A) $10,290

B) $2,710

C) $2,500

D) $2,290

Correct Answer

verified

Correct Answer

verified

Short Answer

Match each description below to the appropriate term (a-g). -The return required by the market on the day of issuance A)contract rate B)effective rate C)bond discount D)bond premium E)bond F)bond indenture G)principal

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When callable bonds are redeemed below the carrying amount

A) gain on redemption of bonds is credited

B) loss on redemption of bonds is debited

C) retained earnings is credited

D) retained earnings is debited

Correct Answer

verified

Correct Answer

verified

True/False

A bond is simply a form of an interest-bearing note.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Bonds that are subject to retirement prior to maturity at the option of the issuer are called

A) debentures

B) callable bonds

C) early retirement bonds

D) options

Correct Answer

verified

Correct Answer

verified

True/False

Only callable bonds can be purchased by the issuing corporation before maturity.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

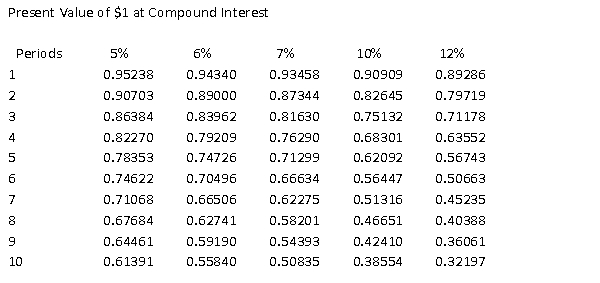

The present value of $40,000 to be received in two years, at 12% compounded annually, is _____ (rounded to nearest dollar) . Use the following table, if needed.

A) $31,888

B) $48,112

C) $8,112

D) $40,000

Correct Answer

verified

Correct Answer

verified

True/False

If bonds are sold for a discount, the carrying amount of the bonds is equal to the face value less the unamortized discount.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Hayden Corporation issues 1,000, 10-year, 8%, $2,000 bonds dated January 1 at 92. The journal entry to record the issuance will show a

A) credit to Discount on Bonds Payable for $160,000

B) debit to Cash of $2,000,000

C) credit to Bonds Payable for $2,000,000

D) credit to Cash for $1,840,000

Correct Answer

verified

Correct Answer

verified

Short Answer

Match each description below to the appropriate term (a-g). -If the contract rate exceeds the effective rate A)contract rate B)effective rate C)bond discount D)bond premium E)bond F)bond indenture G)principal

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Eddie Industries issues $1,500,000 of 8% bonds at 105. The amount of cash received from the sale is

A) $1,425,000

B) $1,080,000

C) $1,000,000

D) $1,575,000

Correct Answer

verified

Correct Answer

verified

Essay

Brubeck Co. issued $10,000,000 of 30-year, 8% callable bonds on May 1 of Year 1, with interest payable on May 1 and November 1. The fiscal year of the company is the calendar year. Journalize the entries to record the following selected transactions: (a) Issued the bonds for cash at their face amount.(b) Paid the interest on the bonds on November 1 of Year 3.(c) Called one-fourth of the bonds at 104, the rate provided in the bond indenture, on May 1 of Year 10. (Omit entry for payment of interest.)

Correct Answer

verified

Correct Answer

verified

Short Answer

Luke Corp. issued $2,000,000 of 20-year, 9% callable bonds on July 1, Year 1, with interest payable on June 30 and December 31. The fiscal year of the company is the calendar year. What is the entry to record the calling of the bonds at the end of year 5 at 97? (Assume interest for the period has been separately recorded.)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On January 1, $2,000,000, 5-year, 10% bonds, were issued for $1,960,000. Interest is paid semiannually on January 1 and July 1. If the issuing corporation uses the straight-line method to amortize discount on bonds payable, the semiannual amortization amount is

A) $8,000

B) $2,000

C) $4,000

D) $10,000

Correct Answer

verified

Correct Answer

verified

True/False

There is a loss on redemption of bonds when bonds are redeemed above the carrying amount.

Correct Answer

verified

Correct Answer

verified

True/False

The buyer determines how much to pay for bonds by computing the present value of future cash receipts using the contract rate of interest.

Correct Answer

verified

Correct Answer

verified

Short Answer

Match each description below to the appropriate term (a-g). -The legal contract between issuer and bond holder A)carrying amount B)face value C)callable bond D)indenture E)term bond F)convertible bond G)serial bond

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The journal entry a company records for the issuance of bonds when the contract rate is less than the market rate would be

A) debit Bonds Payable, credit Cash

B) debit Cash and Discount on Bonds Payable, credit Bonds Payable

C) debit Cash, credit Premium on Bonds Payable and Bonds Payable

D) debit Cash, credit Bonds Payable

Correct Answer

verified

Correct Answer

verified

True/False

The market rate of interest is affected by a variety of factors, including investors' assessment of current economic conditions.

Correct Answer

verified

Correct Answer

verified

True/False

If bonds of $1,000,000 with unamortized discount of $10,000 are redeemed at 98, the gain on redemption of bonds is $10,000.

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 172

Related Exams