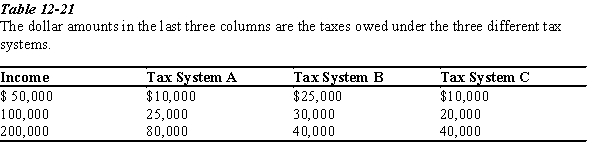

A) Tax System A

B) Tax System B

C) Tax System C

D) None of the systems are progressive.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In which of the following tax systems do taxes increase as income increases?

A) both proportional and progressive

B) proportional but not progressive

C) progressive but not proportional

D) neither proportional nor progressive

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Table 12-20

The following table presents the total tax liability for an unmarried taxpayer under four different tax schedules for the income levels shown.  -Refer to Table 12-20. Which tax schedules are regressive?

-Refer to Table 12-20. Which tax schedules are regressive?

A) Tax Schedule A and Tax Schedule B

B) Tax Schedule B and Tax Schedule C

C) Tax Schedule C and Tax Schedule D

D) None of the Tax Schedules are regressive.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the marginal tax rate exceeds the average tax rate, the tax is

A) proportional.

B) regressive.

C) non-egalitarian.

D) progressive.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The benefits principle of taxation can be used to argue that wealthy citizens should pay higher taxes than poorer ones on the basis that

A) police services are more frequently used in poor neighborhoods.

B) the wealthy benefit more from services provided by government than the poor.

C) the poor are more active in political processes.

D) the poor receive welfare payments.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In general, Democrats tend to prefer

A) higher marginal tax rates to promote vertical equity, while Republicans tend to prefer lower marginal tax rates to promote incentives to work and save.

B) lower marginal tax rates to promote vertical equity, while Republicans tend to prefer higher marginal tax rates to promote incentives to work and save.

C) higher marginal tax rates to promote incentives to work and save, while Republicans tend to prefer lower marginal tax rates to promote vertical equity.

D) lower marginal tax rates to promote incentives to work and save, while Republicans tend to prefer higher marginal tax rates to promote vertical equity.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

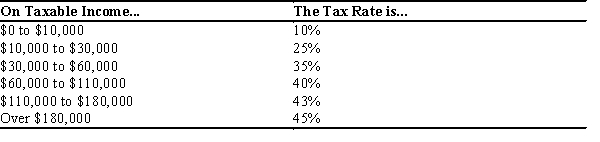

Table 12-6

The table below shows the marginal tax rates for an unmarried taxpayer for various levels of taxable income.  -Refer to Table 12-6. For this tax schedule, what is the total income tax due for an individual with $49,000 in taxable income?

-Refer to Table 12-6. For this tax schedule, what is the total income tax due for an individual with $49,000 in taxable income?

A) $12,650

B) $14,370

C) $15,960

D) $16,220

Correct Answer

verified

Correct Answer

verified

Multiple Choice

-Refer to Table 12-21. Which of the three tax systems is proportional?

-Refer to Table 12-21. Which of the three tax systems is proportional?

A) Tax System A

B) Tax System B

C) Tax System C

D) None of the systems are proportional.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In 2009, the top 1 percent of income earners

A) made about 13 percent of all income.

B) paid about 22 percent of all taxes.

C) made over 2.5 times the percentage of all income earned by the lowest quintile.

D) All of the above are correct.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In choosing the form of a tax, there is often a tradeoff between

A) allocative and productive efficiency.

B) profits and revenues.

C) efficiency and fairness.

D) fairness and profits.

Correct Answer

verified

Correct Answer

verified

True/False

In the United States, all families pay the same proportion of their income in taxes.

Correct Answer

verified

Correct Answer

verified

True/False

Government spending is projected to rise over the next few decades. Three of the most important reasons are spending on Social Security, Medicare, and healthcare.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Athos, Porthos,and Aramis each like to take fencing lessons. The price of a fencing lesson is $10. Athos values a fencing lesson at $15, Porthos at $13, and Aramis at $11. Suppose that if the government taxes fencing lessons at 50 cents each, the price rises to $10.50. A consequence of the tax is that consumer surplus shrinks by

A) $1.50 and tax revenues increase by $1.50, so there is no deadweight loss.

