recorded the transaction, but did not include the merchandise in its inventory. The effect of this on its financial statements for December 31 would be

A) net income, current assets, and retained earnings were understated.

B) net income was correct and current assets were understated.

C) net income was understated and current liabilities were overstated.

D) net income was overstated and current assets were understated.

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 173

Related Exams