Correct Answer

verified

Correct Answer

verified

Multiple Choice

If productivity growth is 2 percent and inflation is 5 percent, on average nominal wage increases will be:

A) 2 percent.

B) 3 percent.

C) 5 percent.

D) 7 percent.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The institutionalist theory of inflation differs from that of the quantity theory by focusing on:

A) how firms determine wages and prices.

B) the equation of exchange.

C) the rate of growth in the money supply.

D) the institutions that determine how the money supply is determined.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not one of the assumptions of the quantity theory of money?

A) Velocity is constant

B) The money growth rate is constant

C) Real output is independent of the money supply

D) Causation goes from money supply to prices

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A reason why the quantity theory of money is problematic is that:

A) money supply increases generally affect only goods prices.

B) the Fed generally runs expansionary monetary policy.

C) the velocity of money has fluctuated over time.

D) real output rises during expansions and falls during contractions.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If inflation is highly volatile, money is

A) more valuable because you need more of it

B) less valuable because there is less of it.

C) more valuable because its unit of account function is reduced

D) less valuable because its unit of account function is reduced.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In an unexpected inflation, lenders will generally:

A) gain relative to borrowers.

B) lose relative to borrowers.

C) neither gain nor lose relative to borrowers.

D) The effect will be totally random.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Globalization will tend to:

A) flatten the short-run Phillips curve.

B) flatten the long-run Phillips curve.

C) shift the short-run Phillips curve.

D) shift the long-run Phillips curve.

Correct Answer

verified

Correct Answer

verified

True/False

Economists who accept the quantity theory of money favor a monetary rule because they believe the short-run effects of monetary policy are unpredictable and the long-run effects are on the price level, not real output.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to the text, if individuals base their expectations on economic models we say that their expectations are:

A) rational.

B) historical.

C) adaptive.

D) extrapolative.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

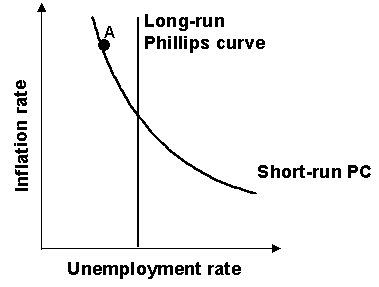

If the economy is at Point A in the Phillips curve graph shown, in the long run the unemployment would be expected to:

A) increase.

B) decrease.

C) remain constant.

D) immediately fall to zero.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Inflationary pressures increase when the economy moves:

A) to the right of the long-run Phillips curve.

B) to the left of the long-run Phillips curve.

C) down the short-run Phillips curve.

D) down the long-run Phillips curve.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The short-run Phillips curve shifts around because of changes in:

A) the money supply.

B) expectations of employment.

C) expectations of inflation.

D) expectations of real income.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The higher the rate of inflation, the lower the:

A) real interest rate can fall as long as it is positive

B) nominal interest rate can fall as long as it is positive

C) nominal interest rate can fall

D) real interest rate can fall

Correct Answer

verified

Correct Answer

verified

Multiple Choice

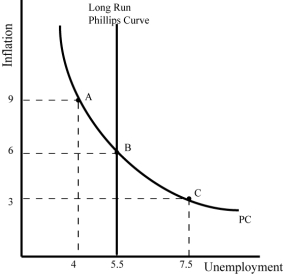

Refer to the graph shown.  Suppose an economy begins at point B but then adopts a contractionary monetary policy.In the short run, this policy would most likely:

Suppose an economy begins at point B but then adopts a contractionary monetary policy.In the short run, this policy would most likely:

A) reduce inflation to 3 percent and raise unemployment to 7.5 percent.

B) reduce inflation to 3 percent and reduce unemployment to 4 percent.

C) raise inflation to 9 percent and raise unemployment to 7.5 percent.

D) raise inflation to 9 percent and reduce unemployment to 4 percent.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If actual inflation is correctly expected and built into people's wage and price setting decisions, the Phillips curve:

A) becomes a horizontal line.

B) becomes a vertical line.

C) remains a downward sloping line.

D) becomes an upward sloping line.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A central policy concern about inflation is to see that it

A) does not become built into expectations

B) does not redistribute income

C) does redistribute income

D) does become built into expectations

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If there is inflation

A) the unit of account function of money is improved

B) the unit of account function of money is undermined.

C) the distributional function of money is improved

D) the distributional function of money is undermined.

Correct Answer

verified

Correct Answer

verified

True/False

The prices of assets are included in standard measures of inflation.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Inflation:

A) can obscure relative price changes.

B) redistributes income from those who can raise prices to those who cannot.

C) can undermine faith in the monetary system, the economy, and the government if it is high enough.

D) makes society poorer on average.

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 126

Related Exams