Correct Answer

verified

Correct Answer

verified

Multiple Choice

Yamamoto Company experienced an actuarial loss of ¥750 in its defined benefit plan in 2012.Yamamoto has elected to recognize these losses immediately.For 2012, Yamamoto's revenues are ¥125,000, and expenses (excluding pension expense of ¥14,000, which does not include the actuarial loss) are ¥85,000.What is the amount of net income that would be presented in Yamamoto's statement of comprehensive income for 2012, if the company recognizes the loss in other comprehensive income?

A) ¥125,000

B) ¥25,250

C) ¥26,000

D) ¥39,250

Correct Answer

verified

Correct Answer

verified

Multiple Choice

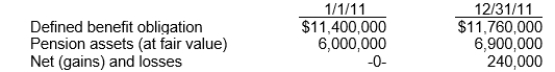

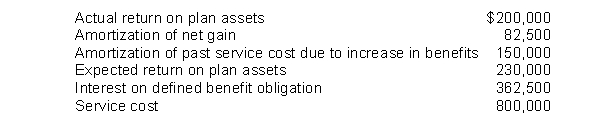

Hubbard, Inc.received the following information from its pension plan trustee concerning the operation of the company's defined-benefit pension plan for the year ended December 31, 2011.

The service cost component of pension expense for 2011 is $840,000 and the amortization of past service cost due to an increase in benefits is $180,000.The rate is 10% and the expected rate of return is 8%.What is the amount of pension expense for 2011?

A) $1,716,000

B) $1,680,000

C) $1,608,000

D) $1,440,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the following information for questions.

The following information for Cooper Enterprises is given below:

There were no unexpected gains or losses at January 1, 2011.The average remaining service life of employees is 10 years.

-The amortization of Unrecognized Net Loss for 2012 is:

-The amortization of Unrecognized Net Loss for 2012 is:

A) $0

B) $6,395

C) $11,500

D) $8,395

Correct Answer

verified

B

Correct Answer

verified

Multiple Choice

Willshire Ltd.is evaluating amendments to its pensions plans.Plan 1 covers its salaried employees and Plan 2 provides benefits to its hourly workers.On January 1, 2012, Willshire will grant employees in Plan 2 additional pension benefits of £240,000 based on their past service.Employees in this plan have an average period to vesting of 8 years.Plan 1 will be amended to reduce benefits by £120,000 (in exchange, employees will receive increased contributions to the company's defined contribution plan) .Employees in this plan have an average period to vesting of 6 years.What is the total unrecognized past service cost amortization for 2012?

A) €50,000

B) €60,000

C) €25,714

D) €10,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

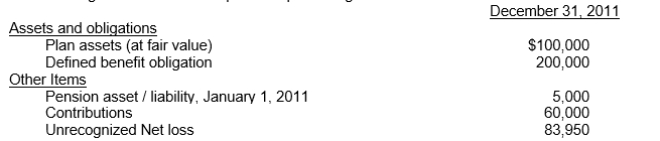

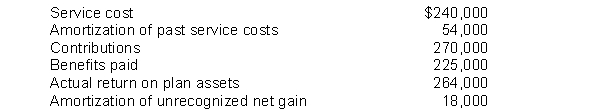

Clarkson Co.provides the following information about its Pension plan for the year 2012.

Based on this information, what is the Pension expense for 2012?

A) 165,900

B) 913,900

C) 72,900

D) 103,900

Correct Answer

verified

Correct Answer

verified

Multiple Choice

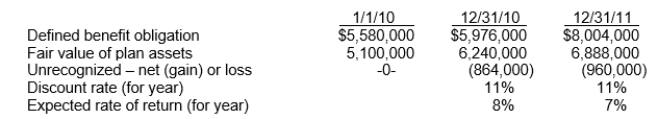

Use the following information for questions.

The following information relates to the pension plan for the employees of Turner Co.:

Turner estimates that the average remaining service life is 16 years.Turner's contribution was $756,000 in 2011 and benefits paid were $564,000.

-The unexpected gain or loss on plan assets in 2011 is

Turner estimates that the average remaining service life is 16 years.Turner's contribution was $756,000 in 2011 and benefits paid were $564,000.

-The unexpected gain or loss on plan assets in 2011 is

A) $39,360 loss.

B) $22,560 gain.

C) $19,200 gain.

