Correct Answer

verified

Correct Answer

verified

True/False

The primary financial statements of a corporation are the income statement, the statement of stockholders' equity, and the balance sheet.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The rights of owners in a corporation are referred to as

A) proprietor's equity

B) stockholder's equity

C) dividends

D) equity in assets

Correct Answer

verified

Correct Answer

verified

Short Answer

Match the following characteristics with the form of business entity that best describes it. Each may be used more than once. -Owned by two or more individuals A)Proprietorship B)Partnership C)Corporation D)Limited liability company (LLC)

Correct Answer

verified

Correct Answer

verified

Essay

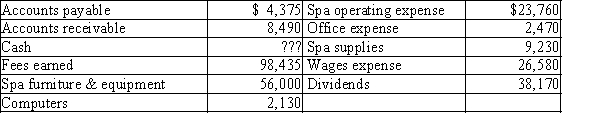

The assets and liabilities of Rocky's Day Spa at December 31 and expenses for the year are listed below. The stockholders' equity was $68,000 ($48,000 in Common Stock and $20,000 in Retained Earnings) at January 1. The shareholders invested in an additional $10,000 of common stock during the year. Net income for the year is $45,625.  Prepare a balance sheet for Rocky's Day Spa for the year ended December 31.

Prepare a balance sheet for Rocky's Day Spa for the year ended December 31.

Correct Answer

verified

Correct Answer

verified

Essay

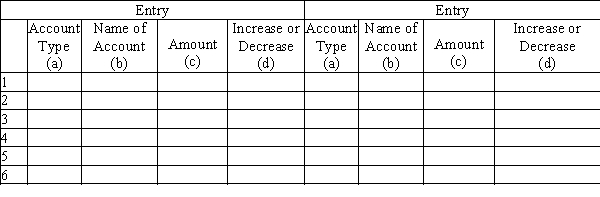

Daniels Company made the following selected transactions during May:

1.Received cash from sale of stock, $55,000

2.Paid creditors on account, $7,000

3.Billed customers for services on account, $2,565

4.Received cash from customers on account, $8,450

5.Paid dividends to stockholders, $2,500

6.Received the utility bill, $160, to be paid next month

Indicate the effect of each transaction on the accounting equation by:

(a)Account type - (A)assets, (L)liabilities, (SE)stockholders' equity, (R)revenue, and (E)expense

b)Name of account

c)The amount by of the transaction

d)The direction of change (increase or decrease) in the account affected

Note: Each transaction has two entries.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The financial statement that presents a summary of the revenues and expenses of a business for a specific period of time, such as a month or year, is called a(n)

A) prior period statement

B) statement of stockholders' equity

C) income statement

D) balance sheet

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Karen Meyer owns and operates Crystal Cleaning Company. Recently, Meyer withdrew $10,000 from Crystal Cleaning, and she contributed $6,000, in her name, to the American Red Cross. The contribution of the $6,000 should be recorded on the accounting records of which of the following entities?

A) Crystal Cleaning and the American Red Cross

B) Karen Meyer's personal records and the American Red Cross

C) Karen Meyer's personal records and Crystal Cleaning

D) Karen Meyer's personal records, Crystal Cleaning, and the American Red Cross

Correct Answer

verified

Correct Answer

verified

Short Answer

Match each transaction with its effect on the accounting equation. Each letter may be used more than once. -Provided a service to a customer on account A)Increase assets, increase liabilities B)Increase liabilities, decrease stockholders' equity C)Increase assets, increase stockholders' equity D)No effect E)Decrease assets, decrease liabilities F)Decrease assets, decrease stockholders' equity

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The business entity assumption means that

A) the owner is part of the business entity

B) an entity is organized according to state or federal statutes

C) an entity is organized according to the rules set by the FASB

D) the entity is an individual economic unit for which data are recorded, analyzed, and reported

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On May 20, White Repair Service extended an offer of $108,000 for land that had been priced for sale at $140,000. On May 30, White Repair Service accepted the seller's counteroffer of $115,000. On June 20, the land was assessed at a value of $95,000 for property tax purposes. On July 4, White Repair Service was offered $150,000 for the land by a national retail chain. At what value should the land be recorded in White Repair Service's records?

A) $108,000

B) $95,000

C) $140,000

D) $115,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Ramos Repair Company is paying a cash dividend. How does this transaction affect Ramos Repair Company's accounting equation?

A) increase in assets (Accounts Receivable) and decrease in assets (Cash)

B) decrease in assets (Cash) and decrease in stockholders' equity (Dividends)

C) decrease in assets (Cash) and decrease in liabilities (Accounts Payable)

D) increase in assets (Cash) and decrease in stockholders' equity (Dividends)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not a characteristic of a corporation?

A) Corporations are organized as a separate legal taxable entity.

B) Ownership is divided into shares of stock.

C) Corporations experience an ease in obtaining large amounts of resources by issuing stock.

D) A corporation's resources are limited to its individual owners' resources.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not a business transaction?

A) make a sales offer

B) sell goods for cash

C) receive cash for services to be rendered later

D) pay for supplies

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Revenues for the year totaled $162,000 and expenses totaled $174,000. The stockholders purchased $15,000 of common stock and were paid $6,000 in dividends during the year. What was the net income or net loss for the year?

A) $12,000 net income

B) $12,000 net loss

C) $18,000 net loss

D) $6,000 net loss

Correct Answer

verified

Correct Answer

verified

True/False

Any twelve-month accounting period adopted by a company is known as its fiscal year.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Computer Corporation is starting its computer programming business and has sold stock of $15,000. Identify how the accounting equation will be affected.

A) increase in assets (Cash) and increase in liabilities (Accounts Payable)

B) increase in assets (Cash) and increase in stockholders' equity (Common Stock)

C) increase in assets (Accounts Receivable) and decrease in liabilities (Accounts Payable)

D) increase in assets (Cash) and increase in assets (Accounts Receivable)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

At the beginning of the year, Winton Company's assets were $180,000 and its stockholders' equity was $82,000. During the year, assets increased by $25,000 and liabilities increased by $9,000. What was the stockholders' equity at the end of the year?

A) $107,000

B) $98,000

C) $114,000

D) $116,000

Correct Answer

verified

Correct Answer

verified

True/False

Managerial accounting information is used by external and internal users equally.

Correct Answer

verified

Correct Answer

verified

True/False

Two factors that typically lead to ethical violations are relevance and timeliness of accounting information.

Correct Answer

verified

Correct Answer

verified

Showing 161 - 180 of 243

Related Exams