A) $2,600

B) $5,200

C) $3,705

D) $7,410

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is true if a bond is issued for an amount equal to its face value?

A) The bond's stated interest rate is less than the prevailing market interest rate at time of sale.

B) The bond's stated interest rate is the same as the prevailing market interest rate at time of sale.

C) The bond's stated interest rate is more than the prevailing market interest rate at time of sale.

D) The bond is not secured by specific assets of the issuer.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On November 1, 2016, EZ Products borrowed $66,000 on a 6%, 8-year note with annual installment payments of $8,250 plus interest due on November 1 of each succeeding year. On November 1, 2018, what is the balance of the Long-Term Notes Payable account? (Round your answer to nearest whole number.)

A) $49,500

B) $66,000

C) $57,750

D) $8,250

Correct Answer

verified

Correct Answer

verified

Essay

On January 2, 2017, Chabot Sales issues $10,000 in bonds for $10,900. These are 5-year bonds with a stated rate of 4%, and pay semiannual interest. Chabot Sales uses the straight-line method to amortize bond premium. Prepare the journal entry for the first interest payment on June 30, 2017.

Correct Answer

verified

Correct Answer

verified

Essay

Hernandez Carpets Company buys a building for $115,000, paying $30,000 cash and signing a 30-year mortgage note for $85,000 at 11%. Prepare the journal entry for the purchase.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Why would a corporation issue bonds payable instead of issuing stock?

A) Debt is a less expensive source of capital than stock.

B) Borrowing by issuing bonds payable carries no risk to the company.

C) Debt affects the percentage of ownership of the corporation by the stockholders.

D) Debt does not have to be shown on the balance sheet.

Correct Answer

verified

Correct Answer

verified

True/False

The balance in the Bonds Payable account is a credit of $72,000. The balance in the Discount on Bonds Payable is a debit of $3,600. The balance sheet will report the bond balance as $75,600.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

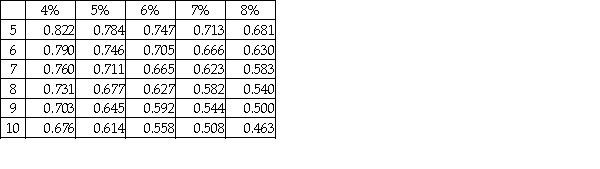

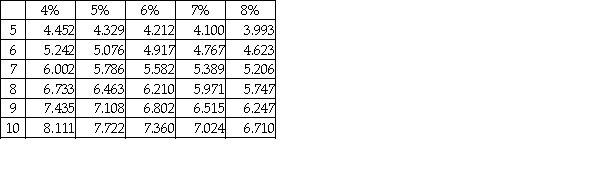

The face value of a bond is $75,000, its stated rate is 7%, and the term of the bond is five years. The bond pays interest semiannually. At the time of issue, the market rate is 8%. Determine the present value of the bonds at issuance. Present value of $1:  Present value of annuity of $1:

Present value of annuity of $1:

A) $53,709

B) $21,291

C) $71,991

D) $75,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On January 1, 2016, Brubeck Company purchased equipment and signed a six-year mortgage note for $110,000 at 15%. The note will be paid in equal annual installments of $29,066, beginning January 1, 2017. Calculate the balance of Mortgage Payable after the payment of the first installment. (Round your answer to the nearest whole number.)

A) $16,500

B) $80,934

C) $97,434

D) $82,983

Correct Answer

verified

Correct Answer

verified

True/False

If a bond is issued at a discount, the issue price is greater than face value.

Correct Answer

verified

Correct Answer

verified

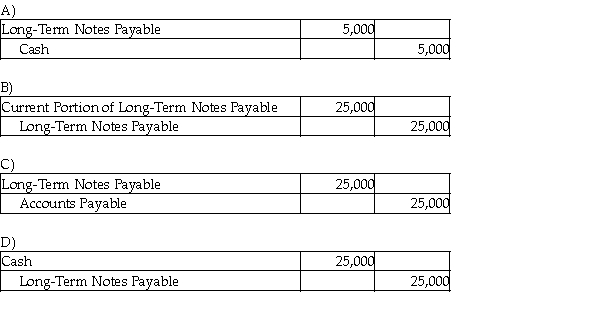

Short Answer

On March 1, 2016, Hughes Services issued a 9% long-term notes payable for $25,000. It is payable over a 5-year term in $5,000 principal installments on March 1 of each year, beginning March 1, 2017. Which of the following entries needs to be made on March 1, 2016?

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The interest rate that determines the amount of cash interest the borrower pays and the investor receives each year is called the ________.

A) amortization rate

B) market interest rate

C) stated interest rate

D) discounting rate

Correct Answer

verified

Correct Answer

verified

Showing 181 - 192 of 192

Related Exams