A) When bonds sold at a discount and are accounted for using amortized cost, interest revenue will be greater than the interest revenue recorded under fair value.

B) When bonds sold at a premium and are accounted for using amortized cost, interest revenue will be less than the interest revenue recorded under fair value.

C) Under the fair value approach, an unrealized gain or loss is recorded in each year whereas no unrealized gains or losses are recorded under the amortized cost method.

D) All of these answer choices are correct.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Debt investments not held for collection are reported at

A) amortized cost.

B) fair value.

C) the lower of amortized cost or fair value.

D) net realizable value.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Investments in trading debt investments are generally reported at

A) amortized cost.

B) face value.

C) fair value.

D) maturity value.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

IFRS requires companies to measure their financial assets based on all of the following except

A) The company's business model for managing its financial assets.

B) Whether the financial asset is a debt or equity investment.

C) The contractual cash flow characteristics of the financial asset.

D) All of these answer choices are IFRS requirements.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Equity investments acquired by a corporation which are accounted for by recognizing unrealized holding gains or losses as other comprehensive income and as a separate component of equity are

A) non-trading where a company has holdings of less than 20%.

B) trading investments where a company has holdings of less than 20%.

C) investments where a company has holdings of between 20% and 50%.

D) investments where a company has holdings of more than 50%.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A gain on sale of a debt investment is the excess of the selling price over the bonds

A) market price.

B) fair value.

C) face value.

D) book value.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The IASB permits which of the following measurement categories for financial assets? Fair value Amortized cost

A) No No

B) Yes No

C) Yes Yes

D) No Yes

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Impairments of debt investments are

A) based on discounted contractual cash flows.

B) recognized as a realized loss if the impairment is judged to be temporary.

C) based on fair value for non-trading investments and on negotiated values for held-for-collection investments.

D) evaluated at each reporting date for every held-for-collection investment.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An option to convert a convertible bond into ordinay shares is a(n)

A) embedded derivative.

B) host security.

C) hybrid security.

D) fair value hedge.

Correct Answer

verified

Correct Answer

verified

True/False

All dividends received by an investor from the investee decrease the investment's carrying value under the equity method.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The accounting for fair value hedges records the derivative at its

A) amortized cost.

B) carrying value.

C) fair value.

D) historical cost.

Correct Answer

verified

Correct Answer

verified

Short Answer

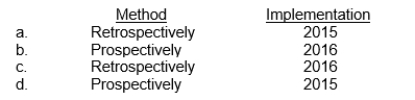

Royce Company holds a portfolio of debt investments.The debt investments are not held-for-collection but managed to profit from interest rate changes.As a result, it accounts for these investments at fair value.As part of its strategic planning process, completed in the fourth quarter of 2015, Royce management decides to move from its prior strategy-which requires active management-to a held-for-collection strategy for these debt investments.The company will account for this change

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Companies that attempt to exploit inefficiencies in various derivative markets by attempting to lock in profits by simultaneously entering into transactions in two or more markets are called

A) arbitrageurs.

B) gamblers.

C) hedgers.

D) speculators.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An unrealized holding gain or loss on a trading debt investment is the difference between the investment's

A) fair value and original cost.

B) face value and amortized cost.

C) fair value and amortized cost.

D) face value and original cost.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Under IFRS,

A) The accounting for non-trading equity investments deviates from the general provisions for equity investments.

B) Realized gains and losses related to changes in the fair value of non-trading equity investments are reported as a part of other comprehensive income and as a component of other accumulated comprehensive income.

C) Dividends received in cash are always reported as income on the income statement.

D) All of hese answer choices are correct.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Transfers between categories

A) result in companies omitting recognition of fair value in the year of the transfer.

B) are accounted for at fair value for all transfers.

C) are considered unrealized and unrecognized if transferred out of held-to-maturity into trading.

D) will always result in an impact on net income.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Investments in trading debt investments should be recorded on the date of acquisition at

A) face value.

B) fair value.

C) amortized cost.

D) the lower of face value or amortized cost.

Correct Answer

verified

Correct Answer

verified

True/False

If a company determines that an investment is impaired, it writes down the amortized cost basis of the individual security to reflect this loss in value.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the investor owns 60% of the investee's outstanding ordinary shares, the investor should generally account for this investment under the

A) cost method.

B) fair value method.

C) consolidation equity method.

D) consolidation method.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

All of the following are characteristics of a derivative financial instrument except the instrument

A) has one or more underlyings and an identified payment provision.

B) requires a large investment at the inception of the contract.

C) requires or permits net settlement.

D) All of these answer choices are characteristics.

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 69

Related Exams