A) takes a higher percentage of income as income rises.

B) rises less than in proportion to income.

C) takes a fixed percentage of income regardless of the taxpayer's level of income.

D) takes a larger share of the income of high-income taxpayers than of low-income taxpayers.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If demand and supply are both very elastic, a decrease in the rate of an excise tax will likely:

A) decrease government revenue.

B) increase government revenue.

C) not affect government revenue.

D) make demand and supply both inelastic.

Correct Answer

verified

Correct Answer

verified

True/False

To minimize deadweight loss, excise taxes should be levied on goods with inelastic demand and inelastic supply rather than goods with elastic demand and elastic supply.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

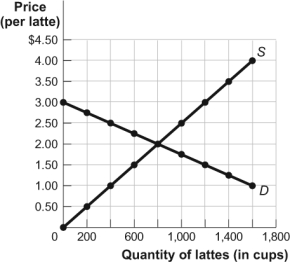

Use the following to answer questions:

Figure: The Market for Lattes  -(Figure: The Market for Lattes) If an excise tax of $1.50 is assessed on each latte, government revenue will be:

-(Figure: The Market for Lattes) If an excise tax of $1.50 is assessed on each latte, government revenue will be:

A) $400.

B) $600.

C) $800.

D) $1,200.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The evidence suggests that taken collectively, taxes in the U.S. economy are:

A) extremely regressive.

B) extremely progressive.

C) somewhat progressive.

D) proportional.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the main purpose of a tax is to decrease the amount of a harmful activity, such as underage drinking, the government should impose it on harmful activities whose supply is _____ and demand is _____.

A) elastic; elastic

B) inelastic; inelastic

C) elastic; inelastic

D) inelastic; elastic

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A tax of $10 on an income of $100, $25 on an income of $200, and $60 on an income of $300 is:

A) progressive.

B) proportional.

C) regressive.

D) flat.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The _____ tax rate on income represents the additional tax an individual pays if his or her income goes up by $1. This rate has _____ since 2000.

A) average; increased

B) marginal; decreased

C) marginal; increased

D) average; decreased

Correct Answer

verified

Correct Answer

verified

Multiple Choice

_____ and _____ taxes are the largest sources of state and local government revenue.

A) Profit; sales

B) Property; sales

C) FICA; income

D) Sales; income

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to the _____ principle, those who use public services should bear the burden of the tax that pays for them.

A) ability-to-pay

B) tax fairness

C) benefits

D) spending

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The price elasticity of demand for a particular cancer drug is zero and the price elasticity of supply is 0.50. If a $1 excise tax is levied on producers, how much of this tax will eventually be paid by consumers?

A) $0

B) $1

C) $0.50

D) $1.50

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The 1990 "yacht tax" caused a large deadweight loss because demand for luxury yachts made in the United States is:

A) very elastic.

B) very inelastic.

C) perfectly inelastic, since rich people will pay whatever is necessary.

D) very steeply sloped.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose an income tax is levied on none of the first $1,000, 10% of the next $9,000, and 20% of the remainder of earnings. How much tax would Miranda have to pay if she earned $20,000?

A) $2,900

B) $5,000

C) $4,900

D) $3,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

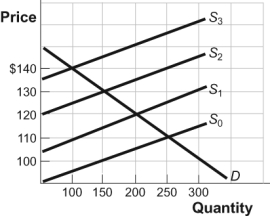

Use the following to answer question:

Figure: Market for Hotel Rooms  -(Figure: The Market for Hotel Rooms) Look at the figure The Market for Hotel Rooms. Suppose with no tax the equilibrium price is $110 and the equilibrium quantity is 250. If the local government levies a tax of $30 per night on each hotel room rented, the new equilibrium price will equal _____ and the new equilibrium quantity will equal _____.

-(Figure: The Market for Hotel Rooms) Look at the figure The Market for Hotel Rooms. Suppose with no tax the equilibrium price is $110 and the equilibrium quantity is 250. If the local government levies a tax of $30 per night on each hotel room rented, the new equilibrium price will equal _____ and the new equilibrium quantity will equal _____.

A) $140; 100

B) $130; 150

C) $120; 200

D) $110; 250

Correct Answer

verified

Correct Answer

verified

Multiple Choice

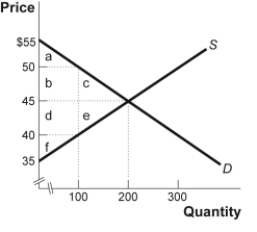

Use the following to answer questions:

Figure: The Market for Blue Jeans  -(Figure: The Market for Blue Jeans) Look at the figure The Market for Blue Jeans. The government recently levied a $10 tax on the producers of blue jeans. What area or areas in the graph identify consumer and producer surplus after the tax was levied?

-(Figure: The Market for Blue Jeans) Look at the figure The Market for Blue Jeans. The government recently levied a $10 tax on the producers of blue jeans. What area or areas in the graph identify consumer and producer surplus after the tax was levied?

A) a + b + c

B) a + b + c + d + e + f

C) d + e + f

D) a + f

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If an excise tax is imposed on automobiles and collected from consumers:

A) the demand curve will shift downward by the amount of the tax.

B) the supply curve will shift upward by the amount of the tax.

C) the equilibrium quantity supplied will increase relative to the pretax level.

D) the equilibrium quantity demanded will increase relative to the pretax level.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

_____ tax is NOT used in the United States.

A) Property

B) Value-added

C) Profits

D) Sales

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Taxation according to the ability-to-pay principle is best illustrated in the United States by:

A) sales taxes.

B) income taxes.

C) excise taxes.

D) user fees.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A tax leads to a(n) _____ in consumer surplus and a(n) _____ in producer surplus.

A) increase; increase

B) increase; decrease

C) decrease; increase

D) decrease; decrease

Correct Answer

verified

Correct Answer

verified

True/False

The deadweight loss of an excise tax arises because the tax prevents some mutually beneficial transactions.

Correct Answer

verified

Correct Answer

verified

Showing 221 - 240 of 298

Related Exams