A) net realizable value is understated.

B) expenses are understated.

C) revenues are understated.

D) receivables are understated.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company may sell its accounts receivable to a factor to

A) speed up the collection of accounts receivable.

B) hide the receivables from creditors.

C) avoid selling on account.

D) allow its customers more time to pay their bills.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The net realizable value of the Accounts Receivable is $21,000 before the write-off of a $1,500 account. What is the net realizable value after the write-off?

A) $22,500

B) $21,000

C) $19,500

D) $18,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Common ways to speed up cash flow from accounts receivable do not include

A) offering customers a discount if they pay earlier than the due date.

B) borrowing money using accounts receivable as collateral.

C) accepting bank debit and credit cards in payment.

D) increasing the payment period from 30 to 45 days.

Correct Answer

verified

Correct Answer

verified

True/False

A factor is a finance company or bank that buys receivables from businesses for a fee.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

To find the balance due from an individual customer, the accountant would refer to the

A) General Journal.

B) Sales account in the general ledger.

C) Accounts Receivable subsidiary ledger.

D) Accounts Receivable account in the general ledger.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Accounts receivable are valued and reported on the statement of financial position

A) in the non-current asset section.

B) at the gross amount less sales returns and allowances.

C) at net realizable value.

D) only if they are not past due.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The maturity value of an $8,000, 6.5%, 3-month note receivable dated February 10, with interest due at maturity, is

A) $8,000.

B) $8,065.

C) $8,130.

D) $8,520.

Correct Answer

verified

Correct Answer

verified

Short Answer

Gray Inc. lends White Ltd. $60,000 on April 1, accepting a 6-month, 4.5% interest note. Interest is due the first of each month, commencing May 1. Gray Inc. prepares financial statements on April 30. What adjusting entry should be made before the financial statements can be prepared?

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Writing off an uncollectible account involves

A) a debit to Bad Debts Expense.

B) a debit to Allowance for Doubtful accounts.

C) a debit to Sales Returns and Allowances.

D) a debit to Accounts Receivable.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Estimated uncollectibles are recorded as a debit to

A) Allowance for Doubtful Accounts.

B) Bad Debts Expense.

C) Sales.

D) Accounts Receivable.

Correct Answer

verified

Correct Answer

verified

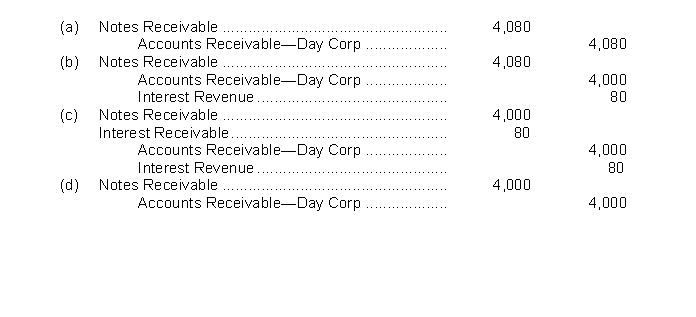

Short Answer

Night Corp receives a $4,000, 3-month, 8% note from Day Corp in settlement of a past due account receivable. What entry will Night Corp make upon receiving the note?

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following is not an accounting issue associated with accounts receivable?

A) Depreciating accounts receivable

B) Recognizing accounts receivable

C) Valuing accounts receivable

D) Estimating the amount collectible

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is true about the presentation of receivables?

A) Companies must report gross accounts receivable on the statement of financial position.

B) Companies must report the net realizable value of accounts receivable on the statement of financial position.

C) Bad debt expense must be reported under non-operating expenses in the income statement.

D) The allowance for doubtful accounts must be reported in the liabilities section of the statement of financial position.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the amount of bad debts expense is understated at year end, then

A) profit will be understated.

B) shareholders' equity will be understated.

C) Allowance for Doubtful Accounts will be overstated.

D) net Accounts Receivable will be overstated.

Correct Answer

verified

Correct Answer

verified

True/False

Bad Debts Expense is a contra account to the Sales account.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When an account is written off using the allowance method for uncollectible accounts, accounts receivable

A) is unchanged and the allowance account increases.

B) increases and the allowance account increases.

C) decreases and the allowance account decreases.

D) decreases and the allowance account increases.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The account Allowance for Doubtful Accounts is classified as a(n)

A) liability.

B) contra account to Bad Debts Expense.

C) expense.

D) contra account to Accounts Receivable.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The term "receivables" refers to

A) amounts due from individuals or companies.

B) merchandise to be collected from individuals or companies.

C) cash to be paid to creditors.

D) cash to be paid to debtors.

Correct Answer

verified

Correct Answer

verified

True/False

Accounts receivable can be the result of either cash or credit sales.

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 132

Related Exams