Correct Answer

verified

Correct Answer

verified

Multiple Choice

At May 1, 2011, Deitrich Company had beginning inventory consisting of 100 units with a unit cost of €3.50.During May, the company purchased inventory as follows:  The company sold 500 units during the month for €6 per unit.Deitrich uses the average cost method.Deitrich's gross profit for the month of May is

The company sold 500 units during the month for €6 per unit.Deitrich uses the average cost method.Deitrich's gross profit for the month of May is

A) €1,125.

B) €1,875.

C) €2,250.

D) €3,000.

Correct Answer

verified

Correct Answer

verified

True/False

One reason a company using a perpetual inventory system must make a physical count of goods is to determine the amount of inventory on hand as of the statement of financial position date.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A problem with the specific identification method is that

A) inventories can be reported at actual costs.

B) management can manipulate income.

C) matching is not achieved.

D) the lower-of-cost-or-net realizable value basis cannot be applied.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company just starting in business purchased three merchandise inventory items at the following prices.First purchase $80; Second purchase $95; Third purchase $85.If the company sold two units for a total of $240 and used FIFO costing, the gross profit for the period would be

A) $65.

B) $75.

C) $60.

D) $50.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Understating beginning inventory will understate

A) assets.

B) cost of goods sold.

C) net income.

D) equity.

Correct Answer

verified

Correct Answer

verified

True/False

A major difference between IFRS and GAAP is that GAAP specifically prohibits use of the FIFO cost flow assumption.

Correct Answer

verified

Correct Answer

verified

True/False

If a company uses the FIFO cost assumption, the cost of goods sold for the period will be the same under a perpetual or periodic inventory system.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

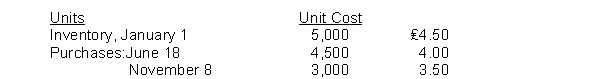

Holliday Company's inventory records show the following data:  A physical inventory on December 31 shows 2,000 units on hand.Holliday sells the units for ₤6 each.The company has an effective tax rate of 20%.Holliday uses the periodic inventory method.What is the cost of goods available for sale?

A physical inventory on December 31 shows 2,000 units on hand.Holliday sells the units for ₤6 each.The company has an effective tax rate of 20%.Holliday uses the periodic inventory method.What is the cost of goods available for sale?

A) ₤10,500

B) ₤18,000

C) ₤22,500

D) ₤51,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

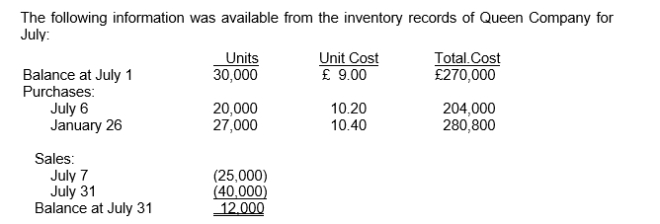

Use the following information for questions .  -What should be the inventory reported on Queen's July 31 statement of financial position using the average-cost inventory method (round per unit amounts to two decimal places) ?

-What should be the inventory reported on Queen's July 31 statement of financial position using the average-cost inventory method (round per unit amounts to two decimal places) ?

A) £108,000.

B) £117,600.

C) £118,440.

D) £126,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The term "FOB" denotes

A) free on board.

B) freight on board.

C) free only (to) buyer.

D) freight charge on buyer.

Correct Answer

verified

Correct Answer

verified

True/False

All inventories are reported as current assets on the statement of financial position.

Correct Answer

verified

Correct Answer

verified

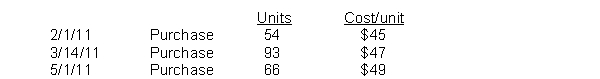

Multiple Choice

Lee Industries had the following inventory transactions occur during 2011:  The company sold 153 units at $63 each and has a tax rate of 30%.Assuming that a periodic inventory system is used, what is the company's after-tax income using FIFO? (rounded to whole dollars)

The company sold 153 units at $63 each and has a tax rate of 30%.Assuming that a periodic inventory system is used, what is the company's after-tax income using FIFO? (rounded to whole dollars)

A) $2,316

B) $2,544

C) $1,781

D) $1,620

Correct Answer

verified

Correct Answer

verified

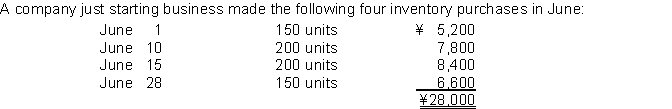

Multiple Choice

A physical count of merchandise inventory on June 30 reveals that there are 200 units on hand.Using the average-cost method, the amount allocated to the ending inventory on June 30 is

A physical count of merchandise inventory on June 30 reveals that there are 200 units on hand.Using the average-cost method, the amount allocated to the ending inventory on June 30 is

A) ¥28,000.

B) ¥20,000.

C) ¥7,670.

D) ¥8,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Blosser Company's goods in transit at December 31 include:

Which items should be included in Blosser's inventory at December 31 ?

Which items should be included in Blosser's inventory at December 31 ?

A) (2) and (3)

B) (1) and (4)

C) (1) and (3)

D) (2) and (4)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

At May 1, 2011, Deitrich Company had beginning inventory consisting of 100 units with a unit cost of €3.50.During May, the company purchased inventory as follows:  The company sold 500 units during the month for €6 per unit.Deitrich uses the average-cost method.The average cost per unit for May is

The company sold 500 units during the month for €6 per unit.Deitrich uses the average-cost method.The average cost per unit for May is

A) €3.50.

B) €3.75.

C) €3.80.

D) €4.00.

Correct Answer

verified

Correct Answer

verified

Showing 141 - 156 of 156

Related Exams