A) prime rate.

B) discount rate.

C) federal funds rate.

D) treasury bill rate.Topic: Money-Creating Transactions of a Commercial Bank

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the reserve ratio is 15 percent and commercial bankers decide to hold additional excess reserves equal to 5 percent of any newly acquired checkable deposits, then the relevant monetary multiplier for the banking system will be

A) 3½.

B) 4.

C) 5.

D) 6.67.

Correct Answer

verified

Correct Answer

verified

True/False

If all depositors of a bank were to try withdrawing all their deposits at the same time, a good solid bank should be able to meet all the withdrawals.

Correct Answer

verified

Correct Answer

verified

True/False

Excess reserves are the amount by which required reserves exceed actual reserves.

Correct Answer

verified

Correct Answer

verified

True/False

The granting of a $10,000 loan and the purchase of a $10,000 government bond from a securities dealer by a commercial bank would have the same effect on the money supply.

Correct Answer

verified

Correct Answer

verified

True/False

The higher the reserve requirement, the lower is the monetary multiplier.

Correct Answer

verified

Correct Answer

verified

True/False

If the banking system has $20 billion in excess reserves and the reserve ratio is 10 percent, the system can increase its loans by a maximum of $22 billion.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The primary purpose of the legal reserve requirement is to

A) prevent banks from hoarding too much vault cash.

B) provide a means by which the monetary authorities can influence the lending ability of commercial banks.

C) prevent commercial banks from earning excess profits.

D) provide a dependable source of interest income for commercial banks.Topic: Money-Creating Transactions of a Commercial Bank

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A bank can get additional excess reserves by doing any of the following except

A) borrowing from other banks.

B) buying Treasury securities from the Fed.

C) receiving additional deposits.

D) borrowing from the Fed.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume that the required reserve ratio is 5 percent.If a commercial bank has $2 million cash in its vault, $1 million in government securities, $3 million on deposit at the Fed, and $60 million in checkable deposits, then its excess reserves equal

A) $0 million.

B) $2 million.

C) $5 million.

D) $6 million.

Correct Answer

verified

Correct Answer

verified

True/False

If a commercial banking system has $200,000 in checkable deposits, actual reserves of $70,000, and a reserve ratio of 20 percent, then the banking system can expand the supply of money by a maximum of $180,000.Topic: The Monetary Multiplier

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A bank's net worth is the

A) measure of its profitability.

B) value of its vault cash and loan portfolio.

C) claims of its owners against the bank's assets.

D) claims of its creditors against the bank's assets.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The relative importance of various asset items on a commercial bank's balance sheet reflects a bank's pursuit of which two conflicting goals?

A) profits and risk

B) liquidity and profits

C) assets and liabilities

D) buying and selling government securities

Correct Answer

verified

Correct Answer

verified

True/False

When a bank grants a loan, the money supply M1 will increase, even if the funds from the loan are not spent.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following transactions has the immediate effect of increasing the money supply M1?

A) A commercial bank accepts deposits from its customers.

B) A commercial bank lends some excess reserves in the federal funds market.

C) A commercial bank increases its reserve holdings.

D) A commercial bank buys government securities from the general public.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Only one commercial bank in the banking system has an excess reserve, and its excess reserve is $400,000.This bank makes a new loan of $300,000 and keeps an excess reserve of $100,000.If the required reserve ratio for all banks is 12.5 percent, the potential expansion of the money supply from this new loan is

A) $37,500.

B) $300,000.

C) $2.4 million.

D) $3.2 million.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

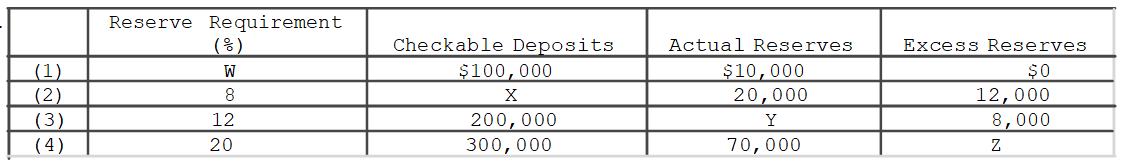

The accompanying table gives data for a commercial bank or thrift.In row 2, the number appropriate for space X is

The accompanying table gives data for a commercial bank or thrift.In row 2, the number appropriate for space X is

A) $20,000.

B) $60,000.

C) $200,000.

D) $100,000.

Correct Answer

verified

Correct Answer

verified

True/False

Actual reserves equal required reserves plus excess reserves.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When bankers hold excess reserves,

A) the size of the monetary multiplier increases.

B) the money-creating potential of the banking system increases.

C) the money-creating potential of the banking system decreases.

D) there is no change in the money-creating potential of the banking system.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Money is "created" when

A) a depositor gets cash from the bank's ATM.

B) a bank accepts deposits from its customers.

C) people receive loans from their banks.

D) people spend the incomes that they receive.

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 177

Related Exams