A) unissued shares minus outstanding shares.

B) outstanding shares plus treasury shares.

C) authorized shares minus treasury shares.

D) outstanding shares plus authorized shares.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The effect of a stock dividend is to

A) decrease total assets and stockholders' equity.

B) change the composition of stockholders' equity.

C) decrease total assets and total liabilities.

D) increase the book value per share of common stock.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a corporation declares a 10% stock dividend on its common stock, the account to be debited on the date of declaration is

A) Common Stock Dividends Distributable.

B) Common Stock.

C) Paid-in Capital in Excess of Par.

D) Stock Dividends.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Sizemore, Inc.has 10,000 shares of 4%, $100 par value, cumulative preferred stock and 100,000 shares of $1 par value common stock outstanding at December 31, 2020.If the board of directors declares a $25,000 dividend, the

A) preferred stockholders will receive 1/10th of what the common stockholders will receive.

B) preferred stockholders will receive the entire $25,000.

C) $25,000 will be held as restricted retained earnings and paid out at some future date.

D) preferred stockholders will receive $12,500 and the common stockholders will receive $12,500.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The ability of a corporation to obtain capital is

A) enhanced because of limited liability and ease of share transferability.

B) less than a partnership.

C) restricted because of the limited life of the corporation.

D) about the same as a partnership.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements about dividends is not accurate?

A) Dividends are generally reported quarterly as a dollar amount per share.

B) Low dividends may mean high stock returns.

C) The board of directors is obligated to declare dividends.

D) Payment of dividends from legal capital is illegal in many states.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Outstanding stock of the West Corporation included 40,000 shares of $5 par common stock and 10,000 shares of 5%, $10 par non-cumulative preferred stock.In 2019, West declared and paid dividends of $4,000.In 2020, West declared and paid dividends of $20,000.How much of the 2020 dividend was distributed to preferred shareholders?

A) $9,000.

B) $15,000.

C) $5,000.

D) None of these answer choices are correct.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

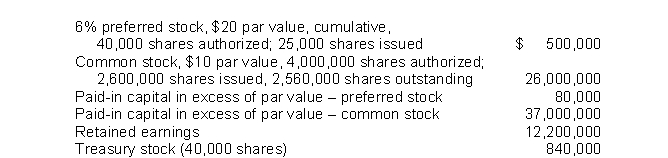

Racer Corporation's December 31, 2020 balance sheet showed the following:  Racer's total paid-in capital was

Racer's total paid-in capital was

A) $63,580,000.

B) $64,420,000.

C) $62,740,000.

D) $36,080,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

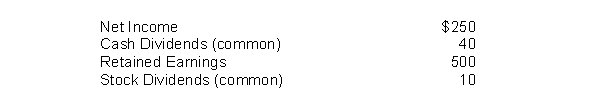

From the information below, compute the payout ratio for Kevin's Trailers.

A) 20%.

B) 16%.

C) 8%.

D) 4%.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Common Stock Dividends Distributable is classified as a(n)

A) asset account.

B) stockholders' equity account.

C) expense account.

D) liability account.

Correct Answer

verified

Correct Answer

verified

True/False

The amount of a cash dividend liability is recorded on the date of record because it is on that date that the persons or entities who will receive the dividend are identified.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When stock dividends are distributed,

A) Common Stock Dividends Distributable is decreased.

B) Retained earnings is decreased.

C) Paid-in Capital in Excess of Par Value is debited if it is a small stock dividend.

D) No entry is necessary if it is a large stock dividend.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

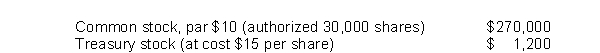

The following data is available for BOX Corporation at December 31, 2020:  Based on the data, how many shares of common stock are outstanding?

Based on the data, how many shares of common stock are outstanding?

A) 30,000.

B) 27,000.

C) 29,920.

D) 26,920.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Ferman Corporation had net income of $140,000 and paid dividends of $40,000 to common stockholders and $20,000 to preferred stockholders in 2020.Ferman Corporation's common stockholders' equity at the beginning and end of 2020 was $870,000 and $1,130,000, respectively.Ferman Corporation's return on common stockholders' equity was

A) 14%.

B) 12%.

C) 9%.

D) 8%.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In published annual reports,

A) subclassifications within the stockholders' equity section are routinely reported in detail.

B) capital surplus is used in place of retained earnings.

C) the individual sources of additional paid-in capital are often combined.

D) retained earnings is often not shown separately.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

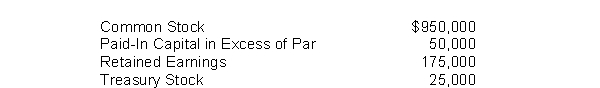

What is the total stockholders' equity based on the following account balances?

A) $1,000,000.

B) $975,000.

C) $1,150,000.

D) $800,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would not be true of a privately held corporation?

A) It is sometimes called a closely held corporation.

B) Its shares are regularly traded on the New York Stock Exchange.

C) It does not offer its shares for sale to the general public.

D) It is usually smaller than a publicly held company.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When retained earnings are restricted, total retained earnings

A) are unaffected.

B) increase.

C) decrease.

D) may increase or decrease.

Correct Answer

verified

Correct Answer

verified

Short Answer

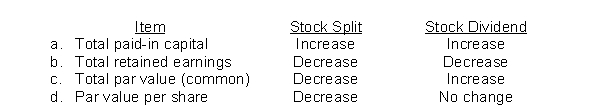

Which of the following show the proper effect of a stock split and a stock dividend?

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On January 1, Hamblin Corporation had 120,000 shares of $10 par value common stock outstanding.On March 17, the company declared a 10% stock dividend to stockholders of record on March 20.The market value of the stock was $13 on March 17.The entry to record the transaction of March 17 would include a

A) credit to Stock Dividends for $36,000.

B) credit to Cash for $156,000.

C) credit to Common Stock Dividends Distributable for $120,000.

D) debit to Common Stock Dividends Distributable for $120,000.

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 216

Related Exams