A) 2.8 times

B) 2 times

C) 3.4 times

D) 3 times

Correct Answer

verified

Correct Answer

verified

Multiple Choice

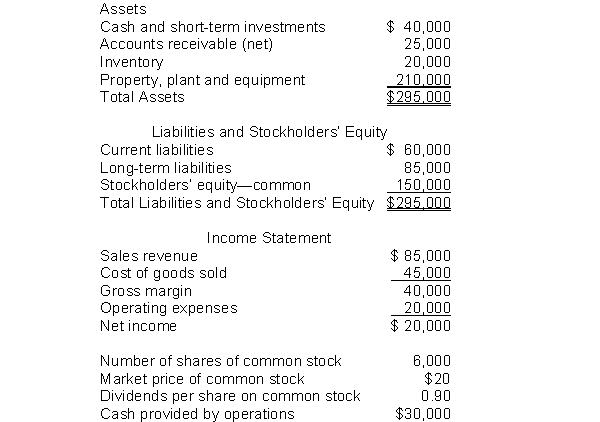

The following information pertains to Unique Company.Assume that all balance sheet amounts represent both average and ending balance figures.Assume that all sales were on credit.  What is the return on assets for this company?

What is the return on assets for this company?

A) 6.8%

B) 10.0%

C) 11.7%

D) 26.7%

Correct Answer

verified

Correct Answer

verified

True/False

Vertical analysis is a technique for evaluating a series of financial statement data over a period of time to determine the increase (decrease) that has taken place.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Comparisons of financial data made within a company are called

A) intracompany comparisons.

B) interior comparisons.

C) intercompany comparisons.

D) industry comparisons.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Long-term creditors are usually most interested in evaluating

A) liquidity.

B) marketability.

C) profitability.

D) solvency.

Correct Answer

verified

Correct Answer

verified

True/False

The current ratio is a measure of all the ratios calculated for the current year.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Solvency is of most interest to

A) short-term creditors.

B) stockholders.

C) competitors.

D) long-term creditors.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The current ratio would be of most interest to

A) short-term creditors.

B) long-term creditors.

C) stockholders.

D) customers.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would be considered an "Other Comprehensive Income" item?

A) Net income

B) Gain on disposal of discontinued operations

C) Other revenues and gains

D) Unrealized loss on available-for-sale securities

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Tito Corporation had net income of $2,000,000 and paid dividends to common stockholders of $300,000 in 2022.The weighted average number of shares outstanding in 2022 was 400,000 shares.Tito Corporation's common stock is selling for $50 per share on the NASDAQ.Tito Corporation's price-earnings ratio is

A) 20 times.

B) 12 times.

C) 10 times.

D) 5 times.

Correct Answer

verified

Correct Answer

verified

True/False

A change in accounting principle occurs when the principle used in the current year is different from the one used by competitors in the current year.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following ratios would not likely be used by a short-term creditor in evaluating whether to sell on credit to a company?

A) Current ratio

B) Inventory turnover

C) Asset turnover

D) Accounts receivable turnover

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Chodron Corporation had net credit sales of $13,000,000 and cost of goods sold of $9,250,000 for the year.The average inventory for the year amounted to $1,250,000.The average days in inventory during the year was approximately

A) 261 days.

B) 122 days.

C) 49 days.

D) 35 days.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Junebag Corporation reported net income $24,000; net sales $400,000; and average assets $600,000 for 2022.What is the 2022 profit margin?

A) 6%

B) 4%

C) 40%

D) 67%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

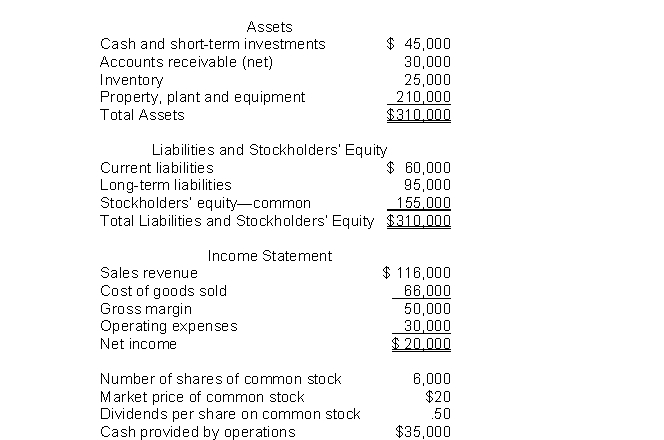

The following information pertains to Blue Flower Company.Assume that all balance sheet amounts represent both average and ending balance figures.Assume that all sales were on credit.  What is the accounts receivable turnover for this company?

What is the accounts receivable turnover for this company?

A) 2.2 times

B) 4.4 times

C) 7.7 times

D) 3.9 times

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following is not a liquidity ratio?

A) Current ratio

B) Inventory turnover

C) Average collection period

D) Return on assets

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Return on common stockholders' equity is most closely related to

A) gross profit rate and operating expenses to sales ratio.

B) profit margin and free cash flow.

C) times interest earned and debt to stockholders' equity ratio.

D) return on asset and leverage (debt to assets ratio) .

Correct Answer

verified

Correct Answer

verified

Multiple Choice

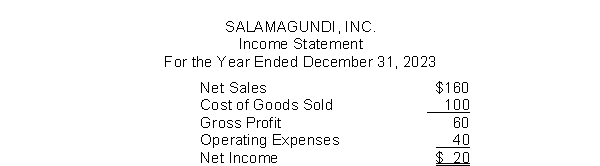

Salamagundi, Inc.has the following Income Statement (in millions) :  Using vertical analysis, what percentage is assigned to gross profit?

Using vertical analysis, what percentage is assigned to gross profit?

A) 37.5%

B) 100%

C) 60%

D) 62.5%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Net sales are $3,250,000, beginning total assets are $1,400,000, and the asset turnover is 2.5 times.What is the ending total asset balance?

A) $1,300,000

B) $1,200,000

C) $1,400,000

D) $1,500,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The best way to study the relationship of the components within a financial statement is to prepare

A) common size statements.

B) a trend analysis.

C) profitability analysis.

D) ratio analysis.

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 203

Related Exams