A) should be corrected as adjustments at the end of the period.

B) should be corrected as soon as they are discovered.

C) should be corrected when preparing annual financial statements.

D) cannot be corrected until the next accounting period.

Correct Answer

verified

Correct Answer

verified

True/False

Common Canadian practice shows current assets as the first items listed on a classified balance sheet.

Correct Answer

verified

Correct Answer

verified

True/False

If a work sheet is used, financial statements can be prepared before adjusting entries are journalized.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A reversing entry

A) reverses entries that were made in error.

B) is the exact opposite of an adjusting entry made in a previous period.

C) is the same as the adjusting entry made in a previous period.

D) is made when a company sustains a loss in one period and reverses the effect with a profit in the next period.

Correct Answer

verified

Correct Answer

verified

Essay

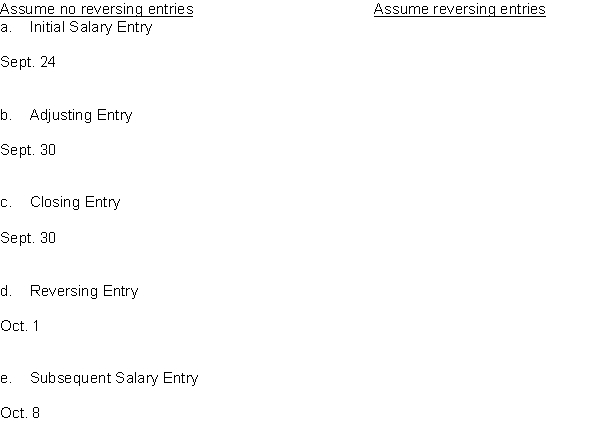

Transaction and adjustment data for Portiski Company for the year ended September 30 is as follows:

1. September 24 (initial salary entry): $12,000 of salaries earned between September 1 and September 24 are paid.

2. September 30 (adjusting entry): Salaries earned between September 25 and September 30 are $5,000. These will be paid in the October 8 payroll.

3. October 8 (subsequent salary entry): Total salary payroll amounting to $9,000 was paid.

Instructions

Prepare two sets of journal entries as specified below. The first set of journal entries should assume that the company does not use reversing entries, and the second set should assume that reversing entries are utilized by the company.

Correct Answer

verified

Correct Answer

verified

Short Answer

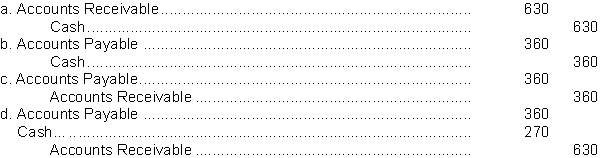

The Saint John River Company received $630 on account from a customer. The transaction was erroneously recorded as a debit to Cash of $360 and a credit to Accounts Payable, $360. The correcting entry is

Correct Answer

verified

Correct Answer

verified

True/False

After closing entries have been journalized and posted, all temporary accounts in the ledger should have zero balances.

Correct Answer

verified

Correct Answer

verified

Essay

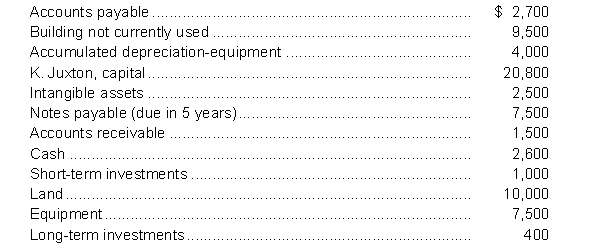

The following information is available for Juxton Company for the year ended December 31, 2013:  Instructions

Use the above information to prepare a classified balance sheet for the year ended December 31, 2013.

Instructions

Use the above information to prepare a classified balance sheet for the year ended December 31, 2013.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Closing entries

A) are prepared before the financial statements.

B) reduce the number of permanent accounts.

C) cause the revenue and expense accounts to have zero balances.

D) close all of the permanent accounts.

Correct Answer

verified

Correct Answer

verified

True/False

The owner's drawings account is closed to the Income Summary account in order to properly determine Profit (or loss) for the period.

Correct Answer

verified

Correct Answer

verified

True/False

Reversing Entries are more relevant in corporations.

