A) I and II only

B) III and IV only

C) I and IV only

D) II and III only

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the volatility of the underlying asset decreases, then the:

A) Value of the put option will increase, but the value of the call option will decrease

B) Value of the put option will decrease, but the value of the call option will increase

C) Value of both the put and call option will increase

D) Value of both the put and call option will decrease

Correct Answer

verified

Correct Answer

verified

True/False

An increase in the exercise price results in an equal increase in the call option price.

Correct Answer

verified

Correct Answer

verified

True/False

A call options gives its owner the right to buy stock at a fixed strike price during a specified period of time.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Relative to the underlying stock, a call option always has:

A) A higher beta and a higher standard deviation of return

B) A lower beta and a higher standard deviation of return

C) A higher beta and a lower standard deviation of return

D) A lower beta and a lower standard deviation of return

Correct Answer

verified

Correct Answer

verified

True/False

Buying a stock and a put option, and depositing the present value of the exercise price in a bank account and buying a call provide the same payoff.

Correct Answer

verified

Correct Answer

verified

True/False

If you write a put option, you acquire the right to buy stock at a fixed strike price.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A put option gives the owner the right:

A) and the obligation to buy an asset at a given price

B) and the obligation to sell an asset at a given price

C) but not the obligation to buy an asset at a given price

D) but not the obligation to sell an asset at a given price

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The value of an option (both call and put) is positively related to: I. volatility of the underlying stock price II. time to expiration III. risk-free rate

A) I and II only

B) II and III only

C) I and III only

D) III only

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The following are examples of disguised options for firms: I. acquiring growth opportunities II. ability of the firm to terminate a project when it is no longer profitable III. options that are associated with corporate securities that provide flexibility to change the terms of the issues

A) I only

B) II only

C) I and III only

D) I, II, and III

Correct Answer

verified

Correct Answer

verified

Multiple Choice

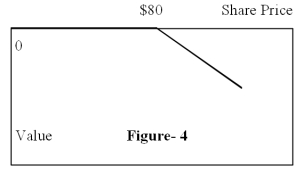

Figure-4 depicts the:

A) position diagram for the writer (seller) of a call option

B) profit diagram for the writer (seller) of a call option

C) position diagram for the writer (seller) of a put option

D) profit diagram for the writer (seller) of a put option

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The value of a put option at expiration is:

A) market price of the share minus the exercise price

B) higher of the exercise price minus market price of the share and zero

C) the exercise price

D) none of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Firms regularly use the following to reduce risk: I. Currency options II. Interest-rate options III. Commodity options

A) I only

B) II only

C) III only

D) I, II, and III

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a put and call cost the same, how can an investor offset the cost of a buying a call?

A) Borrowing money

B) Sell a put

C) Sell a stock

D) Wait for the stock price to rise

Correct Answer

verified

Correct Answer

verified

True/False

An European option gives its owner the right to exercise the option at any time before expiration.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The owner of a regular exchange-listed call-option on the stock:

A) has the right to buy 100 shares of the underlying stock at the exercise price

B) has the right to sell 100 shares of the underlying stock at the exercise price

C) has the obligation to buy 100 shares of the underlying stock at the exercise price

D) has the obligation to sell 100 shares of the underlying stock at the exercise price

Correct Answer

verified

Correct Answer

verified

Showing 61 - 76 of 76

Related Exams