Correct Answer

verified

Correct Answer

verified

Multiple Choice

Treads Corporation is considering the purchase of a new machine to replace an old machine that is currently being used. The old machine is fully depreciated but can be used by the corporation for five more years. If Treads decides to buy the new machine, the old machine can be sold for $60,000. The old machine would have no salvage value in five years.The new machine would be purchased for $1,000,000 in cash. The new machine has an expected useful life of five years with no salvage value. Due to the increased efficiency of the new machine, the company would benefit from annual cash savings of $300,000.Treads Corporation uses a discount rate of 12%. (Ignore income taxes.) Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using the tables provided.The net present value of the project is closest to:

A) $171,000

B) $136,400

C) $141,500

D) $560,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company anticipates incremental net income (i.e., incremental taxable income) of $37,000 in year 3 of a project. The company's tax rate is 30% and its after-tax discount rate is 8%.Click here to view Exhibit 14B-1 to determine the appropriate discount factor(s) using table.The present value of this future cash flow is closest to: (Round your final answer to the nearest whole number.)

A) $11,100

B) $8,813

C) $25,900

D) $20,565

Correct Answer

verified

Correct Answer

verified

Multiple Choice

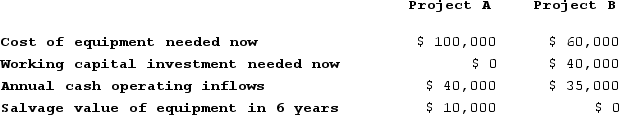

Lambert Manufacturing has $100,000 to invest in either Project A or Project B. The following data are available on these projects (Ignore income taxes.) :  Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using the tables provided.Both projects will have a useful life of 6 years and the total cost approach to net present value analysis. At the end of 6 years, the working capital investment will be released for use elsewhere. Lambert's required rate of return is 14%.The net present value of Project A is:

Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using the tables provided.Both projects will have a useful life of 6 years and the total cost approach to net present value analysis. At the end of 6 years, the working capital investment will be released for use elsewhere. Lambert's required rate of return is 14%.The net present value of Project A is:

A) $51,000

B) $60,120

C) $55,560

D) $94,450

Correct Answer

verified

Correct Answer

verified

Multiple Choice

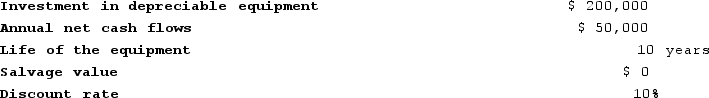

Oriental Corporation has gathered the following data on a proposed investment project:  The company uses straight-line depreciation on all equipment. Assume cash flows occur uniformly throughout a year except for the initial investment.The payback period for the investment would be:

The company uses straight-line depreciation on all equipment. Assume cash flows occur uniformly throughout a year except for the initial investment.The payback period for the investment would be:

A) 2.41 years

B) 0.25 years

C) 10 years

D) 4 years

Correct Answer

verified

Correct Answer

verified

True/False

When computing the profitability index of an investment project, the investment required should exclude any investment made in working capital at the beginning of the project.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

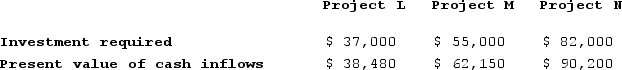

The management of Solar Corporation is considering the following three investment projects (Ignore income taxes.) :  Rank the projects according to the profitability index, from most profitable to least profitable.

Rank the projects according to the profitability index, from most profitable to least profitable.

A) M, N, L

B) L, N, M

C) N, L, M

D) N, M, L

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Boynes Corporation is considering a capital budgeting project that would require investing $200,000 in equipment with an expected life of 4 years and zero salvage value. Annual incremental sales would be $490,000 and annual incremental cash operating expenses would be $330,000. The project would also require an immediate investment in working capital of $10,000 which would be released for use elsewhere at the end of the project. The project would also require a one-time renovation cost of $70,000 in year 3. The company's income tax rate is 30% and its after-tax discount rate is 14%. The company uses straight-line depreciation. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.The total cash flow net of income taxes in year 2 is:

A) $78,000

B) $160,000

C) $110,000

D) $127,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

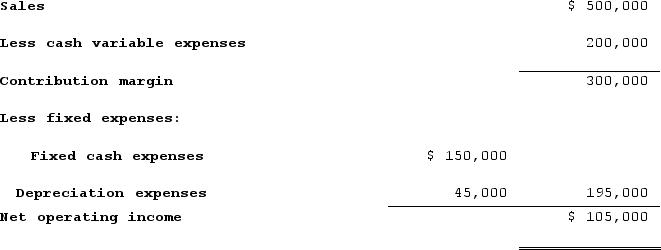

Jarvey Corporation is studying a project that would have a ten-year life and would require a $450,000 investment in equipment which has no salvage value. The project would provide net operating income each year as follows for the life of the project (Ignore income taxes.) :  The company's required rate of return is 12%. The payback period for this project is closest to:

The company's required rate of return is 12%. The payback period for this project is closest to:

A) 3 years

B) 2 years

C) 4.28 years

D) 9 years

Correct Answer

verified

Correct Answer

verified

True/False

The net present value method assumes that cash flows from a project are immediately reinvested at a rate of return equal to the internal rate of return.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

