A) Only Jack is personally liable for the debt, since he has been the managing partner during that time.

B) Only Jill is personally liable for the debt of the business, since Jack has been working and she has not.

C) Both Jack and Jill are personally liable for the business debt.

D) Neither Jack nor Jill is personally liable for the business debt, since the partnership is a separate legal entity.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not a satisfactory statement of the accounting equation?

A) Assets = Stockholders' Equity - Liabilities

B) Assets = Liabilities + Stockholders' Equity

C) Assets - Liabilities = Stockholders' Equity

D) Assets - Stockholders' Equity = Liabilities

Correct Answer

verified

Correct Answer

verified

True/False

Investing activities involve collecting the necessary funds to support the business.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Jimmy's Repair Shop started the year with total assets of $200,000 and total liabilities of $160,000. During the year the business recorded $420,000 in revenues, $220,000 in expenses, and dividends of $40,000. The net income reported by Jimmy's Repair Shop for the year was

A) $160,000.

B) $200,000.

C) $120,000.

D) $380,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The financial statement that summarizes the changes in retained earnings for a specific period of time is the

A) balance sheet.

B) income statement.

C) statement of cash flows.

D) retained earnings statement.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The liability created by a business when it purchases coffee beans and coffee cups on credit from suppliers is termed a(n)

A) account payable.

B) account receivable.

C) revenue.

D) expense.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Claims of owners are called

A) dividends.

B) stockholders' equity.

C) liabilities.

D) income payable.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Stockholders' equity

A) is usually equal to cash on hand.

B) is equal to liabilities and retained earnings.

C) includes retained earnings and common stock.

D) is shown on the income statement.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would not be considered an internal user of accounting data for the Xanadu Company?

A) President of the company

B) Production manager

C) Merchandise inventory clerk

D) President of the employees' labor union

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The group of users of accounting information charged with achieving the goals of the business is its

A) auditors.

B) investors.

C) managers.

D) creditors.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements concerning users of accounting information is incorrect?

A) Management is considered an internal user.

B) Present creditors are considered external users.

C) Regulatory authorities are considered internal users.

D) Taxing authorities are considered external users.

Correct Answer

verified

Correct Answer

verified

True/False

The information needs and questions of external users vary considerably.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An advantage of the corporate form of business is that

A) it has limited life.

B) its owner's personal resources are at stake.

C) its ownership is easily transferable via the sale of shares of stock.

D) it is simple to establish.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is true?

A) Amounts received from issuing stock are revenues.

B) Amounts paid out as dividends are not expenses.

C) Amounts paid out as dividends are reported on the income statement.

D) Amounts received from issued stock are reported on the income statement.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following groups uses accounting information primarily to insure the entity is operating within prescribed rules?

A) Taxing authorities

B) Regulatory agencies

C) Labor Unions

D) Management

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Debt securities sold to investors that must be repaid at a particular date some years in the future are called

A) accounts payable.

B) notes receivable.

C) taxes payable.

D) bonds payable.

Correct Answer

verified

Correct Answer

verified

Essay

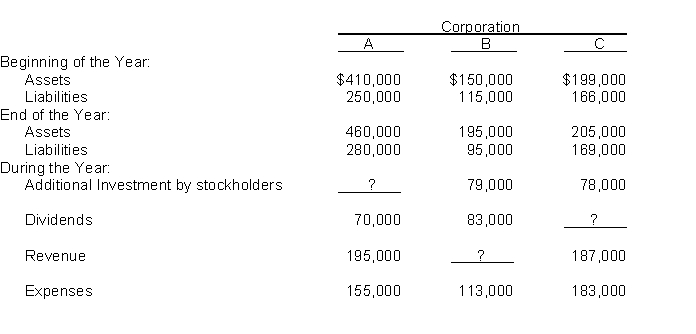

One item is omitted in each of the following summaries of balance sheet and income statement data for three different corporations, A, B, and C.

Determine the amounts of the missing items, identifying each corporation by letter.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Why should the income statement be prepared first?

A) The statement of cash flows should be prepared first because it determines the sources of cash. That information is then used in preparing the income statement.

B) Net income from the income statement flows into the retained earnings statement. The ending retained earnings balance then flows into the balance sheet.

C) The income statement does not have to be prepared first. Financial statements can be prepared in any order.

D) None of these answer choices are correct.

Correct Answer

verified

Correct Answer

verified

True/False

Cash is another term for stockholders' equity.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Issuing shares of stock in exchange for cash is an example of a(n)

A) delivering activity.

B) investing activity.

C) financing activity.

D) operating activity.

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 218

Related Exams