A) I and III only

B) II and IV only

C) I and IV only

D) I, II and III only

E) I, II, III, and IV

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The common stock of United Industries has a beta of 1.34 and an expected return of 14.29 percent.The risk-free rate of return is 3.7 percent.What is the expected market risk premium?

A) 7.02 percent

B) 7.90 percent

C) 10.63 percent

D) 11.22 percent

E) 11.60 percent

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The expected return on a portfolio considers which of the following factors? I.percentage of the portfolio invested in each individual security II.projected states of the economy III.the performance of each security given various economic states IV.probability of occurrence for each state of the economy

A) I and III only

B) II and IV only

C) I, III, and IV only

D) II, III, and IV only

E) I, II, III, and IV

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The standard deviation of a portfolio:

A) is a measure of that portfolio's systematic risk.

B) is a weighed average of the standard deviations of the individual securities held in that portfolio.

C) measures the amount of diversifiable risk inherent in the portfolio.

D) serves as the basis for computing the appropriate risk premium for that portfolio.

E) can be less than the weighted average of the standard deviations of the individual securities held in that portfolio.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following is an example of unsystematic risk?

A) income taxes are increased across the board

B) a national sales tax is adopted

C) inflation decreases at the national level

D) an increased feeling of prosperity is felt around the globe

E) consumer spending on entertainment decreased nationally

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following is an example of systematic risk?

A) investors panic causing security prices around the globe to fall precipitously

B) a flood washes away a firm's warehouse

C) a city imposes an additional one percent sales tax on all products

D) a toymaker has to recall its top-selling toy

E) corn prices increase due to increased demand for alternative fuels

Correct Answer

verified

A

Correct Answer

verified

Multiple Choice

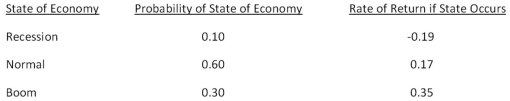

What is the expected return and standard deviation for the following stock?

A) 15.49 percent; 14.28 percent

B) 15.49 percent; 14.67 percent

C) 18.80 percent; 14.95 percent

D) 18.80 percent; 15.74 percent

E) 18.80 percent'; 16.01 percent

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The expected rate of return on a stock portfolio is a weighted average where the weights are based on the:

A) number of shares owned of each stock.

B) market price per share of each stock.

C) market value of the investment in each stock.

D) original amount invested in each stock.

E) cost per share of each stock held.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following statements related to unexpected returns is correct?

A) All announcements by a firm affect that firm's unexpected returns.

B) Unexpected returns over time have a negative effect on the total return of a firm.

C) Unexpected returns are relatively predictable in the short-term.

D) Unexpected returns generally cause the actual return to vary significantly from the expected return over the long-term.

E) Unexpected returns can be either positive or negative in the short term but tend to be zero over the long-term.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Thayer Farms stock has a beta of 1.12.The risk-free rate of return is 4.34 percent and the market risk premium is 7.92 percent.What is the expected rate of return on this stock?

A) 8.35 percent

B) 9.01 percent

C) 10.23 percent

D) 13.21 percent

E) 13.73 percent

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following statements is correct concerning a portfolio beta?

A) Portfolio betas range between -1.0 and +1.0.

B) A portfolio beta is a weighted average of the betas of the individual securities contained in the portfolio.

C) A portfolio beta cannot be computed from the betas of the individual securities comprising the portfolio because some risk is eliminated via diversification.

D) A portfolio of U.S.Treasury bills will have a beta of +1.0.

E) The beta of a market portfolio is equal to zero.

Correct Answer

verified

B

Correct Answer

verified

Multiple Choice

Which one of the following measures the amount of systematic risk present in a particular risky asset relative to the systematic risk present in an average risky asset?

A) beta

B) reward-to-risk ratio

C) risk ratio

D) standard deviation

E) price-earnings ratio

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The _____ tells us that the expected return on a risky asset depends only on that asset's nondiversifiable risk.

A) efficient markets hypothesis

B) systematic risk principle

C) open markets theorem

D) law of one price

E) principle of diversification

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suzie owns five different bonds valued at $36,000 and twelve different stocks valued at $82,500 total.Which one of the following terms most applies to Suzie's investments?

A) index

B) portfolio

C) collection

D) grouping

E) risk-free

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following indicates a portfolio is being effectively diversified?

A) an increase in the portfolio beta

B) a decrease in the portfolio beta

C) an increase in the portfolio rate of return

D) an increase in the portfolio standard deviation

E) a decrease in the portfolio standard deviation

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You want your portfolio beta to be 0.90.Currently, your portfolio consists of $4,000 invested in stock A with a beta of 1.47 and $3,000 in stock B with a beta of 0.54.You have another $9,000 to invest and want to divide it between an asset with a beta of 1.74 and a risk-free asset.How much should you invest in the risk-free asset?

A) $3,965.52

B) $4,425.29

C) $4,902.29

D) $5,034.48

E) $5,683.92

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The capital asset pricing model (CAPM) assumes which of the following? I.a risk-free asset has no systematic risk. II.beta is a reliable estimate of total risk. III.the reward-to-risk ratio is constant. IV.the market rate of return can be approximated.

A) I and III only

B) II and IV only

C) I, III, and IV only

D) II, III, and IV only

E) I, II, III, and IV

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following should earn the most risk premium based on CAPM?

A) diversified portfolio with returns similar to the overall market

B) stock with a beta of 1.38

C) stock with a beta of 0.74

D) U.S.Treasury bill

E) portfolio with a beta of 1.01

Correct Answer

verified

Correct Answer

verified

Multiple Choice

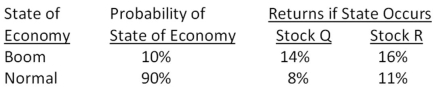

What is the standard deviation of the returns on a portfolio that is invested 52 percent in stock Q and 48 percent in stock R?

A) 1.66 percent

B) 2.47 percent

C) 2.63 percent

D) 3.28 percent

E) 3.41 percent

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The market rate of return is 11 percent and the risk-free rate of return is 3 percent.Lexant stock has 3 percent less systematic risk than the market and has an actual return of 12 percent.This stock:

A) is underpriced.

B) is correctly priced.

C) will plot below the security market line.

D) will plot on the security market line.

E) will plot to the right of the overall market on a security market line graph.

Correct Answer

verified

A

Correct Answer

verified

Showing 1 - 20 of 100

Related Exams