Correct Answer

verified

Correct Answer

verified

True/False

Biological assets, such as milking cows, are reported as non-current assets at fair value less costs to sale (net realizable value).

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Boxer Inc.uses the conventional retail method to determine its ending inventory at cost.Assume the beginning inventory at cost (retail) were $65,500 ($99,000) , purchases during the current year at cost (retail) were $568,000 ($865,600) , freight-in on these purchases totaled $26,500, sales during the current year totaled $811,000, and net markups were $69,000.What is the ending inventory value at cost?

A) $222,600.

B) $174,366.

C) $142,241.

D) $152,308.

Correct Answer

verified

Correct Answer

verified

True/False

When a buyer enters into a formal, noncancelable purchase contract, an asset and a liability are recorded at the inception of the contract.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

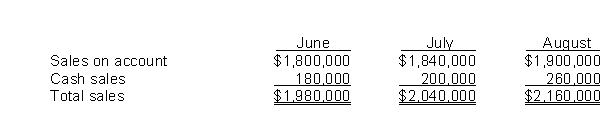

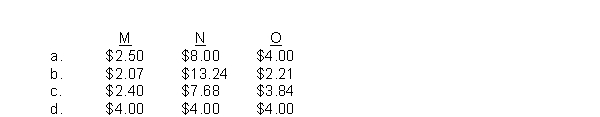

Use the following information for questions.

Miles Company, a wholesaler, budgeted the following sales for the indicated months:  All merchandise is marked up to sell at its invoice cost plus 20%.Merchandise inventories at the beginning of each month are at 30% of that month's projected cost of goods sold.

-Merchandise purchases for July are anticipated to be

All merchandise is marked up to sell at its invoice cost plus 20%.Merchandise inventories at the beginning of each month are at 30% of that month's projected cost of goods sold.

-Merchandise purchases for July are anticipated to be

A) $1,632,000.

B) $2,076,000.

C) $1,700,000.

D) $1,730,000.

Correct Answer

verified

Correct Answer

verified

True/False

The unrealized gains and losses related to recording biological assets at their correct valuation are reported as part of other comprehensive income on the statement of comprehensive income.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

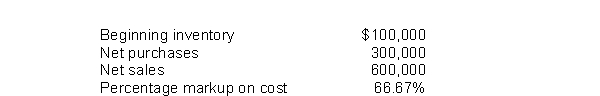

The following information is available for October for Norton Company.  A fire destroyed Norton's October 31 inventory, leaving undamaged inventory with a cost of $6,000.Using the gross profit method, the estimated ending inventory destroyed by fire is

A fire destroyed Norton's October 31 inventory, leaving undamaged inventory with a cost of $6,000.Using the gross profit method, the estimated ending inventory destroyed by fire is

A) $34,000.

B) $154,000.

C) $160,000.

D) $200,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

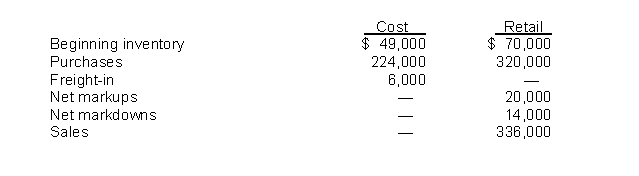

Use the following information for questions.

The following data concerning the retail inventory method are taken from the financial records of Welch Company.  -The ending inventory at retail should be

-The ending inventory at retail should be

A) $74,000.

B) $60,000.

C) $64,000.

D) $42,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not an acceptable method of applying the lower-of-cost-or-net realizable value method to inventory?

A) Inventory location.

B) Groups of inventory items.

C) Individual item.

D) Total of the inventory.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

LF Corporation, a manufacturer of Mexican foods, contracted in 2010 to purchase 1,000 pounds of a spice mixture at $5.00 per pound, delivery to be made in spring of 2011.By 12\31\10, the price per pound of the spice mixture had dropped to $4.60 per pound.In 2010, LF should recognize

A) a loss of $5,000.

B) a loss of $400.

C) no gain or loss.

D) a gain of $400.

Correct Answer

verified

Correct Answer

verified

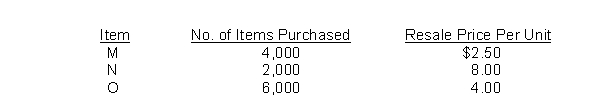

Short Answer

At a lump-sum cost of $48,000, Pratt Company recently purchased the following items for resale:  The appropriate cost per unit of inventory is:

The appropriate cost per unit of inventory is:

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Lower-of-cost-or-net realizable value as it applies to inventory is best described as the

A) reporting of a loss when there is a decrease in the future utility below the original cost.

B) method of determining cost of goods sold.

C) assumption to determine inventory flow.

D) change in inventory value to net realizable value.

Correct Answer

verified

Correct Answer

verified

True/False

In most situations, the gross profit percentage is stated as a percentage of cost.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On March 15, a fire destroyed Interlock Company's entire retail inventory.The inventory on hand as of January 1 totaled $1,650,000.From January 1 through the time of the fire, the company made purchases of $683,000, incurred freight-in of $78,000, and had sales of $1,210,000.Assuming the rate of gross profit to selling price is 30%, what is the approximate value of the inventory that was destroyed?

A) $2,048,000.

B) $1,486,000.

C) $1,564,000.

D) $2,411,000.

Correct Answer

verified

Correct Answer

verified

True/False

Under International Financial Reporting Standards (IFRS), agricultural activity can result in the production of both agricultural produce and biological assets.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An inventory method which is designed to approximate inventory valuation at the lower of cost or net realizable value is

A) last-in, first-out.

B) first-in, first-out.

C) conventional retail method.

D) specific identification.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The sales price for a product provides a gross profit of 25% of sales price.What is the gross profit as a percentage of cost?

A) 25%.

B) 20%.

C) 33%.

D) Not enough information is provided to determine.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

For 2010, cost of goods available for sale for Tate Corporation was $900,000.The gross profit rate was 20%.Sales for the year were $800,000.What was the amount of the ending inventory?

A) $0.

B) $260,000.

C) $180,000.

D) $160,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Lenny's Llamas purchased 1,000 llamas on January 1, 2011.These llamas will be sheared semiannually and their wool sold to specialty clothing manufacturers.The llamas were purchased for $222,000.During 2011 the change in fair value due to growth and price changes is $14,100, the wool harvested but not yet sold is valued at net realizable value of $27,000, and the change in fair value due to harvest is ($1,750) .On Lenny's Llamas income statement for the year ending December 31, 2011, what amount of unrealized gain on biological assets will be reported?

A) $39,350

B) $41,100

C) $14,100

D) $12,350

Correct Answer

verified

Correct Answer

verified

True/False

Under International Financial Reporting Standards (IFRS), separate reporting of reversals of inventory write-downs in the period of sale are required.

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 120

Related Exams