A) They are costs that are "attached" to inventory.

B) They are costs that are usually expenses.

C) They usually don't include freight charges

D) They usually don't include conversion costs.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An exception to the general rule that costs should be charged to expense in the period incurred is

A) factory overhead costs incurred on a product manufactured but not sold during the current accounting period.

B) interest costs for financing of inventories that are routinely manufactured in large quantities on a repetitive basis.

C) general and administrative fixed costs incurred in connection with the purchase of

D) sales commission and salary costs incurred in connection with the sale of inventory.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the conventional retail inventory method is used, markdowns are commonly ignored in the calculation of the cost to retail ratio because

A) there may be no markdowns in a given year.

B) this tends to give a better approximation of the lower of cost and market.

C) mark-ups are also ignored.

D) this tends to result in the showing of a normal profit margin in a period when no markdown goods have been sold.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to U.S.GAAP, under the lower of cost and market method, the replacement cost of an inventory item would be used as the designated market value

A) when it is below the net realizable value less the normal profit margin.

B) when it is below the net realizable value and above the net realizable value less the normal profit margin.

C) when it is above the net realizable value.

D) regardless of net realizable value.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following best describes the concept of standard costs?

A) They are the costs that should be incurred per unit of finished goods inventory.

B) They are the costs that are actually incurred per unit of finished goods inventory.

C) They are the costs that were incurred when current Canadian Accounting Standards were applied.

D) Standard costs are acceptable for reporting purposes

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements with respect to the gross profit method of estimating inventory is not correct?

A) This method is sometimes used by auditors to confirm a physical count.

B) The use of this method eliminates the need for performing an actual inventory count.

C) This method utilizes the interrelationship between the accounts used in the cost of goods sold calculation.

D) It may be used to estimate ending inventory when inventory has been destroyed.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Dubb Co.received merchandise on consignment.As of March 31, Dubb had recorded the transaction as a purchase and included the goods in inventory.The effect of this on its financial statements for March 31 would be

A) no effect.

B) net income was correct and current assets and current liabilities were overstated.

C) net income, current assets, and current liabilities were overstated.

D) net income and current liabilities were overstated.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

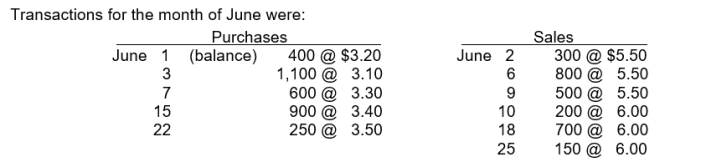

Use the following information for questions

-Assuming that perpetual inventory records are kept in units only, the ending inventory on an average-cost basis, rounded to the nearest dollar, is

-Assuming that perpetual inventory records are kept in units only, the ending inventory on an average-cost basis, rounded to the nearest dollar, is

A) $1,980.

B) $1,956.

C) $1,970.

D) $1,995.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the following information for questions Chi Co.records purchases at net amounts.On May 5 Chi purchased merchandise on account, $8,000, terms 2/10, n/30.Pye returned $500 of the May 5 purchase and received credit on account.At May 31 the balance had not been paid. -The amount to be recorded as a purchase return is

A) $450.

B) $510.

C) $500.

D) $490.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume that no correcting entries were made at December 31, 2010, or December 31, 2011 and that no additional errors occurred in 2011.Ignoring income taxes, by how much will working capital, at December 31, 2011 be overstated or understated?

A) $0

B) $4,000 overstated

C) $4,000 understated

D) $3,000 understated

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which statement is true about the retail inventory method?

A) It may not be used to estimate inventories for interim statements.

B) It may not be used to estimate inventories for annual statements.

C) It may not be used by auditors.