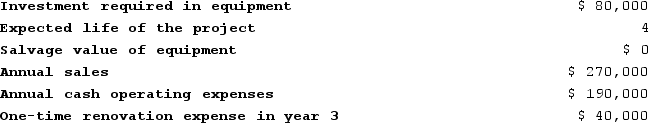

Hinger Corporation is considering a capital budgeting project that would require investing $120,000 in equipment with an expected life of 4 years and zero salvage value. Annual incremental sales would be $350,000 and annual incremental cash operating expenses would be $250,000. The project would also require an immediate investment in working capital of $10,000 which would be released for use elsewhere at the end of the project. The project would also require a one-time renovation cost of $40,000 in year 3. The company's income tax rate is 30% and its after-tax discount rate is 11%. The company uses straight-line depreciation. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.Click here to view Exhibit 14B-1 to determine the appropriate discount factor(s) using table.The net present value of the entire project is closest to:

A) $101,259

B) $108,547

C) $115,137

D) $240,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Mesko Corporation has provided the following information concerning a capital budgeting project:  The company's income tax rate is 30% and its after-tax discount rate is 15%. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.The total cash flow net of income taxes in year 3 is:

The company's income tax rate is 30% and its after-tax discount rate is 15%. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.The total cash flow net of income taxes in year 3 is:

A) $34,000

B) $62,000

C) $14,000

D) $40,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Correll Corporation is considering a capital budgeting project that would require investing $240,000 in equipment with an expected life of 4 years and zero salvage value. Annual incremental sales would be $570,000 and annual incremental cash operating expenses would be $420,000. The project would also require a one-time renovation cost of $40,000 in year 3. The company's income tax rate is 30% and its after-tax discount rate is 15%. The company uses straight-line depreciation. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.The income tax expense in year 3 is:

A) $27,000

B) $15,000

C) $12,000

D) $45,000

Correct Answer

verified

Correct Answer

verified

True/False

Neither the net present value method nor the internal rate of return method can be used as a screening tool in capital budgeting decisions.

Correct Answer

verified

Correct Answer

verified

True/False

A capital budgeting project's incremental net income computation for purposes of determining incremental tax expense includes immediate cash outflows for initial investments in equipment.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Correll Corporation is considering a capital budgeting project that would require investing $240,000 in equipment with an expected life of 4 years and zero salvage value. Annual incremental sales would be $570,000 and annual incremental cash operating expenses would be $420,000. The project would also require a one-time renovation cost of $40,000 in year 3. The company's income tax rate is 30% and its after-tax discount rate is 15%. The company uses straight-line depreciation. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.The total cash flow net of income taxes in year 3 is:

A) $83,000

B) $123,000

C) $95,000

D) $110,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A preference decision in capital budgeting:

A) is concerned with whether a project clears the minimum required rate of return hurdle.

B) comes before the screening decision.

C) is concerned with determining which of several acceptable alternatives is best.

D) involves using market research to determine customers' preferences.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

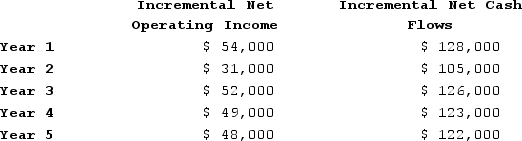

Vandezande Incorporated is considering the acquisition of a new machine that costs $370,000 and has a useful life of 5 years with no salvage value. The incremental net operating income and incremental net cash flows that would be produced by the machine are (Ignore income taxes.) :  Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using the tables provided.Assume cash flows occur uniformly throughout a year except for the initial investment.If the discount rate is 10%, the net present value of the investment is closest to:

Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using the tables provided.Assume cash flows occur uniformly throughout a year except for the initial investment.If the discount rate is 10%, the net present value of the investment is closest to:

A) $370,000

B) $457,479

C) $234,000

D) $87,479

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Anthony operates a part time auto repair service. He estimates that a new diagnostic computer system will result in increased cash inflows of $1,500 in Year 1, $2,100 in Year 2, and $3,200 in Year 3. If Anthony's required rate of return is 10%, then the most he would be willing to pay for the new diagnostic computer system would be (Ignore income taxes.) :Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using the tables provided.

A) $4,599

B) $5,501

C) $5,638

D) $5,107

Correct Answer

verified

Correct Answer

verified

Multiple Choice

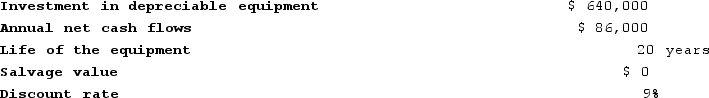

Oriental Corporation has gathered the following data on a proposed investment project:  The company uses straight-line depreciation on all equipment. Assume cash flows occur uniformly throughout a year except for the initial investment.The payback period for the investment would be: (Round your answer to 1 decimal place.)

The company uses straight-line depreciation on all equipment. Assume cash flows occur uniformly throughout a year except for the initial investment.The payback period for the investment would be: (Round your answer to 1 decimal place.)

A) 0.1 years

B) 1.0 years

C) 5.4 years

D) 7.4 years

Correct Answer

verified

Correct Answer

verified

Showing 161 - 180 of 405

Related Exams