B) $9.00 and tax revenues increase by $1.50, so there is a deadweight loss of $7.50.

C) $7.50 and tax revenues increase by $7.50, so there is no deadweight loss.

D) $7.50 and tax revenues increase by $1.50, so there is a deadweight loss of $6.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Table 12-1  -Refer to Table 12-1. Assume that the price of a weekend ski pass is $45 and that the price reflects the actual unit cost of providing a weekend of skiing. What is the value of the surplus that accrues to all four skiers from their weekend trip?

-Refer to Table 12-1. Assume that the price of a weekend ski pass is $45 and that the price reflects the actual unit cost of providing a weekend of skiing. What is the value of the surplus that accrues to all four skiers from their weekend trip?

A) $75

B) $105

C) $185

D) $215

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Table 12-16  -Refer to Table 12-16. In this tax system which of the following is possible?

-Refer to Table 12-16. In this tax system which of the following is possible?

A) vertical and horizontal equity

B) vertical but not horizontal equity

C) horizontal but not vertical equity

D) neither horizontal nor vertical equity

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Table 12-10  -Refer to Table 12-10. If Miss Kay has $80,000 in taxable income, her average tax rate is

-Refer to Table 12-10. If Miss Kay has $80,000 in taxable income, her average tax rate is

A) 18.5%.

B) 20.2%.

C) 21.8%.

D) 25.0%.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

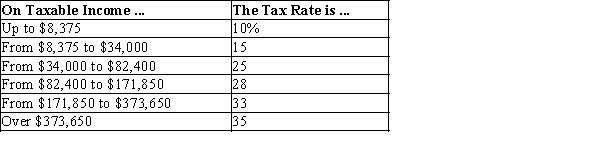

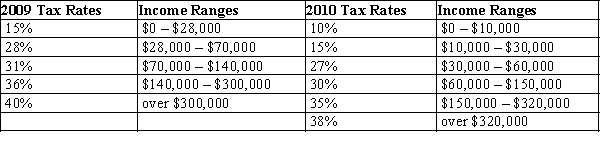

Table 12-18

United States Income Tax Rates for a Single Individual, 2009 and 2010.  -Refer to Table 12-18. What type of tax structure did the United States have in 2009 for single individuals?

-Refer to Table 12-18. What type of tax structure did the United States have in 2009 for single individuals?

A) a proportional tax structure

B) a regressive tax structure

C) a progressive tax structure

D) a lump-sum tax structure

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Scenario 12-5 Senator Filch argues that a tax must be paid by people who benefit from government services. Senator Fudge argues that a tax must be paid in accordance with a person's ability to bear the tax burden. Senator Malfoy argues that people with a greater ability to pay a tax should pay a larger amount. Senator Moody argues that taxpayers with similar abilities to pay should contribute the same amount. -Refer to Scenario 12-5. Which Senator is advocating for taxes based on horizontal equity?

A) Senator Filch

B) Senator Fudge

C) Senator Malfoy

D) Senator Moody

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The most efficient tax possible is a

A) lump-sum tax.

B) marginal tax.

C) proportional tax.

D) value-added tax.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Pat calculates that for every extra dollar she earns, she owes the government 40 cents. Her total income now is $44,000, on which she pays taxes of $11,000. Determine her average tax rate and her marginal tax rate.

A) Her average tax rate is 40 percent and her marginal tax rate is 25 percent.

B) Her average tax rate is 40 percent and her marginal tax rate is 40 percent.

C) Her average tax rate is 25 percent and her marginal tax rate is 25 percent.

D) Her average tax rate is 25 percent and her marginal tax rate is 40 percent.

Correct Answer

verified

Correct Answer

verified

Showing 341 - 360 of 563

Related Exams