A) a credit.

B) a debit.

C) zero.

D) It does not have a normal balance.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

H.R. Camping sold goods for $200 to a charge customer. The customer returned for credit $100 worth of goods. Which entry is required to record the return transaction?

A) Debit Sales Returns and Allowances $100 credit Accounts Receivable $100

B) Debit Sales Returns and Allowances $100; credit Sales $100

C) Debit Sales $100; credit Sales Returns and Allowances $100

D) Debit Accounts Receivable $100; credit Sales Returns and Allowances $100

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Sold merchandise on account would be recorded with:

A) a debit to an asset account.

B) a debit to a liability account.

C) a debit to Capital.

D) None of these is correct.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Mel's Art studio was moving and sold furniture that was no longer needed for cash. The entry would include:

A) a credit to Sales.

B) a debit to Sales.

C) a credit to Furniture.

D) a credit to Cash.

Correct Answer

verified

Correct Answer

verified

True/False

Sales Returns and Allowances is a contra-revenue account with a normal debit balance.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Santa Materials sold goods for $3,200 plus 5% sales tax to a charge customer, terms n/30. Which entry is required to record this transaction?

A) Debit Accounts Receivable $3,360; credit Sales Tax Payable $160; credit Sales $3,200

B) Debit Cash $3,200; credit Sales $3,200

C) Debit Accounts Receivable $3,200; credit Sales $3,200

D) Debit Accounts Receivable $3,360; credit Sales $3,360

Correct Answer

verified

Correct Answer

verified

True/False

The accounts receivable subsidiary ledger shows the amount collected from each customer.

Correct Answer

verified

Correct Answer

verified

True/False

Accounts in the accounts receivable subsidiary ledger are listed alphabetically.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A characteristic of a schedule of accounts receivable is that:

A) it contains a list of customers' names with balances.

B) the total is equal to the accounts receivable control account at the end of the month.

C) it is prepared at the end of the month.

D) All of these answers are correct.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The accounts receivable subsidiary ledger:

A) is organized in alphabetical order.

B) is not kept in the same book as Accounts Receivable.

C) should equal the controlling account in the general ledger.

D) All of the above are correct.

Correct Answer

verified

Correct Answer

verified

Essay

Prepare the necessary general journal entry for December 16. __________________________________________ __________ __________ __________________________________________ __________ __________ __________________________________________ __________ __________

Correct Answer

verified

Correct Answer

verified

True/False

When a customer returns defective office supplies, the Sales Returns and Allowances account will be debited.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Gross sales equals:

A) net sales minus sales discount.

B) sales discount less net income.

C) the total of cash sales and credit sales.

D) supplies minus inventory.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Credit terms of 3/15, n/30 mean that:

A) a 3% discount is allowed if the bill is paid within between 15 and 30 days.

B) a 3% discount is allowed if the bill is paid within 30 days.

C) a 3% discount is allowed if the bill is paid before the 15th day of the following month.

D) a 3% discount is allowed if the customer pays the bill within 15 days, or the entry amount is due within 30 days.

Correct Answer

verified

Correct Answer

verified

Essay

The Milk Co. had the following transactions involving the sale of merchandise. You are to prepare the necessary general journal entries. All sales are subject to a 6% sales tax. Terms of sale were n/30. April 13 Sold merchandise priced at $600 to James Ellsworth on account. April 14 Sold merchandise priced at $325 to a cash customer. April 15 Sold merchandise priced at $175 to Dana Carter on account. April 16 Sold merchandise priced at $700 to a cash customer. April 20 The customer of April 14 returned $50 worth of merchandise for a cash refund. April 25 Received full payment from Dana Carter. April 30 Paid the amount of sales tax to the state. -Prepare the necessary general journal entry for April 20. __________________________________________ __________ __________ __________________________________________ __________ __________ __________________________________________ __________ __________

Correct Answer

verified

Correct Answer

verified

Essay

Prepare the necessary general journal entry for December 10. __________________________________________ __________ __________ __________________________________________ __________ __________ __________________________________________ __________ __________

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The contra-revenue accounts include:

A) Sales Tax Payable.

B) Sales Returns and Allowances.

C) Sales Discount.

D) Both B and C are correct.

Correct Answer

verified

Correct Answer

verified

Essay

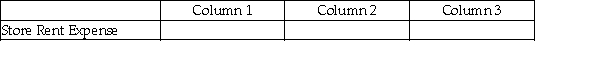

For each of the following, identify in column 1 the category to which the account belongs, in column 2 the normal balance for the account, and in column 3 the financial statement on which the account balance is reported.

-

Correct Answer

verified

Correct Answer

verified

True/False

The discount period is longer than the credit period.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Merchandise is:

A) the same as inventory.

B) an asset.

C) the same as supplies.

D) Both A and B are correct.

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 125

Related Exams