A) $12,606.

B) $12,284.

C) $12,312.

D) $12,432.

Correct Answer

verified

Correct Answer

verified

True/False

The dollar-value LIFO method measures any increases and decreases in a pool in terms of total dollar value and physical quantity of the goods.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Companies must allocate the cost of all the goods available for sale (or use) between

A) The cost goods on hands at the beginning of the period as reported on the statement of financial position and the cost of goods acquired or produced during the period.

B) The cost of goods on hand at the end of the period as reported on the statement of financial position and the cost of goods acquired or produced during the period.

C) The income statement and the statement of financial position.

D) All of the choices are correct.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

White Corporation uses the FIFO method for internal reporting purposes and LIFO for external reporting purposes.The balance in the LIFO Reserve account at the end of 2010 was $80,000.The balance in the same account at the end of 2011 is $120,000.White's Cost of Goods Sold account has a balance of $600,000 from sales transactions recorded during the year.What amount should White report as Cost of Goods Sold in the 2011 income statement?

A) $560,000.

B) $600,000.

C) $640,000.

D) $720,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Chess Top uses the periodic inventory system.For the current month, the beginning inventory consisted of 200 units that cost $65 each.During the month, the company made two purchases: 300 units at $68 each and 150 units at $70 each.Chess Top also sold 500 units during the month.Using the LIFO method, what is the amount of cost of goods sold for the month?

A) $33,770.

B) $32,500.

C) $34,150.

D) $33,400.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the following information for Hay Company had January 1 inventory of $100,000 when it adopted dollar-value LIFO.During the year, purchases were $600,000 and sales were $1,000,000.December 31 inventory at year-end prices was $126,500, and the price index was 110. -What is Hay Company's gross profit?

A) $415,000.

B) $416,500.

C) $426,500.

D) $883,500.

Correct Answer

verified

Correct Answer

verified

Short Answer

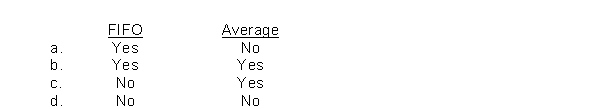

During periods of rising prices, a perpetual inventory system would result in the same dollar amount of ending inventory as a periodic inventory system under which of the following inventory cost flow methods?

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On June 15, 2010, Wynne Corporation accepted delivery of merchandise which it Purchased on account.As of June 30, Wynne had not recorded the transaction or included the merchandise in its inventory.The effect of this on its statement of financial position for June 30, 2010 would be

A) assets and equity were overstated but liabilities were not affected.

B) equity was the only item affected by the omission.

C) assets, liabilities, and equity were understated.

D) none of these.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The pricing of issues from inventory must be deferred until the end of the accounting period under the following method of inventory valuation:

A) moving average.

B) weighted-average.

C) specific identification.

D) FIFO.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

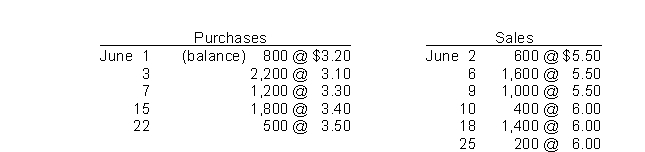

Use the following information for questions.

Transactions for the month of June were:  -Assuming that perpetual inventory records are kept in dollars, the ending inventory on a LIFO basis is

-Assuming that perpetual inventory records are kept in dollars, the ending inventory on a LIFO basis is

A) $4,110.

B) $4,160.

C) $4,290.

D) $4,470.

Correct Answer

verified

Correct Answer

verified

True/False

Under IFRS, agricultural inventories, such as wheat, oranges, etc., are recorded at their fair value less estimated selling costs at the point of harvest.

Correct Answer

verified

Correct Answer

verified

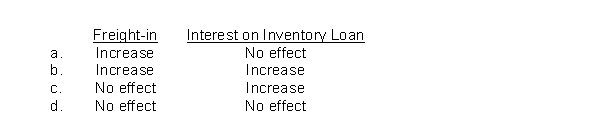

Short Answer

How should the following costs affect a retailer's inventory valuation?

Correct Answer

verified

Correct Answer

verified

True/False

The International Accounting Standards Board requires the specific identification method when unit price is low, inventory turnover is high, and inventory quantities are large.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a company uses LIFO for external reporting purposes and FIFO for internal reporting purposes, an Allowance to Reduce Inventory to LIFO account is used.This account should be reported

A) on the income statement in the Other Revenues and Gains section.

B) on the income statement in the Cost of Goods Sold section.

C) on the income statement in the Other Expenses and Losses section.

D) on the balance sheet in the Current Assets section.

Correct Answer

verified

Correct Answer

verified

True/False

Tang, Inc.sells collectible jewelry on consignment from various manufacturers and should include this consigned inventory on its statement of financial position.

Correct Answer

verified

Correct Answer

verified

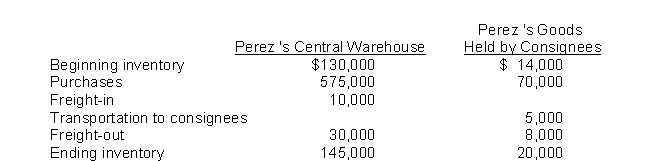

Multiple Choice

The following information was derived from the 2010 accounting records of Perez Co.:  Perez's 2010 cost of sales was

Perez's 2010 cost of sales was

A) $570,000.

B) $600,000.

C) $634,000.

D) $639,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Chess Top uses the periodic inventory system.For the current month, the beginning inventory consisted of 200 units that cost $65 each.During the month, the company made two purchases: 300 units at $68 each and 150 units at $70 each.Chess Top also sold 500 units during the month.Using the average cost method, what is the amount of ending inventory?

A) $10,500.

B) $33,770.

C) $33,400.

D) $10,131.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is included in inventory costs?

A) Product costs.

B) Period costs.

C) Product and period costs.

D) Neither product or period costs.

Correct Answer

verified

Correct Answer

verified

True/False

IFRS requires manufacturers to disclose their inventory components on the statement of financial position or in related notes.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In a period of rising prices, the inventory method which tends to give the highest reported inventory is

A) FIFO.

B) moving average.

C) specific identification.

D) weighted-average.

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 136

Related Exams