D) $214,560 gain.

Correct Answer

verified

Correct Answer

verified

True/False

The interest component of pension expense in the current period is computed by multiplying the settlement rate by the beginning balance of the projected benefit obligation.

Correct Answer

verified

Correct Answer

verified

True/False

The accumulated benefit obligation bases the deferred compensation amount on both vested and nonvested service using future salary levels.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The following information is related to the pension plan of Long, Inc.for 2011.

Pension expense for 2011 is

A) $1,195,000.

B) $1,165,000.

C) $1,030,000.

D) $1,000,000.

Correct Answer

verified

D

Correct Answer

verified

Multiple Choice

Use the following information for questions.

The following information relates to Jackson, Inc.:

-The amount reported as the liability for pensions on the December 31, 2010 statement of financial position is

-The amount reported as the liability for pensions on the December 31, 2010 statement of financial position is

A) $ -0-.

B) $30,000.

C) $360,000.

D) $390,000.

Correct Answer

verified

Correct Answer

verified

True/False

Companies recognize the accumulated benefit obligation in their accounts and in their financial statements.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the following information for questions.

The following information relates to Jackson, Inc.:

-The amount reported as the liability for pensions on the December 31, 2011 statement of financial position is

-The amount reported as the liability for pensions on the December 31, 2011 statement of financial position is

A) $ -0-.

B) $60,000.

C) $1,884,000.

D) $520,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

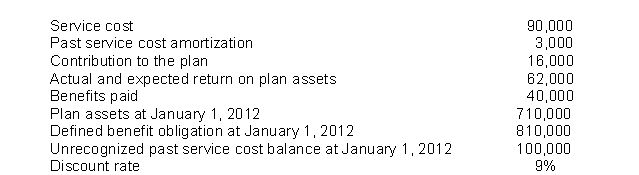

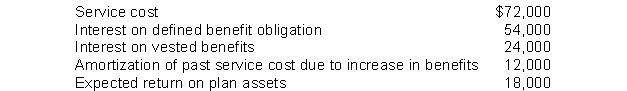

Presented below is pension information related to Woods, Inc.for the year 2011:

The amount of pension expense to be reported for 2011 is

The amount of pension expense to be reported for 2011 is

A) $108,000.

B) $144,000.

C) $162,000.

D) $120,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the following information for questions.

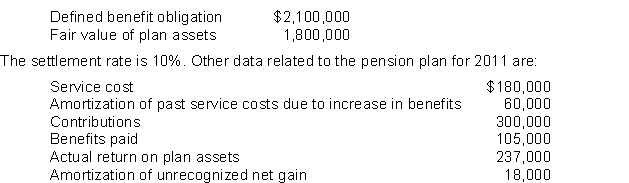

On January 1, 2011, Newlin Co.has the following balances:

-The balance of the defined benefit obligation at December 31, 2011 is

-The balance of the defined benefit obligation at December 31, 2011 is

A) $2,685,000.

B) $2,385,000.

C) $2,355,000.

D) $2,337,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A pension fund gain or loss that is caused by a plant closing should be

A) recognized when the plant closing occurs.

B) spread over the current year and future years.

C) charged or credited to the current pension expense.

D) recognized as a prior period adjustment.

Correct Answer

verified

Correct Answer

verified

True/False

Acurtailment occurs when a company enters into a transaction that eliminates all further obligations for part or all of the benefits provided under a defined benefit plan.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In accounting for a pension plan, any difference between the pension cost charged to expense and the payments into the fund should be reported as

A) an offset to the liability for past service cost.

B) pension asset\liability.

C) as other comprehensive income (G\L)

D) as accumulated other comprehensive income (PSC) .

Correct Answer

verified

B

Correct Answer

verified

True/False

If a company grants plan amendments, it allocates the past service cost of providing these retroactive benefits to pension expense in the future, specifically to the remaining service-years of the affected employees.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the following information for questions.

On January 1, 2011, Parks Co.has the following balances:

The discount rate is 10%.Other data related to the pension plan for 2011 are:

The discount rate is 10%.Other data related to the pension plan for 2011 are:

-The fair value of plan assets at December 31, 2011 is

-The fair value of plan assets at December 31, 2011 is

A) $3,531,000.

B) $3,789,000.

C) $4,059,000.

D) $4,284,000.

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 100

Related Exams