A) Bureau of Labor Statistics.

B) Bureau of Unemployment.

C) Bureau of Economic Analysis.

D) Bureau of Economic Research.

Correct Answer

verified

Correct Answer

verified

True/False

People who work part time, but desire to work full time, are considered to be officially unemployed.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A nation has a population of 260 million people. Of these, 60 million are retired, in the military, institutionalized, or under 16 years old. There are 188 million who are employed and 12 million who Are unemployed. What is the unemployment rate?

A) 4 percent

B) 6 percent

C) 9 percent

D) 27 percent

Correct Answer

verified

Correct Answer

verified

True/False

Proponents of zero inflation argue that even mild inflation (1 to 3 percent) reduces the economy's real output.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The total adult population of an economy is 175 million, the number of employed is 122 million, and the number of unemployed is 17 million. The percentage of adults who are not in the labor force is

A) 25.3 percent.

B) 20.6 percent.

C) 30.3 percent.

D) 13.9 percent.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The annual rate of inflation can be found by subtracting

A) the real income from the nominal income.

B) last year's price index from this year's price index.

C) this year's price index from last year's price index and dividing the difference by this year's price index.

D) last year's price index from this year's price index and dividing the difference by last year's price index.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The unemployment rate is the

A) ratio of unemployed to employed workers.

B) number of employed workers minus the number of workers who are not in the labor force.

C) percentage of the labor force that is unemployed.

D) percentage of the total population that is unemployed.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is correct?

A) During the Great Recession, unemployment rates for men rose above those of women.

B) Unemployment rates for African-American and White workers are approximately the same.

C) Teenagers experience approximately the same unemployment rates as do adults.

D) Laborers are less vulnerable to unemployment than are professional workers.

Correct Answer

verified

Correct Answer

verified

True/False

Unanticipated inflation benefits creditors and savers.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

New college graduates still looking for their first jobs would be classified in the BLS data as

A) frictionally unemployed.

B) not yet in the labor force.

C) cyclically unemployed.

D) part of structural unemployment.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Only two resources, capital and labor, are used in an economy to produce an output of 600 million units. If the total cost of capital resources is $300 million and the total cost of labor resources is $100 million, then the per-unit production costs in this economy are

A) $0.67.

B) $1.50.

C) $2.00.

D) $3.00.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

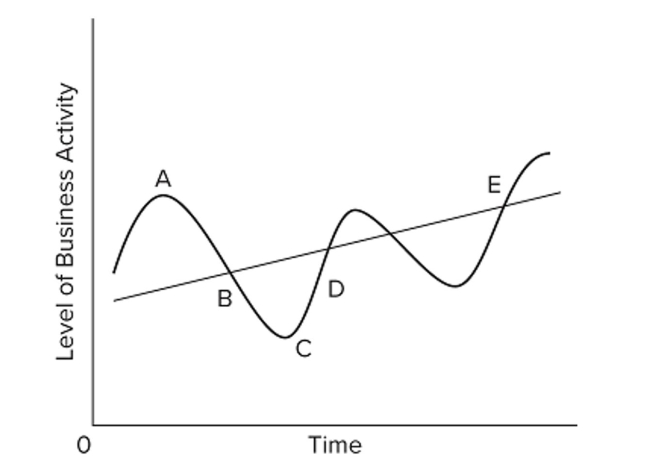

The diagram illustrates the pattern of

The diagram illustrates the pattern of

A) business cycles.

B) wage movements over time.

C) price level movements.

D) economic growth patterns.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A recession is defined as a period in which

A) cost-push inflation is present.

B) nominal domestic output falls.

C) demand-pull inflation is present.

D) real domestic output falls.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Okun's law

A) measures the trade-off between the rate of inflation and the rate of unemployment.

B) indicates the number of years it will take for a constant rate of inflation to double the price level.

C) quantifies the relationship between nominal and real incomes.

D) shows the relationship between the unemployment rate and the size of the negative GDP gap.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which statement about inflation is correct?

A) Families are always hurt by inflation.

B) Inflation "subsidizes" those who receive relatively fixed money income.

C) The redistributive effects of inflation are arbitrary with respect to people and groups in society.

D) Inflation will decrease the real value of property assets and increase the real value of fixed- value assets.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

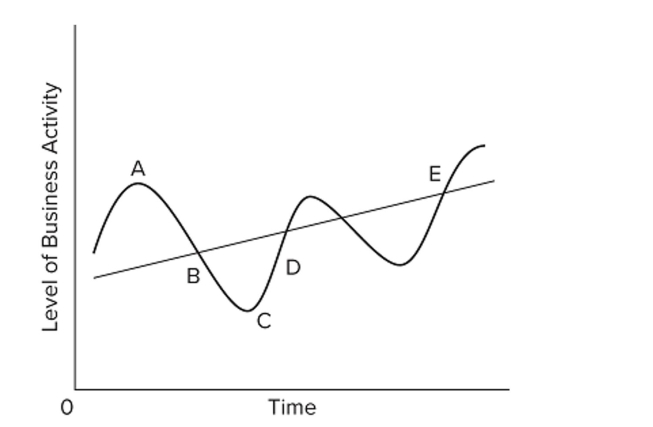

In the accompanying diagram, the straight line E drawn through the wavy lines would provide an estimate of the

In the accompanying diagram, the straight line E drawn through the wavy lines would provide an estimate of the

A) recession fluctuation.

B) economic growth trend.

C) natural rate of unemployment.

D) recovery trend.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Over a 10-year period, the Consumer Price Index doubled. Based on this information and using the rule of 70, we can say that the average annual rate of inflation over this period was approximately

A) 10 percent.

B) 9 percent.

C) 7 percent.

D) 5 percent.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the main problem with mild inflation, according to some economists?

A) It reduces the size of the GDP gap.

B) It leads to unanticipated deflation.

C) It increases frictional and structural unemployment in the economy.

D) It diverts productive time toward activities to hedge against inflation.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that lenders want to receive a real rate of interest of 5 percent and that they expect inflation to remain steady at 2 percent in the coming years. Based on this, lenders should charge a Nominal interest rate of

A) 2 percent.

B) 3 percent.

C) 5 percent.

D) 7 percent.

Correct Answer

verified

Correct Answer

verified

True/False

Demand-pull inflation is usually accompanied by low unemployment and higher real output.

Correct Answer

verified

Correct Answer

verified

Showing 141 - 160 of 298

Related Exams