Correct Answer

verified

Correct Answer

verified

True/False

On the statement of financial position the non-controlling interest account is reported as a long-term investment.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In a statement of cash flows, receipts from sales of property, plant, and equipment and other productive assets should generally be classified as cash inflows from

A) operating activities.

B) financing activities.

C) investing activities.

D) selling activities.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

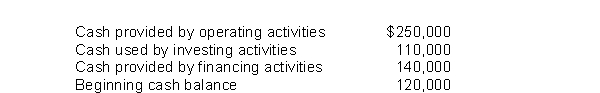

Lohmeyer Corporation reports:  What is Lohmeyer's ending cash balance?

What is Lohmeyer's ending cash balance?

A) $330,000.

B) $400,000.

C) $550,000.

D) $620,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The statement of financial position

A) Omits many items that are of financial value.

B) Makes very limited use of judgments and estimates.

C) Uses fair value for most assets and liabilities.

D) All of the choices are correct regarding the statement of financial position.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

One criticism not normally aimed at a statement of financial position prepared using current accounting and reporting standards is

A) failure to reflect current value information.

B) the extensive use of separate classifications.

C) an extensive use of estimates.

D) failure to include items of financial value that cannot be recorded objectively.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

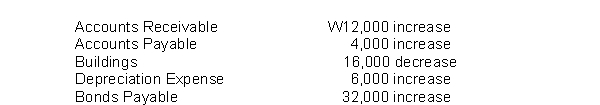

During 2015 the DLD Company had a net income of W200,000.In addition, selected accounts showed the following changes:  What was the amount of cash provided by operating activities?

What was the amount of cash provided by operating activities?

A) W198,000

B) W200,000

C) W206,000

D) W238,000

Correct Answer

verified

Correct Answer

verified

True/False

The equity section of an IFRS statement of financial position includes share capital, share premium, and retained earnings in that order.

Correct Answer

verified

Correct Answer

verified

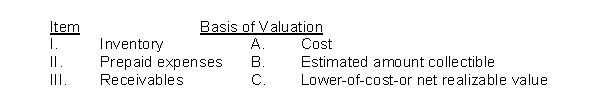

Multiple Choice

Using IFRS, which of the following items is matched correctly with its basis of valuation for purposes of reporting on the statement of financial position?

A) I and A

B) II and C

C) III and B

D) II and B

Correct Answer

verified

Correct Answer

verified

True/False

Collection of a loan is reported as an investing activity in the statement of cash flows.

Correct Answer

verified

Correct Answer

verified

True/False

IFRS requires specific note disclosures on inventories that are disaggregated into classifications such as merchandise, production supplies, work in process, and finished goods.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The amount of time that is expected to elapse until an asset is realized or otherwise converted into cash is referred to as

A) solvency.

B) financial flexibility.

C) liquidity.

D) exchangeability.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Statement of financial position information is useful for all of the following except to

A) compute rates of return

B) analyze cash inflows and outflows for the period

C) evaluate capital structure

D) assess future cash flows

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Treasury shares should be reported as a(n)

A) current asset.

B) investment.

C) other asset.

D) reduction of equity.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Olmsted Company has the following items: share capital-ordinary, $920,000; treasury shares, $85,000; deferred taxes, $100,000 and retained earnings, $363,000.What amount should Olmsted Company report as total equity?

A) $1,098,000.

B) $1,198,000.

C) $1,298,000.

D) $1,398,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Non-current liabilities include

A) obligations not expected to be liquidated within the next year or operating cycle.

B) obligations payable at some date beyond the next year or operating cycle.

C) deferred income taxes and most lease obligations.

D) All of these choices are correct.

Correct Answer

verified

Correct Answer

verified

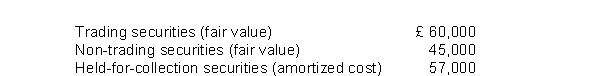

Multiple Choice

Kohler Company owns the following investments:  Kohler will report securities in its long-term investments section of

Kohler will report securities in its long-term investments section of

A) exactly £105,000.

B) exactly £117,000.

C) exactly £162,000.

D) £102,000 or an amount less than £102,000, depending on the circumstances.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Preparing the statement of cash flows, using the indirect method, involves all of the following except determining the

A) cash provided by operations.

B) cash provided by or used in investing and financing activities.

C) change in cash during the period.

D) cash collections from customers during the period.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The basis for classifying assets as current or noncurrent is conversion to cash within

A) the accounting cycle or one year, whichever is shorter.

B) the operating cycle or one year, whichever is longer.

C) the accounting cycle or one year, whichever is longer.

D) the operating cycle or one year, whichever is shorter.

Correct Answer

verified

Correct Answer

verified

True/False

Financial flexibility is a company's ability to respond and adapt to financial adversity and unexpected needs and opportunities.

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 113

Related Exams