Correct Answer

verified

False

Correct Answer

verified

Multiple Choice

A truck was purchased for $40,000 and it was estimated to have a $4,000 residual value.Using the straight-line method, monthly depreciation expense of $600 was recorded.Therefore, the annual depreciation rate expressed as a percentage is

A) 2%.

B) 17%.

C) 18%.

D) 20%.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the following information for questions On January 1, 2022, Flowers Unlimited purchased a new delivery van.The van cost $35,000 with an estimated life of 5 years and $5,000 residual value.Double diminishing-balance depreciation will be used. -What is the balance in the Accumulated Depreciation account at the end of 2023?

A) $22,400

B) $19,200

C) $12,600

D) $10,800

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Equipment was purchased for $25,000.Freight charges amounted to $700 and there was a cost of $3,000 for building a foundation and installing the equipment.It is estimated that the equipment will have a $1,600 residual value at the end of its 5-year useful life.Using the straight-line method, annual depreciation expense will be

A) $4,540.

B) $4,680.

C) $5,420.

D) $5,740.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The cost of a finite intangible asset is

A) not amortized, but the asset is tested periodically for impairment.

B) amortized and tested periodically for impairment.

C) neither amortized or tested periodically for impairment.

D) amortized, but not tested periodically for impairment.

Correct Answer

verified

Correct Answer

verified

True/False

In calculating depreciation, cost, useful life, and residual value are all based on estimates.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Cordo Ltd.uses the units-of-production depreciation method.A new asset is purchased for $30,000 that will produce an estimated 90,000 units over its useful life.Estimated residual value is $3,000.What is the depreciable cost per unit?

A) $3.30

B) $3.00

C) $0.33

D) $0.30

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Land account would include all of the following costs except

A) drainage costs.

B) the cost of building a parking lot.

C) title fees.

D) the cost of tearing down a building.

Correct Answer

verified

B

Correct Answer

verified

Multiple Choice

Which of the following is not an advantage of an operating lease?

A) reduced risk of obsolescence

B) 100 percent financing

C) income tax advantages

D) accelerated depreciation

Correct Answer

verified

D

Correct Answer

verified

Multiple Choice

Which of the following assets does not decline in service potential over the course of its useful life?

A) office equipment

B) furnishings

C) land

D) computers

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A truck costing $32,000 was destroyed when its engine caught fire.At the date of the fire, the accumulated depreciation on the truck was $16,000.An insurance cheque for $37,000 was received based on the replacement cost of the truck.The entry to record the insurance proceeds and the disposition of the truck will include a

A) gain on disposal of $5,000.

B) credit to the Truck account for $16,000.

C) credit to the Accumulated Depreciation account for $16,000.

D) gain on disposal of $21,000.

Correct Answer

verified

Correct Answer

verified

True/False

Under IFRS, companies must account for their property, plant, and equipment using the revaluation model, where depreciable assets are re-valued upward to their fair values.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Can the accumulated depreciation of a depreciable asset be greater than an assets cost when it is fully depreciated and still in use?

A) Yes - as it is still in use it continues to be depreciated.

B) No - although it is still in use it does not continue to be depreciated.

C) No - because the asset is considered retired even though it is still in use.

D) Yes - as the asset is retired and then reinstated on the books to be depreciated for its continued use.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A truck costing $15,000 and on which $14,000 of accumulated depreciation has been recorded was discarded as having no value.The entry to record this event would include a

A) gain of $1,000.

B) loss of $1,000.

C) credit to Accumulated Depreciation for $14,000.

D) credit to Equipment for $1,000.

Correct Answer

verified

Correct Answer

verified

True/False

If a trademark is developed internally, it cannot be recognized as an intangible asset on the statement of financial position.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The expected costs to retire an asset are called

A) off-balance sheet financing.

B) expected retirement costs.

C) disposal costs.

D) asset retirement costs.

Correct Answer

verified

Correct Answer

verified

True/False

All research costs should be capitalized when incurred.

Correct Answer

verified

Correct Answer

verified

True/False

The Accumulated Depreciation account represents a cash fund available to replace property, plant, and equipment.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The carrying amount of an asset with a residual value that has been in use for three years is:

A) its depreciable amount.

B) cost less residual value.

C) its depreciable amount less accumulated depreciation.

D) cost less accumulated depreciation.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

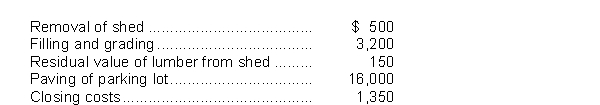

Angus Corp.acquires land for $105,000 cash.Additional costs are as follows:  Angus will record the cost of the land as

Angus will record the cost of the land as

A) $105,000.

B) $109,400.

C) $109,900.

D) $126,200.

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 154

Related Exams