Correct Answer

verified

Correct Answer

verified

True/False

When the cash flows for a project are estimated, interest payments should be included if debt is to be used to help finance the project.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When evaluating a new project, firms should include in the projected cash flows all of the following EXCEPT which statement?

A) previous expenditures associated with a market test to determine the feasibility of the project provided those costs have been expensed for tax purposes

B) the value of a building owned by the firm that will be used for this project

C) a decline in the sales of an existing product provided that decline is directly attributable to this project

D) the salvage value of assets used for the project at the end of the project's life

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A firm is considering a new project whose risk is greater than the risk of the firm's average project, based on all methods for assessing risk. In evaluating this project, it would be reasonable for management to do which of the following?

A) Increase the estimated IRR of the project to reflect its greater risk.

B) Reject the project, since its acceptance would increase the firm's risk.

C) Ignore the risk differential if the project would amount to only a small fraction of the firm's total assets.

D) Increase the cost of capital used to evaluate the project to reflect the project's higher-than- average risk.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following factors should be included in the cash flows used to estimate a project's NPV?

A) all overhead costs incurred

B) interest on funds borrowed to help finance the project

C) the end-of-project recovery of any working capital required to operate the project

D) cannibalization effects, but only if those effects increase the project's projected cash flows

Correct Answer

verified

Correct Answer

verified

True/False

Superior analytical techniques, such as NPV, used in combination with cost of capital adjustments, can overcome the problem of poor cash flow estimation and lead to generally correct accept/reject decisions.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements best describes sunk costs?

A) An example of a sunk cost is the cost associated with restoring the site of a strip mine once the ore has been depleted.

B) Sunk costs must be considered if the IRR method is used but not if the firm relies on the NPV method.

C) A good example of a sunk cost is money that a banking corporation spent last year to investigate the site for a new office, then expensed those funds for tax purposes, and now is deciding whether to go forward with the project.

D) If sunk costs are considered and reflected in a project's cash flows, then the project's calculated NPV will be higher than it otherwise would be.

Correct Answer

verified

Correct Answer

verified

True/False

Because of improvements in forecasting techniques, estimating the cash flows associated with a project has become the easiest step in the capital budgeting process.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct?

A) Straightforward sensitivity analysis, as it is generally employed, is incomplete in that it fails to consider the range of likely values for the key input variables and the probabilities of different input values.

B) A statistically based behavioural approach to project analysis that applies pre-determined probability distributions is the scenario approach.

C) A method for evaluating a project that uses a number of possible values for a given variable, such as cash inflows, to assess its impact on the firm's return is simulation analysis.

D) Sensitivity analysis is a type of risk analysis that considers both the sensitivity of NPV to changes in key variables and the likely range of variable values.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

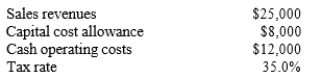

Your company, Omega Corporation, is considering a new project that you must analyze. Based on the following data, what is the project's Year 1 operating cash flow?

A) $10,585

B) $10,913

C) $11,250

D) $11,588

Correct Answer

verified

Correct Answer

verified

Multiple Choice

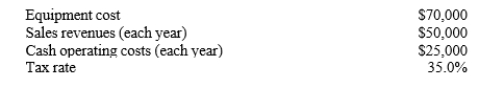

Your company, Q4 Inc., is considering a new project whose data are shown below. The required equipment has an economic year of 5 years, and has a CCA rate of 30% in class 10. Revenues and cash operating costs are expected to be constant over the project's 5-year operating life. What is the project's net operating cash flow during Year 2?

A) $16,213.00

B) $20,067.50

C) $22,497.50

D) $18,863.50

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements best describes CCA?

A) Using CCA method rather than straight-line depreciation would normally have no effect on a project's total projected cash flows but it would affect the timing of the cash flows and thus the NPV.

B) Corporations must use the same depreciation method (e.g., straight-line or CCA) for stockholder reporting and tax purposes.

C) Since CCA deduction is not a cash expense, it has no affect on cash flows and thus no affect on capital budgeting decisions.

