A) $3,600

B) $15,600

C) $14,400

D) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Cash payments on account for February are

A) $30,960

B) $12,384

C) $30,120

D) $25,344

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Cash receipts for April will be

A) $38,800

B) $77,800

C) $100,000

D) $68,800

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A budget that reflects a range of operations is called a

A) Standard budget

B) Activity-based budget

C) Flexible budget

D) Benchmark budget

Correct Answer

verified

Correct Answer

verified

Multiple Choice

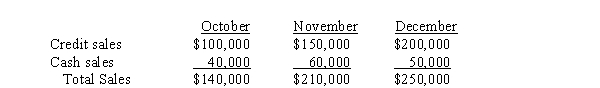

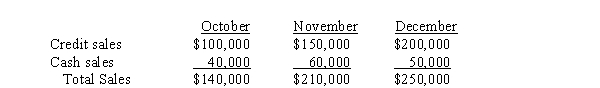

Use the following information for the next 5 questions.

Kelita, Inc., projects sales for its first three months of operation as follows:  Inventory on October 1 is $40,000. Subsequent beginning inventories should be 40% of that month's cost of goods sold. Goods are priced at 140% of their cost. 50% of purchases are paid for in the month of purchase; the balance is paid in the following month. It is expected that 50% of credit sales will be collected in the month following sale, 30% in the second month following the sale, and the balance the third month. A 5% discount is given if payment is received in the month following sale.

-What is the projected cost of goods sold for October?

Inventory on October 1 is $40,000. Subsequent beginning inventories should be 40% of that month's cost of goods sold. Goods are priced at 140% of their cost. 50% of purchases are paid for in the month of purchase; the balance is paid in the following month. It is expected that 50% of credit sales will be collected in the month following sale, 30% in the second month following the sale, and the balance the third month. A 5% discount is given if payment is received in the month following sale.

-What is the projected cost of goods sold for October?

A) $140,000

B) $220,000

C) $257,000

D) $100,000

Correct Answer

verified

Correct Answer

verified

True/False

A flexible budget reflects a range of operations.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

To prepare a cash budget, managers plan I. Cash receipts II. Cash disbursements III. Short-term borrowing or investments

A) I and II only

B) I and III only

C) II and III only

D) I, II, and III

Correct Answer

verified

Correct Answer

verified

True/False

Participative budgeting involves customers and managers at all levels in the organization.

Correct Answer

verified

Correct Answer

verified

True/False

When an organization's actual revenues are greater than its budgeted revenues, the difference is referred to as a favorable variance.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

TFS' budgeted cost of goods available for sale for the next fiscal year will be

A) $10,000

B) $25,000

C) $15,000

D) $35,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the following information for the next 4 questions.

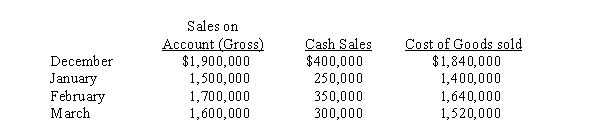

(CPA) The Dilly Company marks up all merchandise at 25% of gross purchase price. All purchases are made on account with terms of 1/10, (1% discount if paid in 10 days) net/60 (full amount due within 60 days) . Purchase discounts, which are recorded as miscellaneous income, are always taken. Normally, 60% of each month's purchases are paid for in the first month after purchase, whereas the other 40% are paid during the first 10 days of the first month after purchase. Inventories of merchandise at the end of each month are kept at 30% of the next month's forecasted cost of good sold.

Terms for sales on account are 2/10 (2% discount if paid within 10 days) , net/30 (full amount due in 30 days) . Cash sales are not subject to discount. Fifty percent of each month's sales on account are collected during the month of sale, 45% are collected in the succeeding month, and the remainder is usually uncollectible. Seventy percent of the collections in the month of sale are subject to discount, and 10% of the collections in the succeeding month are subject to discount (2%) .

Forecasted sales data and cost of sales for selected months are as follows:  -Assuming that all of the beginning inventory for December is sold, forecasted gross purchases for January are

-Assuming that all of the beginning inventory for December is sold, forecasted gross purchases for January are

A) $1,400,000

B) $1,470,000

C) $1,472,000

D) $1,248,000

E) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The research and development cost variance could be explained by

A) Starting too many projects

B) Cost increases due to new information technologies

C) Efficient cost management

D) Higher salaries

Correct Answer

verified

Correct Answer

verified

Multiple Choice

To address the difference between budgeted cash receipts and budgeted cash disbursements, managers also budget which of the following?

A) Debits and credits

B) Short-term borrowing or investments

C) Dividend payments

D) Net income

Correct Answer

verified

Correct Answer

verified

Short Answer

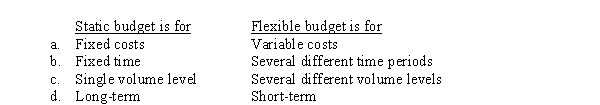

The difference between a static budget and a flexible budget is that

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A firm expects credit sales for the week to amount to $3,000, accounts receivable to increase by $200, and accounts payable to decrease by $500. Given this information, what will be the effect on cash?

A) $2,700 increase

B) $2,300 increase

C) $1,700 increase

D) $1,300 increase

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the following information for the next 5 questions.

Kelita, Inc., projects sales for its first three months of operation as follows:  Inventory on October 1 is $40,000. Subsequent beginning inventories should be 40% of that month's cost of goods sold. Goods are priced at 140% of their cost. 50% of purchases are paid for in the month of purchase; the balance is paid in the following month. It is expected that 50% of credit sales will be collected in the month following sale, 30% in the second month following the sale, and the balance the third month. A 5% discount is given if payment is received in the month following sale.

-What is the projected cost of purchases for October?

Inventory on October 1 is $40,000. Subsequent beginning inventories should be 40% of that month's cost of goods sold. Goods are priced at 140% of their cost. 50% of purchases are paid for in the month of purchase; the balance is paid in the following month. It is expected that 50% of credit sales will be collected in the month following sale, 30% in the second month following the sale, and the balance the third month. A 5% discount is given if payment is received in the month following sale.

-What is the projected cost of purchases for October?

A) $80,000

B) $93,333

C) $120,000

D) $180,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The cost of ending finished goods inventory of round tables for 20x1 is

A) $662,500

B) $622,500

C) $562,500

D) $530,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What will be the ending cash balance for January?

A) $(280)

B) $13,720

C) $19,720

D) $6,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following correctly describes budgeted direct materials purchases?

A) Production needs + desired ending inventory - beginning inventory

B) Production needs + beginning inventory- desired ending inventory

C) Sales + desired production - beginning inventory

D) Beginning inventory + desired production - desired ending inventory

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the following information for the next 2 questions.

Taft Corporation collects cash from customers as follows: 60% in the month of sale, 20% in the month after sale, 19% in the second month after sale, and 1% is never collected. Bad debts are written off annually in December. Budgeted sales are all on credit and amount to:  -What is the budgeted amount of accounts receivable at the end of August?

-What is the budgeted amount of accounts receivable at the end of August?

A) $353,000

B) $340,000

C) $329,000

D) $377,000

Correct Answer

verified

Correct Answer

verified

Showing 121 - 140 of 148

Related Exams