A) direct expense.

B) indirect expense.

C) profit center issue.

D) advertising expense.

Correct Answer

verified

Correct Answer

verified

True/False

A net income would occur if the contribution margin is greater than indirect expenses.

Correct Answer

verified

Correct Answer

verified

True/False

The availability of suppliers and a firm's potential capacity is a consideration before a department is added.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Indirect expenses are normally:

A) subjective and approximate.

B) assigned by arbitrary methods.

C) assigned precisely by accepted methods.

D) assigned to the accounting department.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would NOT be considered a direct expense for a shoe department in a department store?

A) Building expenses

B) Advertising expense

C) Administrative expense

D) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On a departmental income statement, sales less cost of goods sold and direct expenses equals:

A) gross margin.

B) income before taxes.

C) indirect expenses.

D) departmental contribution margin.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

To determine how each profit center is performing, management would analyze the:

A) current forecast.

B) indirect expenses.

C) gross profit for each profit center.

D) other expenses.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The administrative department of a mall is a(n) :

A) cost center.

B) profit center.

C) internal center.

D) revenue center.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the music department in a department store is 10,000 square feet and the total square feet is 80,000, how much of the total building cost of $50,000 will be allocated to music?

A) $25,000

B) $400,000

C) $50,000

D) $6,250

Correct Answer

verified

Correct Answer

verified

Short Answer

Below is a list of departments; you are to identify each as either [1] a profit center or [2] a cost center. -The maintenance office of a mall. ________

Correct Answer

verified

Correct Answer

verified

True/False

Indirect expenses are the same across departments and industries.

Correct Answer

verified

Correct Answer

verified

True/False

The accountant must always consider cost of goods sold when determining gross profit for a department.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Departmental accounting requires:

A) measuring departmental gross profit.

B) allocating direct costs to departments.

C) allocating indirect costs to departments.

D) Both A and C are correct.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

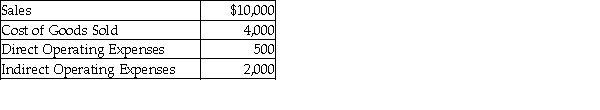

The photography department in a department store experienced the following revenue and expenses during October:  The photography departmental gross profit is:

The photography departmental gross profit is:

A) $3,500.

B) $7,500.

C) $4,000.

D) $6,000.

Correct Answer

verified

Correct Answer

verified

True/False

Departmental income statements are prepared to indicate how well each department is performing.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is false as it relates to direct and indirect expenses?

A) Building expense is an indirect expense.

B) Indirect expenses cannot be assigned to different departments based on an allocation such as square feet.

C) If an expense is traceable to a particular department, it is a direct expense.

D) Advertising expense can be both a direct and an indirect expense.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the cosmetic department in the store measures 20,000 square feet and the total building cost is $90,000 for a 40,000 square foot building, the cost that would be allocated to the cosmetic department would be:

A) $45,000.

B) $8,889.

C) $180,000.

D) $90,000.

Correct Answer

verified

Correct Answer

verified

True/False

A department should not be eliminated just because it becomes unprofitable.

Correct Answer

verified

Correct Answer

verified

True/False

Most companies that prepare departmental income statements typically don't prepare departmental balance sheets.

Correct Answer

verified

Correct Answer

verified

True/False

In departmental accounting, it is necessary to break down revenue and expenses by departments.

Correct Answer

verified

Correct Answer

verified

Showing 121 - 140 of 140

Related Exams