Correct Answer

verified

Correct Answer

verified

Essay

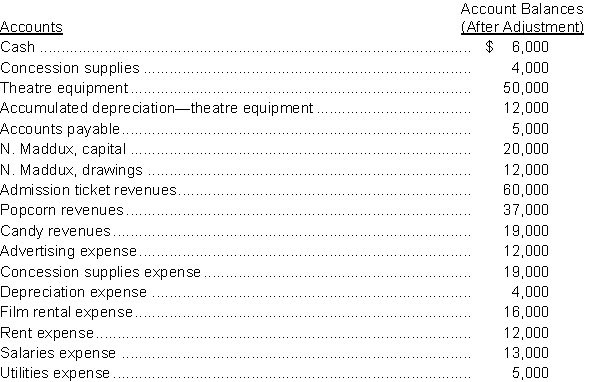

At March 31, 2014, account balances after adjustments for Maddux Cinema are as follows:  Instructions

a. Prepare the closing journal entries for Maddux Cinema.

b. Prepare a post-closing trial balance.

Instructions

a. Prepare the closing journal entries for Maddux Cinema.

b. Prepare a post-closing trial balance.

Correct Answer

verified

Correct Answer

verified

True/False

Current assets are normally listed in the balance sheet in order of permanency.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The balances that appear on the post-closing trial balance will match the

A) income statement account balances after adjustments.

B) balance sheet account balances after closing entries.

C) income statement account balances after closing entries.

D) balance sheet account balances after adjustments.

Correct Answer

verified

Correct Answer

verified

Essay

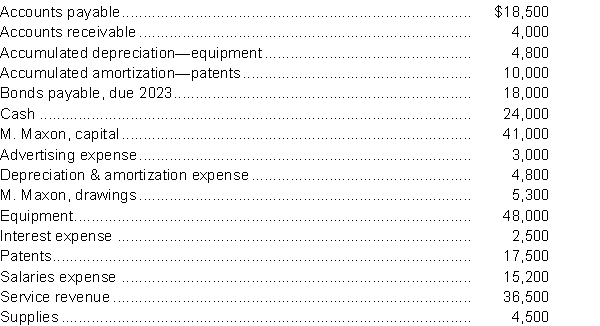

The following items are taken from the financial statements of Maxon Service for 2013:  Instructions

a. Prepare an income statement and a classified balance sheet for Maxon Sales.

b. Calculate the following ratios and values:

1. Current ratio

2. Working capital

3. Acid-test ratio

a. Prepare an income statement and a classified balance sheet for Maxon Sales.

b. Calculate the following ratios and values:

Instructions

a. Prepare an income statement and a classified balance sheet for Maxon Sales.

b. Calculate the following ratios and values:

1. Current ratio

2. Working capital

3. Acid-test ratio

a. Prepare an income statement and a classified balance sheet for Maxon Sales.

b. Calculate the following ratios and values:

Correct Answer

verified

Correct Answer

verified

True/False

The final step in the accounting cycle is the pre-closing trial balance.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The most important information needed to determine if companies can pay their current obligations is the

A) profit for this year.

B) projected profit for next year.

C) relationship between current assets and current liabilities.

D) relationship between current and non-current liabilities.

Correct Answer

verified

Correct Answer

verified

True/False

The acid-test ratio is a measure of a company's long term liquidity.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Jasmine Company received a $350 cheque from a customer for the balance due on an accounts receivable. The transaction was erroneously recorded as a debit to cash of $530 and a credit to service revenue of $530. The correcting entry is

A) debit Accounts Receivable $350; credit Cash $350

B) debit Accounts Receivable $180; credit Cash $180

C) debit Service Revenue $530; credit Cash $180; credit Accounts Receivable $350

D) debit Service Revenue $530; credit Cash $350; credit Accounts Receivable $180

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The purpose of the post-closing trial balance is to

A) ensure that all adjusting entries were made.

B) prove the equality of the balance sheet account balances that are carried forward into the next accounting period.

C) prove the equality of the income statement account balances that are carried forward into the next accounting period.

D) list all the balance sheet accounts in alphabetical order for easy reference.

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 151

Related Exams