D) Under CCA rules, higher CCA deductions occur in the early years, and this reduces the early cash flows and thus lowers a project's projected NPV.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company is considering a new project. The CFO plans to calculate the project's NPV by estimating the relevant cash flows for each year of the project's life (the initial investment cost, the annual operating cash flows, and the terminal cash flow) , then discounting those cash flows at the company's WACC. Which one of the following factors should the CFO include in the cash flows when estimating the relevant cash flows?

A) all interest expenses on debt used to help finance the project

B) the investment in working capital required to operate the project, even if that investment will be recovered at the end of the project's life

C) sunk costs that have been incurred relating to the project, but only if those costs were incurred prior to the current year

D) effects of the project on other divisions of the firm, but only if those effects lower the direct cash flows of the project

Correct Answer

verified

Correct Answer

verified

True/False

The two cardinal rules that financial analysts follow to avoid capital budgeting errors are (1) capital budgeting decisions must be based on accounting income, and (2) all incremental cash flows should be considered when making accept/reject decisions.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

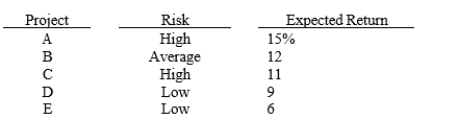

Langston Labs has an overall (composite) WACC of 10%, which reflects the cost of capital for its average asset. Its assets vary widely in risk, and Langston evaluates low-risk projects with a WACC of 8%, average projects at 10%, and high-risk projects at 12%. The company is considering the following projects:  Which set of projects would maximize shareholder wealth?

Which set of projects would maximize shareholder wealth?

A) A, B, and C.

B) A, B, and D.

C) A, B, C, and D.

D) A, B, C, D, and E.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose Tapley Corporation uses a WACC of 8% for below-average risk projects, 10% for average- risk projects, and 12% for above-average risk projects. Which of the following independent projects should Tapley accept, assuming that the company uses the NPV method when choosing projects?

A) Project A, which has average risk and an IRR of 9%

B) Project B, which has below-average risk and an IRR of 8.5%

C) Project C, which has above-average risk and an IRR of 11%

D) Without information about the projects' NPVs we cannot determine which one(s) should be accepted

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company is considering a proposed new plant that would increase productive capacity. Which of the following statements is correct?

A) In calculating the project's operating cash flows, the firm should NOT deduct financing costs such as interest expense, because financing costs are accounted for by discounting at the WACC. If interest were deducted when estimating cash flows, it would in effect be "double-counted."

B) Since depreciation is a noncash expense, the firm does not need to deal with depreciation when calculating the operating cash flows.

C) When estimating the project's operating cash flows, it is important to include any opportunity costs and sunk costs, but the firm should ignore cash flow effects of externalities since they are accounted for in the discounting process.

D) Capital budgeting decisions should be based on BEFORE-TAX cash flows.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

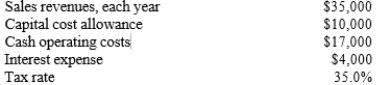

As a member of Midwest Corporation's financial staff, you must estimate the Year 1 operating cash flow for a proposed project with the following data. What is the Year 1 net operating cash flow?

A) $12,380

B) $13,032

C) $14,440

D) $15,200

Correct Answer

verified

Correct Answer

verified

True/False

Suppose Walker Publishing Company is considering bringing out a new finance text whose projected sales include sales that will be taken away from another of Walker's books. The lost sales on the existing book are a sunk cost and as such should not be considered in the analysis of the new book.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is NOT a relevant factor when determining incremental cash flows for a new product?

A) the land that would be used for the new project could be sold to another firm.

B) revenues from an existing product that would be lost as a result of customers switching to the new product.

C) shipping and installation costs associated with preparing a machine that would be used to produce the new product.

D) the cost of a marketing study that was completed last year related to the new product. This research led to the tentative decision to go ahead with the new product, and the cost of the research was expensed for tax purposes last year.

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 69

Related Exams