A) the lender benefits from inflation, while the borrower loses from inflation.

B) the borrower benefits from inflation, while the lender loses from inflation.

C) neither the borrower nor the lender benefits from inflation.

D) both the borrower and the lender lose from inflation.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

As inflation drives up prices, people attempt to find substitutes and adjust what they buy. The resulting substitution bias problem causes the CPI to:

A) overstate the impact of higher prices on consumers.

B) consistently underestimate the true inflation rate.

C) omit the benefits of product quality improvements.

D) have larger fluctuations than other price indexes.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following groups benefits from inflation?

A) Borrowers.

B) Savers.

C) Landlords.

D) Lenders.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Deflation means a decrease in:

A) the rate of inflation.

B) the prices of all products in the economy.

C) homes, autos, and basic resources.

D) the general level of prices in the economy.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the consumer price index in Year 1 was 200 and the CPI for Year 2 was 230, the rate of inflation was:

A) 15 percent.

B) 7.5 percent.

C) 30 percent.

D) 230 percent.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Consumer Price Index compares the:

A) prices of all goods and services in the economy compared to the prices of those goods and services in a base year.

B) prices of consumer goods and services that a household purchases to the prices of those goods and services purchased in a base year.

C) prices of producer goods and services that are made for consumers to the prices of those goods and services in a base year.

D) prices of goods and services that are purchased by producers to the prices of those goods and services in a base year.

E) prices of goods and services that are purchased by consumer manufacturers to the prices of those goods and services in a base year.

Correct Answer

verified

Correct Answer

verified

True/False

The consumer price index (CPI)includes only a market basket of goods and services purchased by the typical urban consumer.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the consumer price index (CPI) in Year 1 was 200 and the CPI in Year 2 was 215, the rate of inflation was:

A) 215 percent.

B) 15 percent.

C) 5 percent.

D) 7.5 percent.

E) 8 percent.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

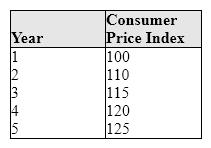

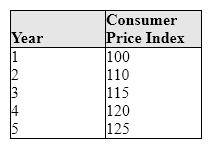

Exhibit 7-1 Consumer Price Index  As shown in Exhibit 7-1, the rate of inflation for Year 2 is:

As shown in Exhibit 7-1, the rate of inflation for Year 2 is:

A) 5 percent.

B) 10 percent.

C) 20 percent.

D) 25 percent.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Real income in Year X is equal to:

A) ![]()

B) ![]()

C) ![]()

D) Year X nominal income ×CPI.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Consider an economy with only two goods: bread and wine. In 1982, the typical family bought 4 loaves of bread at 50¢ per loaf and 2 bottles of wine for $9 per bottle. In Year X, bread cost 75¢ per loaf and wine cost $10 per bottle. The CPI for Year X (using a 1982 base year) is:

A) 100.

B) 115.

C) 126.

D) 130.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

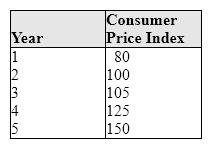

Exhibit 7-2 Consumer Price Index  As shown in Exhibit 7-2, the rate of inflation for Year 4 is:

As shown in Exhibit 7-2, the rate of inflation for Year 4 is:

A) 5 percent.

B) 10 percent.

C) 19 percent.

D) 20 percent.

E) 25 percent.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The real interest rate is defined as the:

A) actual interest rate.

B) fixed-rate on consumer loans.

C) nominal interest rate minus the inflation rate.

D) expected interest rate minus the inflation rate.

Correct Answer

verified

Correct Answer

verified

True/False

Inflation psychosis and wage-price spirals are two types of hyperinflation.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Exhibit 7-1 Consumer Price Index  As shown in Exhibit 7-1, the rate of inflation for Year 5 is:

As shown in Exhibit 7-1, the rate of inflation for Year 5 is:

A) 4.2 percent

B) 5 percent.

C) 20 percent.

D) 25 percent.

Correct Answer

verified

Correct Answer

verified

True/False

During periods of inflation, the general price level of goods and services in the economy rises.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would understate the consumer price index?

A) Substitution bias.

B) Deteriorating quality of products.

C) Improving quality of products.

D) Law of demand bias.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The substitution bias is believed to cause the consumer price index to:

A) overstate the true rate of inflation.

B) understate the true rate of inflation.

C) understate the true GDP deflator.

D) none of these.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the consumer price index (CPI) for Year X is 130. This means the average price of goods and services is:

A) currently $130.

B) 130 percent more in Year X than in the base year.

C) 130 percent more in the base year than in Year X.

D) priced at 30 percent more in Year X than in the base year.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the inflation rate rises, the purchasing power of nominal income:

A) remains unchanged.

B) decreases.

C) increases.

D) changes by the inflation rate minus one.

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 126

Related Exams