A) The dividend can be rescinded once it has been declared.

B) The corporation is committed to a legal, binding obligation.

C) The board of directors formally authorizes the cash dividend.

D) A liability account must be increased.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following is not necessary in order for a corporation to pay a cash dividend?

A) Adequate cash

B) Approval of stockholders

C) Declaration of dividends by the board of directors

D) Retained earnings

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A net loss

A) occurs if operating expenses exceed cost of goods sold.

B) is not closed to Retained Earnings if it would result in a debit balance.

C) is closed to Retained Earnings even if it would result in a debit balance.

D) is closed to the paid-in capital account of the stockholders' equity section of the balance sheet.

Correct Answer

verified

Correct Answer

verified

True/False

A successful corporation can have a continuous and perpetual life.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The effect of a stock dividend is to

A) decrease total assets and stockholders' equity.

B) change the composition of stockholders' equity.

C) decrease total assets and total liabilities.

D) increase the book value per share of common stock.

Correct Answer

verified

Correct Answer

verified

True/False

A corporation can be organized for the purpose of making a profit or it may be not-for-profit.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Northern Corporation issues 7,000 shares of $100 par value preferred stock for cash at $120 per share. The entry to record the transaction will consist of a debit to Cash for $840,000 and a credit or credits to

A) Preferred Stock for $840,000.

B) Paid-in Capital from Preferred Stock for $840,000.

C) Preferred Stock for $700,000 and Retained Earnings for $140,000.

D) Preferred Stock for $700,000 and Paid-in Capital in Excess of Par-Preferred Stock for $140,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The two ways that a corporation can be classified by ownership are

A) publicly held and privately held.

B) stock and non-stock.

C) inside and outside.

D) majority and minority.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not a right or preference associated with preferred stock?

A) The right to vote

B) First claim to dividends

C) Preference to corporate assets in case of liquidation

D) To receive dividends in arrears before common stockholders receive dividends

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A separate paid-in capital account is used to record each of the following except the issuance of

A) no-par stock.

B) par value stock.

C) stated value stock.

D) treasury stock above cost.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

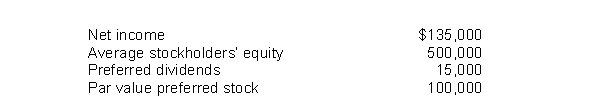

Farmer Company reports the following amounts for 2015:  The 2015 rate of return on common stockholders' equity is

The 2015 rate of return on common stockholders' equity is

A) 30.0%.

B) 24.0%.

C) 27.0%.

D) 33.8%.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Jason Thomas has invested $200,000 in a privately held family corporation. The corporation does not do well and must declare bankruptcy. What amount does Thomas stand to lose?

A) Up to his total investment of $200,000.

B) Zero.

C) The $200,000 plus any personal assets the creditors demand.

D) $100,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The authorized stock of a corporation

A) only reflects the initial capital needs of the company.

B) is indicated in its by-laws.

C) is indicated in its charter.

D) must be recorded in a formal accounting entry.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In published annual reports

A) subdivisions within the stockholders' equity section are routinely reported in detail.

B) capital surplus is used in place of retained earnings.

C) the individual sources of additional paid-in capital are often combined.

D) retained earnings is often not shown separately.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a corporation declares a 10% stock dividend on its common stock, the account to be debited on the date of declaration is

A) Common Stock Dividends Distributable.

B) Common Stock.

C) Paid-in Capital in Excess of Par.

D) Retained Earnings.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Stockholders of a corporation directly elect

A) the president of the corporation.

B) the board of directors.

C) the treasurer of the corporation.

D) all of the employees of the corporation.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Retained earnings are occasionally restricted

A) to set aside cash for dividends.

B) to keep the legal capital associated with paid-in capital intact.

C) due to contractual loan restrictions.

D) if preferred dividends are in arrears.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Dillon Corporation splits its common stock 2 for 1, when the market value is $40 per share. Prior to the split, Dillon had 50,000 shares of $10 par value common stock issued and outstanding. After the split, the par value of the stock

A) remains the same.

B) is reduced to $2 per share.

C) is reduced to $5 per share.

D) is reduced to $20 per share.

Correct Answer

verified

Correct Answer

verified

True/False

A corporation must be incorporated in each state in which it does business.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Land Inc. has retained earnings of $800,000 and total stockholders' equity of $2,000,000. It has 300,000 shares of $5 par value common stock outstanding, which is currently selling for $30 per share. If Land declares a 10% stock dividend on its common stock:

A) net income will decrease by $150,000.

B) retained earnings will decrease by $150,000 and total stockholders' equity will increase by $150,000.

C) retained earnings will decrease by $900,000 and total stockholders' equity will increase by $900,000.

D) retained earnings will decrease by $900,000 and total paid-in capital will increase by $900,000.

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 244

Related Exams