Correct Answer

verified

Correct Answer

verified

True/False

An S shareholder's stock basis does not include a ratable share of S corporation liabilities.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An S corporation must possess which of the following characteristics?

A) Not more than 100 shareholders.

B) Corporation organized in the United States.

C) Only one class of stock.

D) All of these.

E) None of these.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

During the year, Miles Nutt, the sole shareholder of a calendar year S corporation, received a distribution of $16,000. At the end of last year, his stock basis was $4,000.The corporation earned $11,000 ordinary income during the year.It has no accumulated E & P.Which statement is correct?

A) Nutt recognizes a $1,000 LTCG.

B) Nutt's stock basis is $2,000.

C) Nutt's ordinary income is $15,000.

D) Nutt's tax-free return of capital is $11,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Several individuals acquire assets on behalf of Skip Corporation on May 28, purchased assets on June 3 and began business on June 11.They subscribe to shares of stock, file articles of incorporation for Skip, and become shareholders on June 21.The S election must be filed no later than two and one-half months after:

A) May 28.

B) June 3.

C) June 11.

D) June 21.

E) December 31.

Correct Answer

verified

Correct Answer

verified

Essay

If any entity electing S status is currently a C corporation, NOL carryovers from prior years generally be used in an S corporation year.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which item does not appear on Schedule K of Form 1120S?

A) Intangible drilling costs.

B) Foreign loss.

C) Utilities expense.

D) Recovery of a tax benefit.

E) All of these items appear on Schedule K.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which statement is incorrect with respect to the number-of-shareholders test in filing an S election?

A) Husband Jaime and wife Maria count as one shareholder.

B) Grandmother Adela and granddaughter Maria count as one shareholder.

C) Husband Jaime and the estate of wife Maria count as one shareholder.

D) Husband Jaime and ex-wife Isabel count as one shareholder.

E) All of these statements are correct.

Correct Answer

verified

Correct Answer

verified

True/False

An S election made before becoming a corporation is valid only beginning with the first 12-month tax year.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which statement is incorrect with respect to an S shareholder's consent?

A) Both husband and wife must consent if one owns the stock as community property.

B) An S election requires a consent from all of the S corporation's shareholders.

C) A consent must be in writing.

D) All of these statements are correct.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following, if any, can be eligible shareholders of an S corporation?

A) A Roth IRA.

B) A partnership.

C) A non-U.S.corporation.

D) A nonqualifying trust.

E) None of these.

Correct Answer

verified

Correct Answer

verified

Essay

Nonseparately computed loss (increases, reduces) a S shareholder's stock basis.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which corporation is eligible to make the S election?

A) Non-U.S.corporation.

B) One-person limited liability company.

C) Insurance company.

D) U.S.bank.

E) None of these.

Correct Answer

verified

Correct Answer

verified

True/False

Any distribution of cash or property by a corporation that does not exceed the balance of AAA with respect to S stock during a post-termination transition period of approximately one year is applied against and reduces the basis of the S stock.

Correct Answer

verified

Correct Answer

verified

True/False

The AAA begins with a zero balance on the first day of an S corporation's first tax year.

Correct Answer

verified

Correct Answer

verified

Essay

The exclusion of on the disposition of small business stock (is/is not) available for S stock.

Correct Answer

verified

Correct Answer

verified

Essay

In the case of a complete termination of an S corporation interest, a tax year may occur.

Correct Answer

verified

Correct Answer

verified

True/False

The exclusion of gain on disposition of small business stock is not available on disposition of S corporation stock.

Correct Answer

verified

Correct Answer

verified

True/False

There are no advantages for an S corporation to issue § 1244 stock.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

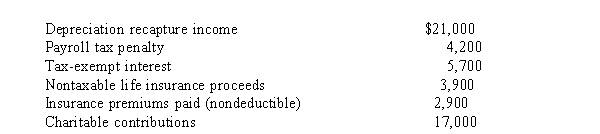

If the beginning balance in OAA is zero and the following transactions occur, what is the ending OAA balance?

A) $1,300.

B) $6,700.

C) $23,300.

D) $27,500.

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 109

Related Exams