A) 2.0:1

B) 1.7:1

C) 1.6:1

D) 0.6:1

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The return on assets ratio is affected by the

A) profit margin and debt to total assets ratios.

B) profit margin and asset turnover ratios.

C) times interest earned and debt to total assets ratios.

D) profit margin and free cash flow.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The current ratio is a

A) liquidity ratio.

B) profitability ratio.

C) solvency ratio.

D) cash flow ratio.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is false about the dividend yield ratio?

A) High growth companies tend to have lower dividend yield ratios.

B) It measures the rate of return a shareholder earned from dividends during the year.

C) A low dividend yield, by itself, is neither bad nor good.

D) Dividend yield ratio = Market price per share ÷ Dividends per share.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following solvency positions would a company consider most favourable?

A) a high debt to total assets ratio and a low times interest earned ratio

B) a low debt to total assets ratio and a high times interest earned ratio

C) a high debt to total assets ratio and a high times interest earned ratio

D) a low debt to total assets ratio and a low times interest earned ratio

Correct Answer

verified

Correct Answer

verified

Multiple Choice

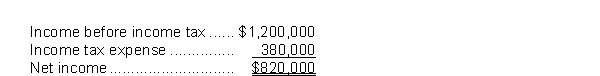

Affluent Limited reported the following on its statement of income:  Interest expense was $150,000.Gifford's times interest earned was

Interest expense was $150,000.Gifford's times interest earned was

A) 9 times.

B) 8 times.

C) 6.5 times.

D) 5.5 times.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The current ratio is

A) calculated by dividing current liabilities by current assets.

B) used to evaluate a company's liquidity and short-term debt paying ability.

C) used to evaluate a company's solvency and long-term debt paying ability.

D) calculated by subtracting current liabilities from current assets.

Correct Answer

verified

Correct Answer

verified

True/False

The first step in any comprehensive analysis is to perform a horizontal and vertical analysis.

Correct Answer

verified

Correct Answer

verified

True/False

Free cash flow is the cash available after a company pays dividends.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the following information to answer questions

Green Thumb Garden Supplies reported the following information for 2021 and 2022:

-What is the profit margin for 2022?

-What is the profit margin for 2022?

A) 8.6%

B) 10.0%

C) 17.1%

D) 31.6%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A statement of income would not include

A) assets held for sale of a discontinued operation.

B) a loss on disposal of a component of an entity.

C) an operating loss on discontinued operations.

D) an unusually large bad debt expense.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the following information to answer questions

Green Thumb Garden Supplies reported the following information for 2021 and 2022:

-What is the dividend yield for 2022?

-What is the dividend yield for 2022?

A) 2.3%

B) 4.4%

C) 9.0%

D) 12.5%

Correct Answer

verified

Correct Answer

verified

True/False

The price-earnings ratio reflects investors' expectations about the future profitability of the company.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Non-GAAP measures are

A) management-defined measures of financial performance that are not usually found in the management discussion and analysis section of a public company's annual or quarterly report.

B) management-defined measures of financial performance that are not included in accounting standards.

C) included in accounting standards but are specifically non-financial in nature.

D) management-defined measures of non-financial performance that are not included in accounting standards.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Horizontal analysis is a technique for evaluating financial statement data

A) within a period of time.

B) over a period of time.

C) on a certain date.

D) as it may appear in the future.

Correct Answer

verified

Correct Answer

verified

True/False

Comparisons of company data with industry averages provide information about a company's relative position within the industry.

Correct Answer

verified

Correct Answer

verified

True/False

The gain (loss) on disposal of a discontinued operation is not reported on the statement of income.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A common measure of profitability is the

A) current ratio.

B) free cash flow.

C) return on common shareholders' equity ratio.

D) debt to total assets ratio.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The return on common shareholders' equity ratio is affected by the

A) gross profit margin and profit margin ratio.

B) profit margin and free cash flow.

C) times interest earned and debt to total assets ratios.

D) return on assets and debt to total assets ratios.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the following information for questions

-In performing a vertical analysis, the percentage for accounts receivable is

-In performing a vertical analysis, the percentage for accounts receivable is

A) 0.5%.

B) 1.0%.

C) 5.0%.

D) 10.0%.

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 127

Related Exams