D) None of these.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

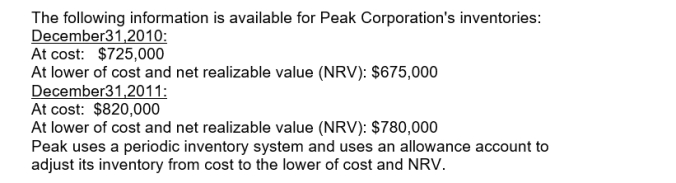

Use the following information for questions

-Peak's 2011 entry to record to adjust its inventory from cost to the lower of cost and net realizable value (NRV) is

-Peak's 2011 entry to record to adjust its inventory from cost to the lower of cost and net realizable value (NRV) is

A) Debit: "Loss-NRV" and credit: "Allowance-NRV" $40,000

B) Debit: "Allowance-NRV" and credit: "Loss-NRV" $40,000

C) Debit: "Allowance" and credit "Recovery of loss" $10,000

D) Debit: "Recovery of loss" and credit "Allowance" $10,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Danner, Ltd.estimates the cost of its physical inventory at March 31 for use in an interim financial statement.The rate of mark-up on cost is 25%.The following account balances are available:  The estimate of the cost of inventory at March 31 would be

The estimate of the cost of inventory at March 31 would be

A) $34,000.

B) $104,000.

C) $121,500.

D) $78,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

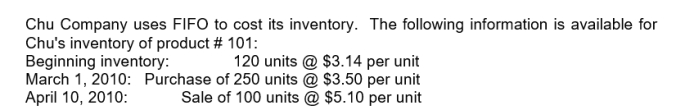

Use the following information for questions

-Assuming Chu uses a periodic inventory system, the entry to account for the March 1 purchase is:

-Assuming Chu uses a periodic inventory system, the entry to account for the March 1 purchase is:

A) Debit: "Inventory" and Credit: "Accounts Payable" $875

B) Debit: "Purchases" and Credit: "Accounts Payable" $875

C) Debit: "Accounts Payable" and Credit: "Purchases" $875

D) Debit: "Accounts Payable" and Credit: "Inventory" $875

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On January 1, 2010, the merchandise inventory of Morton, Ltd.was $1.2 million.During 2010 Morton purchased $2,300,000 of merchandise and recorded sales of $2.7 million.The gross profit rate on these sales was 35%. What is the merchandise inventory of Morton at December 31, 2010?

A) $1,125,000.

B) $1,745,000.

C) $1,765,000.

D) $945,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

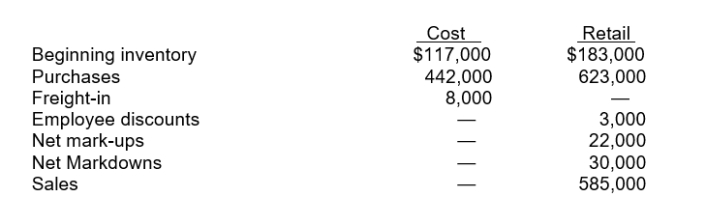

Use the following information for questions

Toby Co.uses the retail inventory method.The following information is available for the current year.

-The ending inventory at retail should be

-The ending inventory at retail should be

A) $240,000.

B) $225,000.

C) $216,000.

D) $210,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following does not correctly describe a perpetual inventory accounting system?

A) In a perpetual system cost of goods sold are calculated every time a sale is made.

B) In a perpetual system, assuming shrinkage of zero, inventory and cost of goods sold do not have to be updated at the end of the period.

C) The use of this system eliminates the requirement for an annual physical inventory

D) In a perpetual system, assuming a FIFO cost flow, the cost of goods sold would equal those from a periodic system

Correct Answer

verified

Correct Answer

verified

Multiple Choice

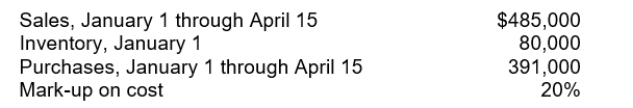

On April 15 of the current year, a fire destroyed the entire uninsured inventory of a retail store.The following data are available:  The amount of the inventory loss is estimated to be

The amount of the inventory loss is estimated to be

A) $75,000.

B) $66,833.

C) $111,500.

D) $90,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When inventory declines in value below original (historical) cost, and this decline is considered other than temporary, what is the maximum amount that the inventory can be valued at?

A) Sales price

B) Net realizable value

C) Historical cost

D) Net realizable value reduced by a normal profit margin

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following types of interest cost incurred in connection with the purchase or manufacture of inventory should be capitalized as a product cost?

A) Purchase discounts lost

B) Interest incurred during the production of discrete projects such as ships or real estate projects

C) Interest incurred on notes payable to vendors for routine purchases made on a

D) All of these should be capitalized.

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 99

Related Exams