A) $960,000

B) $1,200,000

C) $1,260,000

D) $1,680,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If an industrial firm uses the units-of-production method for calculating depreciation on its only plant asset, factory machinery, the credit to accumulated depreciation from period to period during the life of the firm will

A) be constant.

B) vary with unit sales.

C) vary with sales revenue.

D) vary with production.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The following is true of depreciation accounting.

A) It is not a matter of valuation.

B) It is part of the matching of revenues and expenses.

C) It retains funds by reducing income taxes and dividends.

D) All of these.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On January 3, 2010, Pankor Co.purchased machinery.The machinery has an estimated useful life of nine years and an estimated residual value of $45,000.The depreciation applicable to this machinery was $77,000 for 2012, calculated by the straight-line method.The acquisition cost of the machinery was

A) $693,000.

B) $685,000.

C) $738,000.

D) $710,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Hopper Company acquired machinery on January 1, 2005 which it amortized under the straight-line method with an estimated life of fifteen years and no residual value.On January 1, 2010, Hopper estimated that the remaining life of this machinery was six years with no residual value.How should this change be accounted for by Hopper?

A) As a prior period adjustment

B) As the cumulative effect of a change in accounting principle in 2010

C) By setting future annual depreciation equal to one-sixth of the book value on January

D) By continuing to amortize the machinery over the original fifteen year life

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A general description of the depreciation methods applicable to major classes of depreciable assets

A) is not a current practice in financial reporting.

B) is not essential to a fair presentation of financial position.

C) is needed in financial reporting when company policy differs from income tax policy.

D) should be included in corporate financial statements or notes thereto.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Marlowe Corporation purchased factory equipment that was installed and put into service January 2, 2010, at a total cost of $110,000.Residual value was estimated at $6,000.The equipment is being amortized over four years using the double declining-balance method.For the year 2011, Marsh should record depreciation expense on this equipment of

A) $21,000.

B) $55,000.

C) $27,500.

D) $48,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On January 1, 2010, Olds Company purchased a machine costing $250,000.The machine is an asset class for tax purposes with a CCA rate of 30%.It has an estimated $40,000 residual value at the end of its economic life.Assuming the company uses the capital cost allowance method, the amount of CCA deduction for tax purposes for the year 2010 is

A) $40,000.

B) $75,000

C) $37,500.

D) $35,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A major objective of capital cost allowance for tax depreciation is to

A) reduce the amount of depreciation deduction on business firms' tax returns.

B) assure that the amount of depreciation for tax and book purposes will be the same.

C) help companies achieve a faster write-off of their capital assets.

D) require companies to use the actual economic lives of assets in calculating tax depreciation.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The sale of a depreciable asset resulting in a loss indicates that the proceeds from the sale were

A) less than current market value.

B) greater than cost.

C) greater than book value.

D) less than book value.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use of the double declining-balance method

A) results in a decreasing charge to depreciation expense.

B) means residual value is not deducted in calculating the depreciation base.

C) means the book value should not be reduced below residual value.

D) all of these.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Dividends representing a return of capital to shareholders are not uncommon among companies which

A) use accelerated depreciation methods.

B) use straight-line depreciation methods.

C) recognize both functional and physical factors in depreciation.

D) none of these.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Private entity GAAP requires that assets must be assessed for indications of impairment

A) At the end of each reporting period.

B) At the end of every quarter.

C) When events and circumstances indicate that asset's carrying amount may not be recoverable.

D) Whenever the method of depreciation has changed

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Consider an asset that is classified as held for sale for which the following information is available:  If the asset was sold on April 1, 2011 for $27,600, there would be

If the asset was sold on April 1, 2011 for $27,600, there would be

A) A loss of $1,900

B) A gain of $1,900

C) A loss from discontinued operations

D) An extraordinary loss

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Moldowa Co.purchased machinery that was installed and ready for use on January 3, 2010, at a total cost of $115,000.Residual value was estimated at $15,000.The machinery will be amortized over five years using the double declining-balance method. For the year 2011, Vincent should record depreciation expense on this machinery of

A) $24,000.

B) $27,600.

C) $30,000.

D) $46,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Consider an asset that was separated into its main components (A, B and C) .The $1,200,000 purchase price was allocated to these components in equal proportions.The useful lifes are 12, 4, and 7 years for components A, B and C respectively.Neither of the Components (except for component C for which a $18,000 value is anticipated) is Expected to have a residual value.Assuming straight-line depreciation, total annual depreciation expense relating to these assets is

A) $125,120

B) $190,476

C) $100,000

D) $187,905

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The activity method of depreciation

A) is a variable charge approach.

B) assumes that depreciation is a function of the passage of time.

C) conceptually associates cost in terms of input measures.

D) all of these.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

During 2010, Sayer Co.sold equipment that had cost $206,000 for $127,600.This resulted in a gain of $9,600.The balance in Accumulated depreciation-Equipment was $660,000 on January 1, 2010, and $630,000 on December 31.No other equipment was Disposed of during 2010.Depreciation expense for 2010 was

A) $20,000

B) $58,000

C) $59,600

D) $101,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

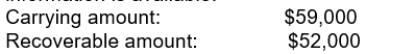

Magenta Company, a public corporation owns equipment for which the following year-end information is available:  Which of the following best describes the proper accounting treatment for Magenta's equipment?

Which of the following best describes the proper accounting treatment for Magenta's equipment?

A) It is not impaired and a loss should not be recognized

B) It is impaired, a loss must be recognized, but may be reversed in future periods.

C) It is impaired and a loss must be recognized

D) (b) and (c)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

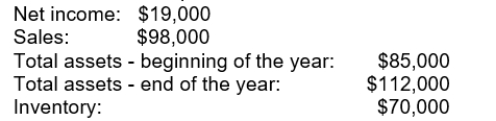

In 2010 Banko Corporation's financial statements included the following information:  Banko's return on assets (ROA) for 2010 was

Banko's return on assets (ROA) for 2010 was

A) 17.2%

B) 21.0%

C) 0.99

D) 19.3%

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 62

Related Exams