A) the amount the company received for all stock when issued plus the amount of retained earnings minus treasury stock.

B) the amount the company received for all stock authorized plus the amount of retained earnings and treasury stock.

C) the par value the company received for all stock issued plus the amount of retained earnings minus treasury stock.

D) the amount the company received for all stock when issued minus the amount of retained earnings and

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a company's P/E ratio is 24 and the company's EPS is $1.50, then the company's stock price is:

A) $36.00.

B) $25.50.

C) $16.00.

D) $6.25.

Correct Answer

verified

Correct Answer

verified

True/False

At the beginning of each accounting period, the capital account for a proprietor starts with a zero balance.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements regarding a stock split is true?

A) A stock split decreases retained earnings.

B) Stock splits do not require a journal entry.

C) Stock splits are the same as stock dividends.

D) Stock splits increase the par value per share.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a company's P/E ratio suddenly decreases:

A) you should sell the stock as soon as possible.

B) you should buy more of the stock to increase your average gain.

C) the company probably announced higher earnings forecasts.

D) the market must have reacted to some bad news that is expected to affect the company in the future.

Correct Answer

verified

Correct Answer

verified

True/False

The owner's salary is frequently the largest expense of a sole proprietorship.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements regarding business forms is true?

A) A sole proprietorship is an unincorporated business owned by one person.

B) All partnerships are owned by two people.

C) A corporation is not a legal entity.

D) An LLC (limited liabilitycompany) has the same tax treatment as a corporation.

Correct Answer

verified

Correct Answer

verified

True/False

A major advantage of debt financing is that interest expense is tax deductible.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

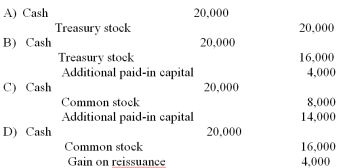

What is the journal entry to record the reissuance on July 3?

A) Option: A

B) Option: B

C) Option: C

D) Option: D

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Typically, all other things equal, a profitable company that pays relatively high dividends:

A) is an attractive investment for those seeking a steady income, like retired people.

B) will reinvest more profit which can lead to smaller growth potential.

C) will experience more growth in stock price over time.

D) is a bad investment.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company originally issues 180,000 shares of stock at a price of $22; one year later the stock price is $40 per share, the number of outstanding shares is unchanged, and the company's net income for the year is $230,400. The P/E ratio at the end of the year is:

A) 0.0002.

B) 24.22.

C) 31.25.

D) 0.0001.

Correct Answer

verified

Correct Answer

verified

True/False

A stock split increases total stockholders' equity.

Correct Answer

verified

Correct Answer

verified

True/False

A corporation's charter establishes the market value of the company's stock.

Correct Answer

verified

Correct Answer

verified

True/False

Treasury stock is a corporation's own stock that has been issued and subsequently repurchased by the corporation.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The retained earnings balance was $22,900 on January 1. Net income for the year was $18,100. If retained earnings had a credit balance of $23,800 after closing entries were made for the year, and if additional stock of $5,200 was issued during the year, what was the amount of dividends declared during the year?

A) $17,200

B) $23,700

C) $23,300

D) $13,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In its most basic form, the earnings per share ratio is calculated as:

A) dividends paid on common stock divided by the average number of outstanding common shares.

B) net income divided by the average number of outstanding common shares.

C) total dividends paid divided by the average number of total stock shares.

D) net income divided by average stockholders' equity.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A stock dividend:

A) is the same thing as a stock split.

B) will reduce stockholders' equity just like a cash dividend.

C) will not change any of the accounts within stockholders' equity.

D) will reduce retained earnings just like a cash dividend.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A corporate charter specifies that the company may sell up to 20 million shares of stock. The company sells 12 million shares to investors and later buys back 3 million shares. The number of authorized shares after these transactions are accounted for is:

A) 12 million shares.

B) 20 million shares.

C) 9 million shares.

D) 17 million shares.

Correct Answer

verified

Correct Answer

verified

True/False

If a company's preferred stock is 7%, $1 par value, then the dividend on the stock is $.07 per share.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is true?

A) Stock splits and stock dividends both reduce the market price of a share, but only stock splits reduce the par value of a share.

B) Stock splits and stock dividends both reduce the market price of a share and the par value of a share.

C) Stock splits and stock dividends both reduce the market price of a share, but only stock dividends reduce the par value of a share.

D) Stock splits and stock dividends both reduce the market price of a share and reduce retained earnings.

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 142

Related Exams