A) to clear checks

B) to supervise member banks

C) to serve as the lender of last resort

D) to handle the sale of U.S.Treasury securities

E) to serve as the government's tax collector

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Open market purchases of government securities

A) are designed to increase trading on the stock exchange.

B) generally decrease the money supply.

C) always decrease the money supply.

D) cause bank reserves to increase.

E) all of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

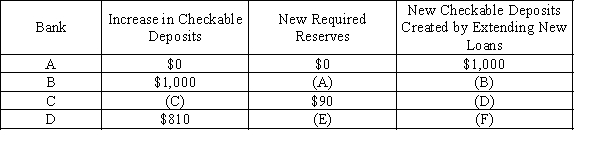

Exhibit 13-1

Assume that the required reserve ratio is 10%, that there are no cash leakages, and that banks hold zero excess reserves.

-Refer to Exhibit 13-1. Suppose that the Federal Reserve conducts open market operations by purchasing $1,000 worth of government securities from Bank A. As a result, Bank A finds itself with $1,000 in excess reserves that it lends out and those funds end up in Bank B. The loan made by Bank B ends up in Bank C. What dollar value goes in blanks (C) and (D) , respectively?.

Assume that the required reserve ratio is 10%, that there are no cash leakages, and that banks hold zero excess reserves.

-Refer to Exhibit 13-1. Suppose that the Federal Reserve conducts open market operations by purchasing $1,000 worth of government securities from Bank A. As a result, Bank A finds itself with $1,000 in excess reserves that it lends out and those funds end up in Bank B. The loan made by Bank B ends up in Bank C. What dollar value goes in blanks (C) and (D) , respectively?.

A) $900; $810

B) $90; $810

C) $110; $700

D) $700; $110

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Raising the required reserve ratio __________ the simple deposit multiplier which will __________ the economy's money supply.

A) raises; increase

B) raises; decrease

C) lowers; increase

D) lowers; decrease

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the Fed purchases government securities from Bank A, __________ in the banking system __________ and the money supply __________.

A) reserves; fall; falls

B) reserves; rise; falls

C) reserves; rise; rises

D) excess reserves; fall; rises

E) excess reserves; rise; falls

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A decrease in the required reserve ratio __________ the money supply; an open market purchase __________ the money supply.

A) decreases; decreases

B) decreases; increases

C) increases; increases

D) increases; decreases

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The major policy-making group within the Fed is the __________ Committee.

A) Federal Reserve Tax

B) Federal Reserve Banking

C) Federal Open Market

D) Federal Reserve Decision-Making

E) Regional Bank

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The __________ rate is the interest rate one bank pays another bank for a loan.

A) discount

B) mortgage

C) reserve requirement

D) federal funds

E) bank-borrowing

Correct Answer

verified

Correct Answer

verified

True/False

Controlling the nation's money supply is the most important duty of the Federal Reserve.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the Fed purchases securities from a bank, it __________ reserves and ____________ the money supply.

A) decreases; decreases

B) increases; increases

C) decreases; increases

D) increases; decreases

E) has no impact on; has no impact on

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The lower the required reserve ratio,

A) the less money that can be loaned at each round of the lending process.

B) the larger the simple deposit multiplier.

C) the smaller the simple deposit multiplier.

D) the fewer excess reserves there are at each round of the simple deposit multiplier process.

E) a, c, and d

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Banking Act of 1935 changed the name of the _______________ to the Board of Governors of the Federal Reserve System.

A) Federal Open Market Committee

B) Board of Monetary Affairs

C) Central Bank Board

D) Federal Reserve Board

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the Fed ______________________, the money supply will ultimately __________.

A) raises the required reserve ratio from 8 percent to 10 percent; decrease

B) lowers the required reserve ratio from 10 percent to 8 percent; increase

C) lowers the required reserve ratio from 10 percent to 8 percent; decrease

D) raises the required reserve ratio from 8 percent to 10 percent; increase

E) a and b

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When one commercial bank borrows from another commercial bank, it pays the __________ rate.

A) discount

B) bank interest

C) federal funds

D) prime

E) none of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following will increase the money supply?

A) increasing the required reserve ratio

B) an open market sale

C) raising the discount rate relative to the federal funds rate

D) none of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Open market operations are the

A) buying and selling of Federal Reserve Notes in the open market.

B) means by which the Fed supplies the economy with currency.

C) means by which the Fed acts as the government's banker.

D) buying and selling of government securities by the Fed.

E) buying and selling of government securities by the Treasury.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following Fed actions will increase the money supply?

A) open market purchases of Treasury notes

B) an increase in the required reserve ratio

C) an increase in the discount rate

D) all of the above

E) none of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Here is how an open market purchase works: The Fed __________ government securities to (from) a commercial bank, which raises the bank's deposits at the __________ and increases the bank's __________.

A) sells; Fed; reserves

B) buys; Fed; reserves

C) buys; Treasury; discount loans

D) sells; Treasury; required reserve ratio

E) buys; Fed; liabilities

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following actions is most likely to lead to an increase in the money supply?

A) Fed purchases of government securities

B) an increase in the required reserve ratio

C) an increase in the discount rate

D) none of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Federal Open Market Committee (FOMC)

A) has six members.

B) conducts open market operations.

C) is the policy-making body within the Treasury.

D) is the governing body of the Federal Reserve System.

E) a, b, and c

Correct Answer

verified

Correct Answer

verified

Showing 161 - 180 of 180

Related Exams